The Rise of MAC ?

Earlier this month, I predicted that just like the CDS market moved to standardized contracts a few years ago, the day would come when the interest rate market would move to a standardized world, namely in the form of Market Agreed Coupon contracts (MAC). The logic being: Managing line items in a cleared world is easier because they naturally compress […]

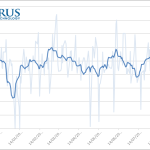

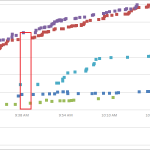

Stress Testing of Initial Margin and Procyclicality post Oct 15th

There has been much comment on the market moves in the US Treasury market on October 15, 2014. Our article Swaps and the Flash Crash described what we saw in Interest Rate Swaps. So I thought it would be interesting to look at what this period of market stress and higher volatility means for Cleared Swap Margin requirements. And […]

NDFs and Clearing

So that our readers don’t have to go through the pain, I’ve read the most recent ESMA Regulatory Technical Standards (RTS) on NDF markets. In summary, ESMA would like the market’s view on mandatory clearing for NDFs vs USD in the following 11 currencies: BRL CLP CNY COP IDR INR KRW MYR PHP RUB TWD […]

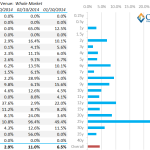

Market Share in the Swaps Market

Interest Rate trading volumes are going up and up – October 14th last week saw nearly 2.5 times the Average Daily Volume trading when compared to the past year. As volumes move higher, it is important to appreciate where those volumes are coming from and what it means for your business. As a result, we […]

Record Volumes On SEFs in September and October

Recent weeks and months have seen record volumes traded On SEFs, so I wanted to update my July Blog; A Six Month Review of Swap Volumes. USD IRS On SEF Volumes Lets start with On SEF USD IRS plain vanilla volumes by month in SDRView Res. Which shows that: September was a record month […]

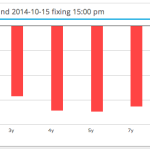

Swaps and the Flash Crash 15th October 2014

Did SEFs Survive the Crash? Yesterday’s events reminded everyone, everywhere of what trading in ‘08 and ‘09 was like. And yet Swaps trading has changed completely since then. In theory, we should now see continuous trading across SEFs with a degree of liquidity constantly available. The market conditions yesterday were the first real test of […]

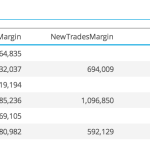

Why a Margin Forecast is important

Variation Margin and Initial Margin are required for a Cleared Swaps Portfolio. Each day a Clearing House will calculate margin requirements in an overnight batch and margin statements will be sent to Clearing brokers and then on to Clients. Just as a trader or a portfolio manager should not leave for the day without knowing their […]

Mechanics and Definitions of Spread and Butterfly Swap Packages

(a.k.a. Spreads and Butterflies Part Zero) Interest Rate Swap markets are jargon-heavy. Traders live and breathe the language. Professional investors pick-up the nuances over time and the vicious circle of incomprehensibility is complete. However, now that Swaps markets have transitioned to electronic trading, will we see market-standard terms adopted across asset-classes? As a result, will […]

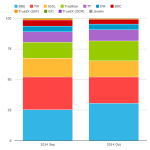

SEF: A Year In Review

It’s been a year since the first SEF executed trade. Whether you’ve been subscribing to our data services, peeking in on the freeview versions of these tools, or just reading our blogs, you probably have a good idea about how its all gone down over the past year. I thought it worthwhile to share a general […]

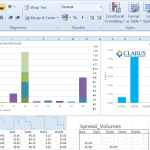

USD Swaps: Spreads and Butterflies Part III

This is Part III in a series. Please also see Part I and Part II. As we continue upon our noble goal of democratizing swaps market knowledge, we look into (maturity) spread prices and their volumes. We’ve so far been focussed on the previous FOMC meeting, but let’s bring the analysis a little more up-to-date […]