2Q23 CCP Volumes and Share in CRD

A review of Credit Derivatives (CRD) volumes and market share at Clearing Houses (CCPs) in 2Q 2023. All the charts and detail from CCPView. USD CDX, CDS and Swaptions CDX volumes significantly down compared to all the prior quarters shown. Market Share of USD CDX The upcoming ICE Clear Europe shutdown later in 2023, resulting in […]

Deutsche Bank Credit Default Swaps

One of our readers pointed me to yesterday’s Bloomberg article, “A Single Bet on Deutsche Bank’s Credit Default Swaps is Seen Behind Fridays Rout“, which makes the bold claim that a single CDS trade fuelled a global sell-off on Friday. So in today’s article I will take a look at what the data shows. SEC […]

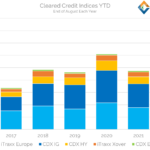

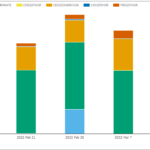

2022 CCP Volumes and Share in CRD

A review of Credit Derivatives (CRD) volumes and market share at Clearing Houses (CCPs) in 2022. All the charts and detail from CCPView. CRD by Currency USD CDX, CDS and Swaptions CDX volumes at $12.9 trillion, representing 91% of USD volume with single-name 7.5% and CDXSwaptions volumes six times higher in 2022. USD CRD Index Series […]

CDS Volumes now $6.6Trn higher than last year

Credit Derivative volumes have been huge in 2022. YTD volume data shows that 2022 will likely see all-time record volumes. Volumes are already $6.6Trn larger than at the same point in 2021. We analyse the Cleared market in Index and Single Name CDS. SBSDRView reveals the most active names across uncleared and cleared CDS. We’ve […]

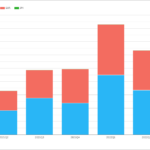

2Q22 CCP Volumes and Share in CRD

A review of Credit Derivatives (CRD) volumes and market share at Clearing Houses (CCPs) in 2Q 2022. Index, Single-name and Swaptions Volumes lower in 2Q than 1Q but massively higher than 2Q 2021 USD CDX volumes up 100% in 2Q 2022 than 2Q 2021 ICE Clear Credit with 97.2% share of volume in USD CDX […]

CDS Data Made Simple

SBSDRView from Clarus takes transaction level transparency data and makes it simple to use, aggregate and monitor. We look at the most active corporate names in single name CDS trading since records began. We find that a significant portion of activity in concentrated in the Top 10 names, with close to half of all volumes […]

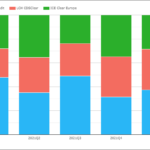

1Q22 CCP Volumes and Share in CRD

A review of Credit Derivatives (CRD) volumes and market share at Clearing Houses (CCPs) in 1Q 2022. Index, Single-name and Swaptions Volumes significantly higher in 1Q22 than a year earlier USD CDX up 50% and CDS up 37% EUR iTraxx up 80% and CDS 27% ICE Clear Credit 97.5% in USD CDX ICE Clear Credit […]

Most Actives in CDS Trading

In our latest data app, SBSDRView, we continue to interrogate the newly available transparency data from the SEC. In my blog last week, I took a first look at Total Return Swaps. Now, let’s take a look at Credit – and specifically single name CDS. What are the most active securities being traded? Using Our […]

SBSDR – Credit Derivative Volumes

Following on from my blog, SEC Security-Based Swap Data Repositories Are Now Live, and now with 5 weeks of data published, I wanted to take a deeper look at the data for Credit Derivatives. CDS and TRS in USD Let’s start by looking at trades reported to the DTCC and ICE repositories by US persons […]

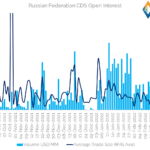

Russia CDS Trades are now showing in SBSDR Data

CCPView data shows that Open Interest in Russia CDS has decreased 13% from $9.4bn to $8.1bn. Over the same time period, average trade size in Russia CDS has decreased from $8.5m to below $5m. More trades are happening than we have seen previously, with February seeing nearly 1,000 trades. There was a single trade at […]