The Latest on Canada and the Transition from CDOR to CORRA

ISDA recently published a very informative webinar on the CDOR Transition: From this, I learned that 30th June 2023 (i.e. Friday!) is a big day for Canada Rates markets. Succinctly, no more new CDOR trading should take place after this date, other than for some well-defined exceptions. The CARR website is a great resource (from […]

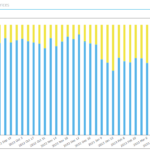

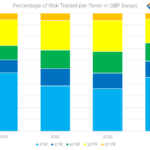

Gilty Secrets Of GBP Swaps

(Sorry/not sorry for the title) UK Rates UK rates markets have been interesting ever since the autumn meltdown, and there are now lots of headlines around as yields break the highs last reached in those tumultuous trading days: The FT Alphaville overview of why June 2023 is not September 2022 is well worth a read […]

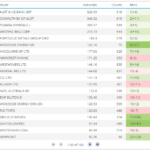

Most Active Names in Credit and Equity Derivatives – May 2023

Last month I looked at the most active trading names in CDS and TRS in April 2023, so today I will update that for May 2023. This data is from U.S. SEC Securities Based Swap Data Repositorys (SBSDRs). CDS on Sovereigns Using SBSDRView, we can find the most active sovereigns for CDS trades in May 2023. […]

What’s New in CCP Disclosures – 1Q23?

Clearing Houses have published their latest CPMI-IOSCO Quantitative Disclosures: Background Under the CPMI-IOSCO Public Quantitative Disclosures, CCPs publish over two hundred quantitative data fields covering margin, default resources, credit risk, collateral, liquidity risk, back-testing and more. CCPView has over 7 years of these quarterly disclosures for 44 Clearing Houses, each with multiple Clearing Services, covering the period from 30 Sep […]

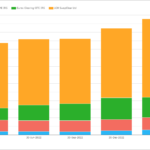

Find Out What Was Weird About RFR Trading In May

The latest ISDA-Clarus RFR Adoption Indicator has been published for May 2023 so I asked ChatGPT about the next report: I love how it states that because it is a language model it doesn’t predict the future. Rather than simply stating “you cannot predict the future smart @rse”. From my experience with ChatGPT, I found […]

Central Clearing of Bonds and Repos

Regular readers of this blog will know that we are strong proponents of Central Clearing and since 2013 have written numerous articles on this topic for OTC Derivatives in Interest Rate, Credit and Foreign Exchange. In the past year or two, there has been increasing attention on central clearing for Bonds and Repos, so it […]

We Need to Talk About €STR Futures

There are extremely liquid markets in a number of EUR-denominated interest rate futures. If you don’t already know your Bund from your Bobl or Schatz then please read our primer “Mechanics and Definitions of Bond Futures“. As you can see from our CCPView volume charts, EUR bond futures are a significant portion of EUR futures […]