Is It Time To MAT The Entire Curve? (Part 1)

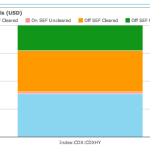

Scrutinizing the most recent OTC data tells a fairly consistent picture over the previous months. The percentage of trades registered On-SEF in recent times is, at best, inching up. In fact the preliminary August data shows no change from July, hovering right around 58% of all trades (and 67% of all cleared trades). Let’s not […]

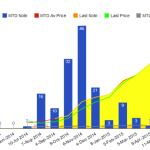

CDSIndex Volumes: A Year to Date Review

Reading a Bloomberg article today, Swaps Boom is Unintended Consequence of New Curbs on Wall Street, it seems that instead of trading investment-grade bonds themselves investors are increasingly turning to derivatives. The reason given that they cannot get quickly in and out of cash bonds as dealers are pulling back from debt trading. While the figures quoted in […]

Super Mario’s EONIA Effect

Guest Blog Series Profile: Interest Rate Swaps trader. 12+ years’ experience, European and cross markets focused Super Mario to the rescue? No, not this Mario. Draghi was again even more dovish than expected at the central-banker’s annual shindig in Jackson Hole. Veering from the script, it looks like he’s ready to push the Bundesbank toward […]

SEF: Month 10 (Another look at Futures?)

A few months ago I examined swap futures at Eris and CME, and postulated that the swap market has most certainly not moved to swaps. While there has not been a shift to futures products, the infrastructure and behavior of the market most certainly has been “futurized”. You need to look no further than the transparency […]

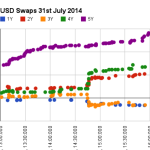

Hawkeye and Super Slo-Mo for USD Swaps

Guest Blog Series Profile: Interest Rate Swaps trader. 12+ years’ experience, European and cross markets focused With the Premier League back, we’ll have the joys of Super Slo-Mo replays and Hawkeye reconstructing every kick of every game for the next nine months. What if we could have the same for every trading day? If you are […]

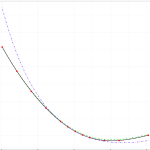

SABR Calibration: A simple, explicit initial guess

The SABR model is widely used, particularly in the interest rate world, to help manage the volatility smile. Depending on 4 parameters, \(\alpha\), \(\beta\), \(\rho\) and \(\nu\), often \(\beta\) is considered a fixed constant whilst the other 3 parameters are calibrated to liquid market prices. There tends to be two types of calibration algorithms; local […]

Sterling Work: Looking into GBP Swaps

Guest Blog Series Profile: Interest Rate Swaps trader. 12+ years’ experience, European and cross markets focused We open this week with an age old adage – what applies to one market does not and should not be applied to another. This applies across the board, but seems particularly apt in terms of trade reporting. Let’s […]

The Professionals: USD Swaps on Bloomberg SEF

Guest Blog Series Profile: Interest Rate Swaps trader. 12+ years’ experience, European and cross markets focused Happily we are coming into the quiet summer time. As well documented, many market participants head to the beach for August and we expect to see a significant drop-off in liquidity and trading volumes as a result. Of course, […]

Swaps Compression: Clearing Fees and Margin

In my recent article, Swaps Compression and Compaction on trueEx and Tradeweb SEFs, I looked at the mechanics of these trades, the evidence in SEF and SDR figures and stated that the benefit was to reduce line items and clearing fees. In this article, I am going to take a deeper look at just the […]