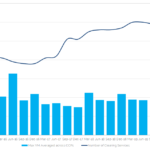

ISDA-Clarus RFR Adoption Indicator

The ISDA-Clarus RFR Adoption Indicator was at 4.7% in June 2020. This indicator measures the risk-weighted (DV01) percentage of trading activity that takes place in RFR products. Five further sub-indicators have been developed in conjunction with ISDA, providing market participants with granular transparency into RFR activity. Check out the first publication to learn about RFR […]

Managing IBOR Transition – Fallback Spreads

Last month I wrote about the potential for a very non-linear transition when LIBOR is discontinued. This was also covered in a recent Risk article: ‘Beware the cliff edge in Libor fallbacks’. The impending announcement on the timing of LIBOR cessation process was covered by Chris Barnes earlier this month, Also with the potential for […]

€STR Discounting Switch

I’m sure that I am not the only one sat here wondering how the switch from EONIA to €STR discounting went at the CCPs over the weekend? As far as I understand it, the change in valuation (cash compensation) amounts should have settled on Monday (July 27th) morning. Will this switch lead to activity in […]

Clarus at the CFTC

Clarus were invited along to the CFTC’s Market Risk Advisory Committee on July 21st, for which we are very thankful. It was a great session, and we hope provided an opportunity to highlight to all market participants how vital transparency was to the smooth functioning of markets during March 2020. We presented on “Rates OTC […]

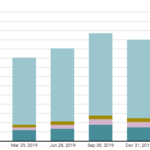

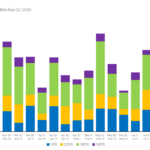

CCP Swap Volumes and Share – 2Q 2020

In today’s blog, I look at interest rate swap volumes and CCP market share in major currencies, focusing on 2Q 2020 and comparing QoQ and YoY figures. After the massive volatility and volume we saw in 1Q 2020, the most recent quarter was much quieter. Even so, there are interesting changes in volume and market […]

Margin Calls During COVID-19

John Maynard Keynes said in the 1930s; The market can stay irrational a lot longer than you can stay solvent. Keynes Since March 2020, the bounce-back in almost all “risky” assets since the nadir of the crisis has been breathtakingly sharp: Motivated by Amir’s blog last week on Initial Margin, I got to wondering how […]

CAD CORRA Futures and Swaps

We last covered CAD Rates Markets and CORRA Reform in Oct-19, so I wanted to look at what’s new and in particular the news that TMX launches CORRA Futures. Background on CORRA The Bank of Canada took over the calculation and publication of the Canadian Overnight Repo Rate (“CORRA”) on June 15, 2020 , subsequent […]

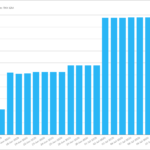

Clearing House Margin calls in Q1 2020

Clearing Houses have recently published data on the magnitude of margin calls they made in Q1 2020 and these are interesting to say the least. Given the massive price volatility we observed in March across all asset classes, we knew these were going to be big numbers, so let’s dive into the detail. Variation Margin […]

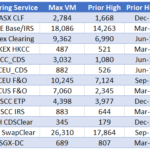

Swaps Data: Initial Margin Soars in Q1 2020

My monthly Swaps Review looks at Initial Margin requirements as disclosed in the recently published 1Q 2020 CPMI-IOSCO Quantitative Disclosures for CCPs, showing: The extent of the IM increases in Q1 2020 The wide variance by product class 23%, 46%, 66% for IRS, CDS, F&O respectively The wide variance between CCPs in the same product […]

SONIA Q2 2020 Update

43% of GBP risk transacted in Q2 2020 was in SONIA. And only 24% of GBP notional was in LIBOR. Now that volatility has died down somewhat there is less short-dated trading activity. Can we consider the market standard as SONIA yet? The first Monday in March 2020 will likely be remembered for many reasons. […]