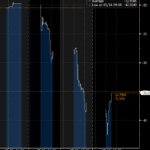

Deutsche Bank Credit Default Swaps

One of our readers pointed me to yesterday’s Bloomberg article, “A Single Bet on Deutsche Bank’s Credit Default Swaps is Seen Behind Fridays Rout“, which makes the bold claim that a single CDS trade fuelled a global sell-off on Friday. So in today’s article I will take a look at what the data shows. SEC […]

Tracking CAD and SGD RFRs

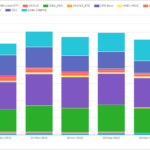

ISDA and Clarus have now added CAD and SGD RFRs to the currencies we track in the RFR Adoption Indicator. This brings the total number of currencies up to 8: As we approach the end of USD LIBOR it will be interesting to see how other IBOR rates fare. CAD is in the middle of […]

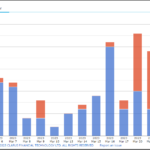

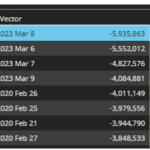

USD Swaps Margin Calls in March 2023

I know our readers will have followed the events of the last two weeks, covering Silicon Valley Bank (SVB), First Republic Bank(FRC) and Credit Suisse (CS). Each different institutions, but each faced with massive depositor withdrawals caused by a loss of trust in the soundness of their business. At the start of 2023, who would […]

Credit Suisse & UBS LIVE Blog

SBSDRView allows us to track trading in single name CDS: Follow the blog live today to see what the market thinks of the Credit Suisse-UBS deal. We will also be following other banking CDS (Deutsche amongst others….) to monitor any potential contagion. 10:00am CET We have already had the first Credit Suisse CDS trade of […]

How to Trade A Bank Run

Much of what is written on this blog stems from the “OG” Financial Crisis back in 2008. Without that, we would not have seen the Dodd Frank Act or post trade transparency in OTC derivative markets. Back in 2008 I was trading cross currency swaps. These were one of the hardest hit instruments as the […]

What’s New in CCP Disclosures – 4Q22?

Clearing Houses have published their latest CPMI-IOSCO Quantitative Disclosures: Background Under the CPMI-IOSCO Public Quantitative Disclosures, CCPs publish over two hundred quantitative data fields covering margin, default resources, credit risk, collateral, liquidity risk, back-testing and more. CCPView has over 7 years of these quarterly disclosures for 44 Clearing Houses, each with multiple Clearing Services, covering the period from 30 Sep […]

Clearing Houses are about to convert your USD LIBOR swaps. What do you need to know?

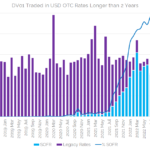

A crucial step in the final transition to USD SOFR is the physical conversion of outstanding cleared OTC swaps from USD LIBOR to USD SOFR. Clearing Houses (CCPs) provide this as a service to clearing participants and it is a crucial “last step” in the move away from LIBOR. Remember that USD is the last […]

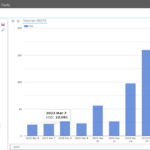

The Most Popular SOFR Trades

Transparency data allows us to look at the distribution of risk across the curve. We may be used to seeing activity concentrated in benchmark tenors such as 2Y, 5Y, 10Y and 30Y in US markets, but have SOFR swaps developed in a similar manner? As a starter the ISDA-Clarus RFR Adoption Indicator shows the amount […]