Archegos, APAs and Uncleared Margin Rules

My recent blog on Archegos, Trade Repositories and Initial Margin, was very popular, so I wanted to do a follow up on the same two topics; transparency of derivatives and initial margin requirements. For those of you not familiar with the three letter acronym, APA, it stands for Approved Publication Arrangement which is a European […]

New: What caused volumes to decrease in April?

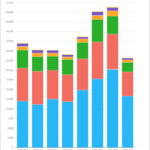

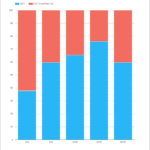

The latest ISDA-Clarus RFR Adoption Indicator has just been published for April 2021. It saw an increase to 10.1% and it is now back to the levels it has been at for most of 2021. Was March maybe just a blip in the RFR story? Showing; The RFR Adoption Indicator was at 10.1%, higher than last month […]

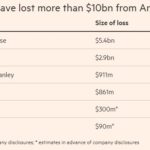

Archegos, Trade Repositories and Initial Margin

Amongst the many questions that standout from the huge losses suffered by prime brokers in closing out the positions of Archegos Capital Management, the two that interest me most are, first the lack of transparency of the derivatives (total return swaps) used for these positions and second the in-adequate risk management by the prime brokers. […]

JSCC and CME RFR Adoption Indicators

A client recently asked us if we had ever calculated our RFR Adoption Indicators for individual CCPs. The answer was a surprising “No” so I thought I should rectify that in today’s blog. This was somewhat motivated by this Risk.net story on JPY this week. The story highlights how different CCP market shares are at […]

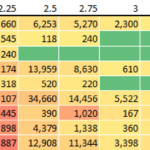

Swaption Volumes by Strike Q1 2021

USD Swaptions activity hit all time records in March 2021. Driven by the large sell-off in Fixed Income markets, we see particular evidence in 5Y tails of convexity hedging in Swaptions markets. We analyse the activity by strike and underlying (tails). For once, we are playing catch-up here. Chris Whittall over at IFR brought to […]