Swaps Data Review: CCP and SEF Volumes

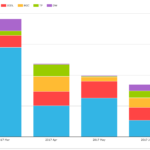

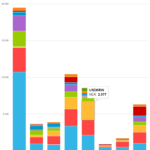

My Monthly Swaps Data Review for Risk Magazine was published on Friday. This looks at volumes of G4 Swaps in the first six months of 2017, showing: Strong growth at LCH and JSCC OIS volumes significant in USD, EUR and GBP JSCC volumes in JPY Swaps exceeding LCH in 2017 SEF volumes show D2C continuing […]

CCP Disclosures 1Q 2017 – What the Data Shows

Central Counterparties recently published their latest CPMI-IOSCO Quantitative Disclosures and in this article I will highlight what the data shows, similar to my article on 4Q 2016 trends. Background Under the voluntary CPMI-IOSCO Public Quantitative Disclosures by CCPs, over two hundred quantitative data fields covering margin, default resources, credit risk, collateral, liquidity risk and more […]

MIFID II: What Should Transparency Look Like?

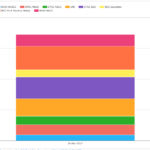

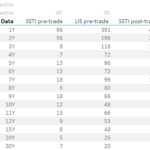

We replicate the transparency calculations published by ESMA, using SDR data on EUR Swaps. EUR swaps are the second largest IRS market, and yet do not benefit from real-time trade level reporting. Our data shows that most of the EUR IRS curve is “liquid”, with ADV >€50m. SDR data calibrates realistic pre-trade transparency thresholds at €50k […]

ISDA SIMM For Excel

SIMM for Excel performs ISDA SIMM™ Initial Margin calculations from Excel. Free 14-day trials are available for all financial firms. Reconcile ISDA SIMM calculations. Perform pre-trade analysis of your bilateral trades quickly, simply, reliably. The functions calculate Initial Margin across a whole portfolio. Users can also create CRIF sensitivities from trade-level details. Functions That Won’t Kill Excel Our […]

June 2017 Swaps Review in 15 Charts

Continuing with our monthly Swaps review series, let’s look at volumes in June 2017. Summary: SDR USD IRS price-forming volume > $2.1 trillion gross notional, similar to a year earlier SEF Compression activity in USD IRS > $300 billion, 51% higher than a year earlier On SEF IMM Roll volume > $60 billion USD OIS price-forming volume was > $2.7 trillion, again […]

MIFID II Transitional Transparency

ESMA have published Transitional Transparency Calculations for a number of asset classes. These calculations define which asset classes and instruments are deemed liquid for the purposes of making trade data public as of 3rd January 2018. Anything deemed “illiquid” will likely have a two-day lag applied to the trade record being made publicly available. The transitional […]

New Swap Execution Facilities

There have been a couple noteworthy advances in SEF’s in July. The NEX SEF has launched, and LedgerX has been approved. Let’s have a look at these. BLOCKCHAIN We’ll start with the bitcoin venture LedgerX, who applied for SEF registration in January 2017 and was approved on July 6. They put out some press in […]

GBP Swaps for Dummies

GBP IRS markets are the third largest Interest Rate Derivatives market. Almost 100% of volumes are cleared at a CCP. Most trades are standardised contracts versus 6 month Libor (IRS) or SONIA (OIS). SONIA swaps are frequently forward-starting out of MPC dates and IMM dates. 42% of GBP Libor swaps are forward-starting; spot-starting swaps account […]

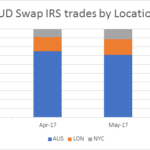

AUD Swaps: What Does the Data Show?

Over the last few years we have published many blogs on the AUD Swap market. Amir also includes an AUD summary in his monthly swaps review. The DTCC does publish some market info from the Australian SDR, but the aggregated nature of this data does not allow for a meaningful analysis of what is actually […]

Swaps Data Review: A Day in the Life of a Swap

My Monthly Swaps Data Review for Risk Magazine was published today. This looks at what can be seen in price data for Interest Rate Swaps by focusing on June 14, 2017 (the most recent FOMC meeting) and three of the highest volume products: USD 10Y Swaps USD 10Y Spreadovers USD Curve/Switch/Butterfly Swaps in 10Y Trade prints, […]