MIFID II Data – It’s Finally Good News!

The availability of MIFID II data has been one of our hot topics in 2018. We’ve aired our frustrations previously. Happily, MIFID II data is about to become truly accessible to all. Find out how and why below. Questions and Answers ESMA have just released an updated “Questions and Answers On MiFID II and MiFIR […]

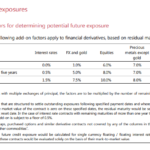

Current Exposure Methodology – What You Need To Know

The Current Exposure Methodology is a key part of Leverage Ratio calculations. It dates back to the late 1980s and the first Basel accords on banking capital. CEM calculates the Potential Future Exposure of a derivative trade using a look-up table based on Asset Class and Maturity. CEM is a very simple, notional-based measure of […]

Identifiers, Identifiers, Everywhere

Anyone working in Capital Markets technology cannot have failed to notice the increase in global identifiers; they now seem to be everywhere for all manner of use cases, some mandatory others best practice. Often a new identifier is held up as a solution to an existing data problem and is promulgated by regulators as a […]

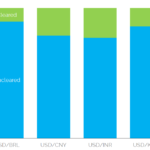

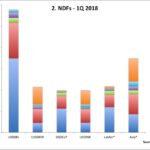

NDF Volume Data

The challenges in Emerging Markets recently, as well as finding different data sources for NDFs, prompted me to refresh our data on FX markets. Is Clearing still accelerating for NDFs? It looks that way. Clearing accounted for 16% of the total market, even before the recent 30% growth in Cleared volumes. 2018 Q1 and March […]

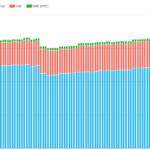

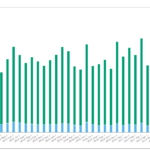

CCP Basis and Volume in Major Currencies

Almost a year has passed since we last looked in detail at CCP Basis, which just goes to show how normal and accepted this has become in the market. Since the shock emergence of the CME-LCH Basis Spread in June 2014, we have seen regular trading of CME-LCH Switch trades to manage the CCP Basis […]

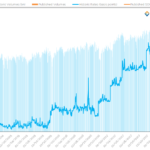

SOFR – What you need to know

Major markets across our industry are looking to transition (some) liquidity away from Libor-based products and towards Risk Free Rates. We’ve variously looked at Libor Reform, Euribor, SONIA and SARON but so far have not done a deep dive into new RFRs in the US. SOFR – What is it? As we reported in our […]

Swaps Regulations Are Changing – Part Two, Capital and CCPs

What You Need To Know Swaps Regulation 2.0 is a whitepaper that was presented by Chairman of the CFTC, Christopher Giancarlo, at the annual ISDA AGM. The paper sets out 6 broad areas of reform for Swaps markets. We looked at (1) Trade Execution and (2) Trade Reporting in Part One. This week, we look at […]

Swaps Data: The Allure of Liquidity

My monthly Swaps Review in Risk Magazine looks at execution venue market share in 1Q 2018 for: CDS Index NDFs by currency pair FX Options by currency pair Interest Rate Swaps by major currencies Bloomberg MTF for EUR IRS In simple terms, it shows that volume is either dominated by a single venue or split […]

Swaps Regulations Are Changing – Part One, SEFs

What You Need to Know Last week, the CFTC Chairman, Christopher Giancarlo, presented a whitepaper at the annual ISDA shindig. This whitepaper should be a pretty good guide for any regulatory changes that we can expect to see out of the CFTC for the remainder of his term (it expires in April 2019). He looked […]

Enterprise Software Vendor to a Cloud Service

I recently joined Clarus Financial Technology after 15 years of working for one of the premier enterprise software companies in capital markets. My first month has been an eye-opening experience in the stark difference in how cloud vendors operate and what this means for employees and customers. Below is a short summary of what I […]