Clearing Participant CDS at ICE

Earlier in April, ICE began clearing single name CDS on a larger number of banks. ICE has been clearing single names on various financial companies & banks for a while, but what makes this unique is that they have added swaps on their own clearing members. The correct terminology is “Clearing Participant CDS” or just […]

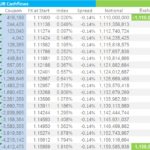

March 2017 Swaps Review

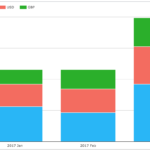

Continuing with our monthly Swaps review series, let’s look at volumes in March 2017. Summary: SDR USD IRS price-forming volume > $2.5 trillion gross notional The highest month ever and 23% up from a year earlier SEF Compression activity in USD IRS > $320 billion The second highest month on record USD OIS volume at > $4.5 trillion is up 33% from previous high […]

FRTB モデラブルとノン・モデラブルなリスク・ファクター

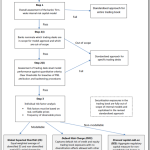

以前の私のブログ、FRTB 内部モデルと標準アプローチに続いて、内部モデル・アプローチのある特定の部分をフォーカスしたいと思う。すなわち、全てのリスク・ファクターが、モデラブルとノン・モデラブルに分類されて、ノン・モデラブルなリスク・ファクターはより高い資本賦課がなされると言う点についてだ。

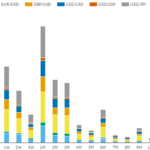

Examining The Cleared OTC FX Options Market

One of the better known / worst kept secrets in the OTC markets these days is that the largest clearing houses are planning to clear FX Options. Details on this are very thin. LCH have made a couple announcements over the years with respect to clearing options, and if you look hard enough on the […]

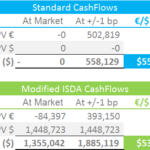

Mechanics of Cross Currency Swaps

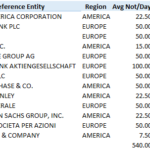

Cross Currency Swaps exchange a funding position in one currency for a funding position in another currency. The interbank market trades a resettable floating-floating swap, incorporating a USD cash payment to reset the mark-to-market close to zero at each coupon date. We explain the nuances of the product via the cashflows. The cross currency swap market […]

Microservices: ISDA SIMM™ in R

The Clarus API has a function to compute ISDA SIMM™ from a CRIF file contain portfolio sensitivities. What-if analysis can be performed in addition to the portfolio margin calculation. The function is very easy to call from many popular languages, including R, Python, C++, Java and Julia. What is R? R is a language and […]

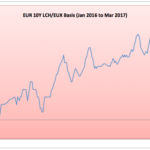

LCH-Eurex Basis in EUR IR Swaps

In my Dec 2015 blog, CCP Basis Spreads:What Next, I opined that we would see CCP Basis Spreads becoming significant in non-USD Interest Rate Swaps and I subsequently covered the LCH-JSCC Basis in JPY Swaps. Today I will look at the LCH-EUREX Basis in EUR Swaps. Broker Quotes Lets start with Tradition’s EUR CCP Basis Swaps prices […]

We are expanding in Asia

And opening an office in Singapore. While we have had customers in Asia Pacific for a while now, we have not had a physical presence. So I am pleased that Mark Bell has agreed to join and lead our efforts in the region. Having worked with Mark before and seen the difference he makes, it is […]

Monthly Swap Data review: Libor dominance challenged

My monthly Swap Data review was published on Risk.net, see here for the article. (no subscription required)

ISDA SIMM™ in Excel – Cross Currency Swaps

The ISDA SIMM™ methodology has been expanded to include Cross Currency Swaps. We explain in detail how to create the required input sensitivities. These sensitivities are not the typical cross currency basis risk that a risk management system would calculate. Once the input sensitivities are calculated, the calculation of Initial Margin follows the typical SIMM equations. We show how […]