Mechanics and Definitions of SA-CCR (Part 1)

SACCR is the Standardised Approach to Counterparty Credit Risk (CRE52 under the consolidated Basel capital framework). It covers calculations for Credit Risk Weighted Assets and exposures under the Leverage Ratio (known as the Supplemental Leverage Ratio, SLR, in the US). It will impact the amount of Tier 1 capital banks must hold. SACCR means that […]

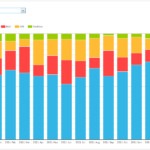

2021 SEF Volumes and Share – CRD and FXD

Today I review 2021 Swap Execution Facility (SEF) volumes and market share for both Credit Derivatives and Foreign Exchange Derivatives, in a similar format to my 2020 SEF Market Share Statistics article. Summary: CRD Index, Option and Tranche products Volume in USD of $7 trillion, down 8% from the prior year Volume in EUR of $4.3 […]

What Now for SOFR?

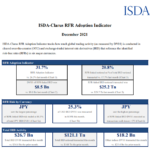

The ISDA-Clarus RFR Adoption Indicator was published last week, covering December 2021. December saw some notable (!) events, including: Conversion of GBP, JPY and CHF positions into RFRs at major CCPs. Cessation of LIBOR in those three currencies (at the very end of our sample period). Activation of ISDA Fallbacks for any bilateral positions outstanding […]

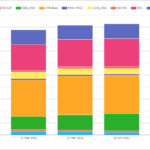

What’s New in CCP Disclosures – 3Q21

Clearing Houses have published their latest CPMI-IOSCO Quantitative Disclosures: Initial margin for IRS at $252 billion down 3% QoQ and 4% YoY Initial margin for CDS at $60 billion up 4% QoQ and down 3% YoY Initial margin for selected ETD at $470 billion up 6% QoQ and 13% YoY Initial margin increases at ICE Europe F&O, Eurex OTC IRS, ICE Credit Clear, JSCC IRS Explanatory […]

Deciphering the end of LIBOR in the data

The final cessation of GBP, JPY and CHF LIBOR will have some impacts on transparency data across our Clarus data. Here are some of the more obvious ones to highlight. We are sure that more will become apparent over the coming weeks: IRS Have Disappeared The most stark representation of the cessation of LIBOR comes […]

2021 CCP Volumes and Market Share in IRD

Details of 2021 volumes and market share for OTC Derivatives in Interest Rates reported by Clearing Houses. Clarus CCPView has daily volume and open interest data published by each CCP, which is filtered, normalised and aggregated to allow meaningful comparisons of volumes, as in all the charts below. Contents: USD Swaps (LIBOR, OIS, SOFR) EUR Swaps (EURIBOR, OIS, €STR) GBP Swaps […]