US Treasury Quarterly Refunding: Traded Volume Data

Clarus data for August 2020 shows a big increase in 30Y traded volumes in Rates products. This was specifically in USTs and exchange traded derivatives. Long-dated OTC derivatives did not see the same increase. The 20Y and 30Y US Treasury auctions, as part of the quarterly refunding cycle, were clear drivers of this volume. However, […]

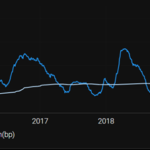

Valuation challenges for non-cleared derivatives

The past few months I have been looking closely at the potential for valuations challenges over the last months and days of LIBOR with a potential cliff and wall as we approach December 2021. The rather benign pricing in the market predicts a very gradual ‘glide’ into the end but this may not actually be […]

Calculate your own RFR Adoption Indicators

The ISDA-Clarus RFR Adoption Indicator provides a set of monthly metrics that firms can use to monitor the progress of RFR trading in IRD markets, both ETD and OTC. In this article, I explain why firms should also calculate RFR Adoption Indicators for their own trading. Background For those of you not yet familiar, below […]

YouTube: Markets and COVID-19

The presentation that I gave at the CFTC’s Market Risk Advisory Committee on July 21st is now available to view. The section on Derivatives Markets during COVID-19 is well worth a watch, covering content from ourselves, Bloomberg and Tradeweb. Have a click through to watch it all, and make sure to listen to the closing […]

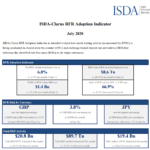

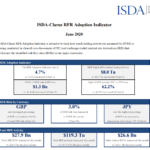

RFR Data: SOFR Sees Record Risk Traded

The ISDA-Clarus RFR Adoption Indicator has been published for July 2020. The headlines are: The RFR Adoption Indicator was at 6.8% in July 2020. This moved higher from 4.7% the prior month, reaching the highest level since February. Of particular note, 3.8% of all USD risk was traded in SOFR. This was higher than the […]

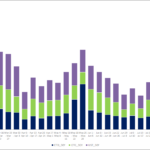

CCP Volumes and Share in CRD and FXD – 2Q 2020

I recently looked at CCP Swap Volumes and Share – 2Q 2020 for Interest Rate Swaps, so today I will do the same analysis for Credit Derivatives and FX Derivatives. USD CRD Starting with Credit Derivatives in USD, both Indices and Single-names. 2Q 2020 with $2.65 trillion, up from the $2 trillion in 2Q 2019 […]

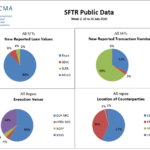

SFTR Public Data

In April I covered Securities Finance Transaction Reporting (SFTR) and ended that article by stating that I would check back end July for the first set of public reports from Trade Repositories. As there are four authorized Trade Repositories (DTCC, Regis-TR, UnaVista and KDPW), I had expected to look for the weekly data files published […]

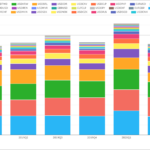

ISDA-Clarus RFR Adoption Indicator Analysis – June 2020

4.7% of derivatives risk was transacted versus an RFR in June 2020. June 2020 was a record month for the proportion of risk transacted versus SOFR in USD markets. €STR is at the beginning of adoption following the CCP discounting switch last week. JPY TONA sees a significant proportion of risk transacted in longer maturities. […]