LIBOR Fallbacks

ISDA have launched a consultation for a fallback mechanism in the event that a LIBOR rate ceases to be published. This would mean that any contract referencing the LIBOR rate and governed by the ISDA 2006 Definitions would use these proposed “fallback” rates. How Will it Work? The consultation document states that fallbacks will be defined in […]

ISDA SIMM in Python Dashboards

ISDA SIMM is the industry standard for calculating Initial Margin on non-cleared derivatives The Clarus Microservices API makes it very easy to compute ISDA SIMM™ from Python What-if trades can be easily added to determine the incremental change in SIMM Margin Before and after SIMM Margin levels can be easily displayed in charts and tables CRIF format risk sensitivties can […]

SOFR Swaps Are Trading!

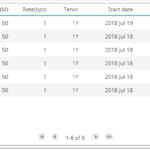

We have now had six SOFR swap trades hit the SDRs. Both Basis vs Fed Funds and Outright OIS has traded. All trades have been $50m and one year maturity. It looks like they were all cleared at LCH. The first swap was done on the TP-ICAP SEF. SOFR Everything you need to know about […]

EUR Swap Volumes by Tenor

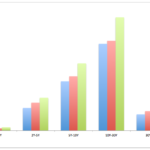

Last week I briefly covered cleared EUR Swap volumes in Swaps Data: The Big Get Bigger in Cleared Swaps, so today I will look in more detail into these and specifically LCH SwapClear volumes by tenor. Average Daily Volume (ADV) Lets start with ADV by month for EUR Interest Rate Swaps cleared at LCH SwapClear, […]

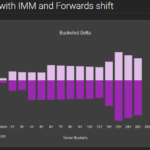

A Dashboard for Interest Rate Risk

Clarus Microservices make it very easy to create Dashboards Dashboards that perform new risk calculations (not just display old ones) Interest rate risk measures such as DV01 and IR Delta can be calculated Tables, Charts, Panels can be easily created with a single line of Python code Our Browser Sandbox allows you to try yourself Introduction […]

Swaps Data: The Big Get Bigger in Cleared Swaps

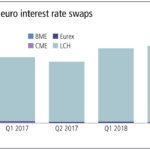

My monthly Swaps Review in Risk Magazine looks at global cleared volumes by CCP in 1H 2018 compared to 1H 2017 for: USD IR Swaps, EUR IR Swaps, JPY IR Swaps CDS Index and Single-name, USD and EUR Non-Deliverable Forwards Showing strong growth in all of these, except one. Please click here for free access […]

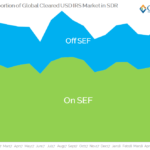

How Much Data Do We Have?

We saw record cleared volumes in vanilla IRS in June 2018. We take a look at the data behind these records. SDR data covers 60% of cleared volumes in USD swaps. SDR data also covers non-USD swaps and we quantify exactly what proportion of the market it covers. Introduction With MIFID data soon to be […]

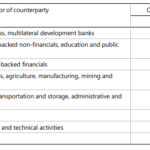

FRTB – Basic Approach for CVA

Introduction A core component of managing bilateral exposures is CVA – Credit Valuation Adjustment. The grandfather of all XVAs, it describes the change in exposure we have to a counterparty as a result of changes in both the mark-to-market of a derivative and the change in credit-worthiness of our counterparty. Today, we’ll look at the […]

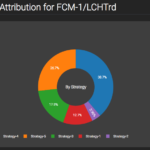

Creating a Dashboard for Margin Attribution

Clarus Microservices make it very easy to create Dashboards Tables, Charts, Panels are easily created with python scripts A complex portfolio analytic such as Margin Attribution is presented Our Browser Sandbox allows you to try yourself Introduction Generally a firm will have a single margin account at a CCP, as this is most efficient for netting. […]