Can the UK get transparency right?

Happy New Year everyone. My New Year has started by tackling 172 pages of FCA consultation – lucky me! In Summary Context The UK rules for pre- and post-trade transparency were largely inherited from MIFID II post-Brexit. In case any of our readers are not familiar with MIFID II transparency – it doesn’t work. We […]

What is a Consolidated Tape?

Following on from last week’s blog, I realised maybe I had jumped the gun somewhat. Since the European Commission has now published their report (and a Consolidated Tape for derivatives is included), I thought it worthwhile to take a step back. What actually is a Consolidated Tape and what that might mean for Transparency in […]

Consolidated Tape: Don’t let perfection be the enemy of good for derivatives

Dutch regulators have today stated with regards to European transparency data: Significant regulatory changes are needed to simplify the current fixed income post-trade deferral regime. Common data standards [are required], to set required data fields, and to agree on data access. Trading venues and APAs [need] to contribute the required data fields and supporting commercial […]

Have You Seen This New Idea for Execution Analysis?

In a quick blog today I summarise a recent report from the FICC Markets Standards Board about execution analysis in our markets. And suggest a potential way forward… The Who? First off, it is worth highlighting the role the FMSB intends to play in our markets: In their own words: The Fixed Income, Currencies and […]

MIFID II Transparency – Can we get it right this time?

There is a new April 2020 ESMA consultation on the Transparency Regime for OTC derivatives. ESMA are proposing potentially wide-sweeping changes to post-trade transparency in their latest consultation. Deadline for responses is currently April 19th 2020. We encourage all market participants to respond to this vital consultation. We could finally witness the beginning of transparency […]

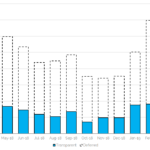

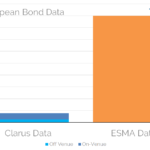

MIFID II Data for Bonds

Let’s take a look at the European bond market today. I wanted to repeat much of the analysis that I performed for MIFID II post-trade data concerning Interest Rate Swaps. However, I realised that we do not have enough of a complete data set due to a myriad of data access issues. For example, the […]

What we need to do to fix MIFID II Data

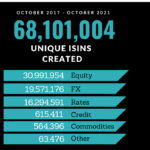

We attempt an analysis of available MIFID II transparency data. Analysis shows that 89% of notional in vanilla EUR IRS is reported with a four-week delay. We show that at least €800bn of transaction data for vanilla, cleared EUR IRS is missing each week. We estimate that as little as 5% of notional of off-venue […]

5 Things That Are Making MIFID II Data Useless

To all of our readers who, like me, are responding to the latest ESMA consultation, I thought I would provide a simple list of ways that MIFID II data is being made difficult to access. Hopefully this can help to get transparency right in Europe. ESMA report that the users of data that they spoke […]

ESMA: Let’s Get Transparency Right

Transparency under MIFID II has been a failure so far. ESMA is consulting to put this right. We have already lost three years of transparency. This issue is more important now than ever before as the transition to RFRs demands transparency. I return to work with possibly the most important consultation of the year to […]

MIFID II Transparency Update

Back in August 2017 I wrote that “MIFID II Transparency will leave us in the dark“. I didn’t realise at the time how right I would be. As I write this blog as of April 2019, I still feel like transparency is sadly lacking. Could things change in the future? Transitional Transparency Regular readers of […]