Swaps Data: Volumes rise, CCP Switches Spike

I wrote an article for Risk.net, reviewing recent trends in Swap volumes, available at this link. (Complete with my bang up to date picture, time has flown by ……, only 15 years to be precise.)

Capital requirements for exposures to CCPs

Following on from my article SA-CCR: Standardised Approach Counterparty Credit Risk, I wanted to look at the related topic of Capital requirements for Cleared Swaps and get a sense of the size of these requirements. Background In March 2014, the Basel Committee on Banking Supervision (BCBS) published it’s Standardised Approach (SA-CCR) for measuring exposure at default […]

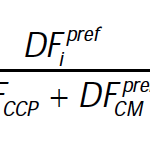

ISDA SIMM™ in Excel – Equity Derivatives

We build an IM calculator in Excel for Equity Derivatives under ISDA SIMM™. The methodology builds on the margin methodology for Rates products, and uses very similar formulae. We cover all forms of IM. This blog is for the Delta Margin. There are subtle differences to the implementation for Rates, mainly around the concept of “buckets” […]

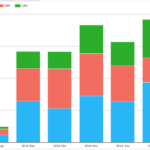

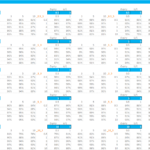

January 2017 Swaps Review

Continuing with our monthly Swaps review series, let’s look at volumes in January 2017. Summary: SDR USD IRS price-forming volume > $2.3 trillion gross notional 21% higher than a year earlier On SEF vs Off SEF at 62% to 38% is lower than average; 65% to 35% SEF Compression activity in USD IRS was > $220 billion USD OIS volume at […]

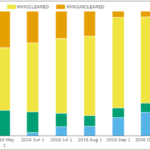

Latam Swaps Data & Analytics

This week, we go south of the border to look at Latin American Interest rate swaps. Over the past few years we have looked at MXN (Mexican Peso) and BRL (Brazilian Real) swaps in some detail, particularly around their launch of clearing: Sizing the MXN Swaps Market (Dec 2013) A Year of MXN Swaps data […]

FRTB Curvature Risk Charge

Various risk charges must be calculated under the Standardised Approach of the FRTB. These risk charges are split into Delta, Vega and Curvature. Curvature Risk Charge is complicated to calculate as we must record MTM changes to large input shocks. We explain the calculations involved. For Rates products, the Curvature Risk Charge is not split by tenor […]

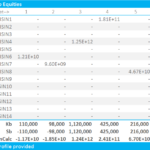

Final 2016 FCM Rankings

Data is now in for the final month of the year, and we can put together our updated metrics on the FCM industry. If you remember from the previous quarterly reports we do on this topic, the common themes have been: The growth in clearing is in swaps European banks stand out as retreating, or […]

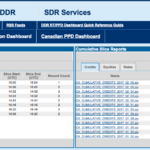

Canadian Derivatives Public Dissemination

Canadian Derivatives public dissemination of transactions is now in effect We can see transactions starting from Jan 16, 2017 Published with a 48 hour delay from execution time Covering Interest Rate, Credit and Equity Derivatives Similar in content to US CFTC public dissemination Clarus SDRView now includes this Canadian data Background Following on from my blog on […]

FRTB Vega Risk Charge

Various risk charges must be calculated under the Standardised Approach of the FRTB. These risk charges are split into Delta, Vega and Curvature. Vega Risk Charge is complicated to calculate as we must build several co-variance matrices. We provide a step-by-step explanation of all of the calculations involved. We use Excel throughout to calculate and illustrate the […]

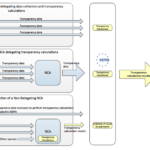

MIFID II: Transparency Data

Following on from my article on the MiFID II: Instrument Reference Data, I wanted to look at the “Transparency Data” mentioned in the briefing note released by ESMA on 12 Jan 2017, titled “MiFID II technical data reporting requirements“. This starts with the following table: Showing that from September 2017 ESMA will start collecting Transparency data. Transparency Data […]