MXN Interest Rate Swaps

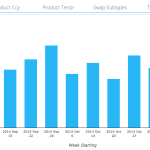

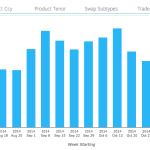

My earlier article on Mexican Peso Interest Rate Swaps looked at the trade volume, both On and Off SEF and noted that CME were going offer Clearing for these. So almost exactly one year later, I thought it would be interesting to look at what the data show. Weekly Volumes Lets start with weekly volumes using […]

Margin Games 2014

2014 So, it’s that time of year when we look back at 2014, the year that was. We go through the (painful) year-end reviews, give the year a mark out of 10 if you must. Think about all of the tail events you’ve traded through during the year. Those once-in-10,000-lifetime events that seem to occur at least […]

Transparency in Clearing Data

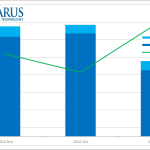

About a month ago I was at a conference and heard folks mention OTC clearing volumes, and my curiosity got the best of me: Who is clearing what, and how much is going through each venue? So I began pulling clearing data and managed to address my initial curiosity, which I detail in my article “The Truth […]

Swaps Compression Continued

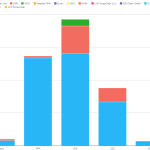

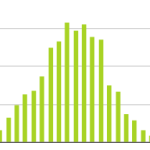

Last week we introduced the idea that we can identify compression trades within the SDR data. Combining this with information direct from SEFView, we now have good estimates for compression volumes being traded across the three SEFs currently active in this market – TrueEx, BSEF and Tradeweb. Due to the nature of the exercise, we […]

Compression in USD Swaps

We hear a lot about how much notional is outstanding in OTC Derivatives, and the industry efforts to reduce this burden. We’ve written before about compression and compaction, and what the exact economic and operational benefits are. Now, we can look across the Clarus product suite and augment the data to identify which trades done on-SEF […]

November Volumes in Interest Rate Swaps

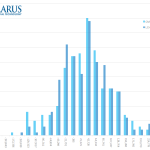

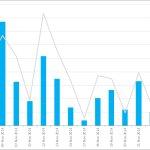

Now that November data is in, I wanted to update my blog October Volumes in Interest Rate Swaps. USD IRS ON SEF Lets start with a chart from SDRView Res showing USD IRS On SEF volumes: A disappointing month after the record volumes seen in September and October; with volumes similar to August. And the […]

JAVELIN’S 2-DAY VAR LETTER: WHAT DOES IT MEAN?

A short while ago I saw the letter written by Javelin to the CFTC regarding MAC swaps and margin. The press release can be found here. My brief synopsis: Swap futures are equivalent (in terms of risk) to cleared OTC MAC contracts Swap futures enjoy 2-day VaR margining (SPAN or SPAN like) OTC MAC contracts are […]

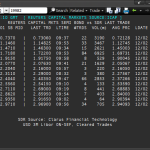

IR Swap Prices on Reuters, Bloomberg and SDR

SDRView Pro shows the latest IR Swap trade prices reported to US Swap Data Repositories with a 15-minute snap of prices from ICAP. However this requires a user to use a Web browser and login to the SDRView application. We have all heard how difficult it is to get screen real-estate on a traders desktop; even with […]