SACCR Multipliers, Initial Margin and KCCP

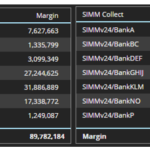

KCCP defines the amount of capital that must be held versus default fund contributions at a CCP. The lower the value of KCCP, the lower the overall cost of clearing. The SACCR multiplier used to calculate KCCP suggests that KCCP reduces for every extra dollar of Initial Margin posted at a CCP. We look at […]

ISDA SIMM v2.4 – Covid Calibration and More

ISDA SIMM v2.4 is effective December 4, 2021 Updated with a full re-calibration and industry backtesting Including for the first time the Covid-19 Crisis time period Meaning Initial Margin will increase for most portfolio To quantify the actual impact of SIMM v2.4 CHARM can run SIMM v2.4 and v2.3 on your portfolios And do so before go-live, to […]

LIVE BLOG: RFR First in Cross Currency Swaps

There are some blogs I look forward to writing – this is one of ’em! Circled in our diaries for quite some time has been Tuesday September 21st. This is when the Cross Currency Swaps market is expected to follow the lead of the recent SOFR First initiative and start the transition away from LIBOR […]

RFR trading is now at 50% in CHF and JPY!

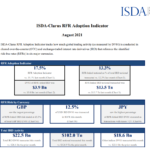

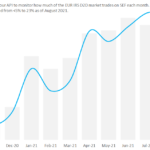

The latest ISDA-Clarus RFR Adoption Indicator presents some truly incredible numbers in August 2021. On to the details. August 2021 The headline RFR Adoption Indicator increased to a new all time high of 17.5% in August 2021. The chart looks particularly healthy: August 2021 was the first month where SOFR First really demonstrated its impact […]

Our Sale to ION

Following on from our announcement that ION acquires Clarus Financial Technology, I wanted to provide some color on the rationale for the deal and what it means going forward. The Rationale After almost a decade as an independent firm why did we decide to become part of ION Group and more specifically ION Markets? A […]

Latest EUR Swaps market share for CCPs and SEFs

Eurex EUR share stands at 7-9% when measured by DV01. Globally, August 2021 saw the lowest EUR IRS volumes in the past 5 years. 23% of EUR IRS executes on-SEF. 60% of EUR CRD Index volumes now execute on-SEF. And we look at where clearing of EUR CRD Index trades is taking place. Now that […]

August 2021 – What Happened?

SOFR trading now accounts for 30% of the USD market. This is as a direct result of the SOFR first initiative. Elsewhere, US markets have been in the midst of a Summer lull. Volumes outside of SOFR were around 15% lower than other weeks in 2021. We look forward to updating the ISDA-Clarus RFR adoption […]