CCP Quantitative Disclosures 3Q19 – Skin in the Game

Clearing Houses 3Q 2019 CPMI-IOSCO Quantitative Disclosures are now available, so lets look at what the data shows, similar to my CCP Disclosures 2Q 2019 article. Summary: Initial Margin for IRS is up 17% in the quarter and 45% in a year Each of the four major IRS CCPs increasing IM Client IM is significantly up IM for ETD up […]

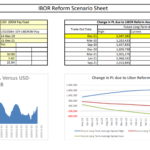

Will GBP LIBOR stop trading on 2nd March 2020?

The market convention for GBP Swaps is expected to move to SONIA from Monday March 2nd 2020. This structural change follows an announcement from UK regulators. The data shows that already 88% of total notional in GBP swaps is versus SONIA. Maturities longer than 2 years have still not transitioned to SONIA trading. Probably* as […]

SGX FlexC FX Futures

In March 2019, just over 8 years after its launch, SGX shut down it’s OTC Financials Clearing business. However SGX continues to innovate and has focused on the futures market. One example of this is the launch of FlexC FX Future, a product which aims to replicate a Non-Deliverable Forward and capture liquidity/volume from the […]

£700bn SONIA Traded on a Single Day

SONIA volumes have hit all-time highs in January 2020. The highest volume of SONIA traded on a single day has been £700bn on 15th January. Total monthly volumes will be over £4trn for the first time ever. The spike in activity is concentrated in short-dated instruments, suggesting it is closely related to the BoE meeting […]

Swaps Data: Have SOFR and Sonia swaps and futures lived up to expectations?

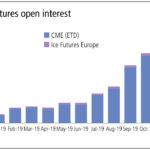

My monthly Swaps Review looks at open interest and volume in 2019 for: SOFR Futures at CME and ICE SONIA Futures at ICE, CME, CurveGlobal SOFR Swaps at LCH and CME SARON Swaps at LCH €STR Swaps at LCH GBP Libor and SONIA Swaps at LCH Please click here for free access to the full article on […]

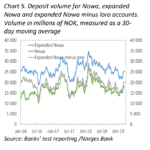

NOK Rates: What You Need to NOWA

Following on from the surprise entry of our NOK Rates blog in the Top 10 Clarus blogs of 2019, it is high time I updated it with both a look at whether OIS is trading yet and what has happened in the world of NOWA since we last wrote about it in April 2019. And […]

What You Need to Know about MXN Swaps

MXN Swaps are the 8th most traded interest rate swap at CCPs. 99% of cleared volumes are at CME, and most MXN swaps are now cleared. MXN swaps are a long-dated market. Almost half of all risk is executed in the 5y and 10y tenors. 66% of MXN swaps are executed on-SEF, but there is […]

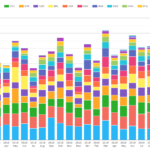

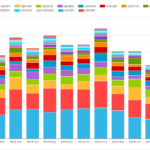

2019 SEF Market Share Statistics

In this article I look at 2019 Swap Execution Facility (SEF) market share for Credit, Foreign Exchange and Interest Rate Derivative asset classes, in a similar format to my 2018 SEF Market Share Statistics. A brief summary is that 2019 volumes held onto 2018 volumes, a banner year, in both FXD and IRD but CRD volumes […]

Moving from Libor to SOFR/SONIA – Buyside Considerations

2020 is shaping up to be an important year for the development of markets in SONIA and SOFR. Recently on 21st November in a speech the FCA outlined plans to accelerate development of SONIA markets during 2020. Although plans are well advanced, the markets are still developing liquidity in longer-dated derivatives. I recently looked at […]