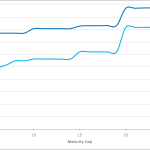

Can SPAN Margin for Futures be higher than HistSim Margin?

Following on from my article on Portfolio Cross-Margining of Swaps and Futures, I wanted to take a more detailed look into the Initial Margin of Interest Rate Futures. In this article I will compare SPAN with Historical Simulation and check whether SPAN margin is always lower than HistSim margin, which is what we would expect given […]

Our Response to the ESMA Consultation

We recently responded to the European Securities and Markets Authority (ESMA) Consultation Paper on a “Review of the technical standards on reporting under Article 9 of EMIR”. This consultation is on the revision of the Regulatory Technical Standards (RTS) and Implementing Technical Standards (ITS) of EMIR which deal with the obligation of Counterparties and CCPs […]

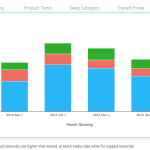

Swap Curve and Fly Trading: What goes in, must come out

Curve and Fly trading looks like a simple old game – existing trades are ripped-up and replaced with spot-starting hedges. So why don’t people do that across the Bloomberg SEF? Curve and Fly Trades Today, we indulge in a little bit of data mining for our recently launched Curve and Fly feature. This is a fascinating […]

Inflation Swaps: What the Data Shows

As LCH SwapClear plans to start clearing Inflation Swaps I thought I would look at what the US SDR data shows for this product. While this is only part of the global market, it still provides very interesting insight into the market. Summary Inflation Swaps trade in USD, EUR, GBP Gross Notional volume averages $2 billion […]

Clearing Efficiency: A New Metric?

With the release of CCPView, we now have a great tool to monitor OTC clearing data. CRYING FOUL My previous articles on the topic of clearing data garnered a lot of comments from folks surprised by some of the data we can see when we start tearing off layers of data. In each of these […]

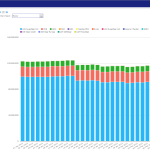

Swap Curve and Fly Trades: A quarter of all trades are not what they first seem

We now identify package trades within SDR data in real-time. These packages represent 25% of reported trades. Users can access this analysis via our SDRView Pro application, further increasing the utility and transparency of the data within OTC markets. This is a good example of how we can add simplicity and clarity to the data […]

SEF Package Relief Runs Out Again

Happy Valentines Day. Love, The CFTC The next phase of expanded MAT-package interpretations is upon us. Back on November 10, the CFTC released their letter outlining their most recent extended package relief for certain swap packages. The next deadline is now upon us, February 15. SUMMARY The table below is my little summary of the package relief […]

ECB QE and EMIR Reporting. More transparency please!

Will ECB QE affect European Cross Currency swap markets? We need more transparency in European OTC data to definitively answer that question. In this blog, we use 2014 data from the SDRs to first examine what has traded over the past twelve months and then we take a quick look at 2015 data and discover a […]

Clearing Certainty (ESMA’s Version)

I think ESMA has got it wrong when it comes to Pre-Trade Credit Checking / Certainty of Clearing. For starters, Pre-Trade credit checking is discussed under chapter 9 “Post-Trading issues” of both ESMA documents (consultation paper and draft RTS). I can see how it happened: the post-trading issue is that the clearing house does not […]

Portfolio Cross-Margining of Swaps and Futures

We often get asked about Cross-Margining of Swaps and Futures, as well as SPAN margin for Futures. In this article I will introduce the benefits of cross-margining, using a few simple examples and the CME Clearing model. As this is my first article on this topic, I will endeavour to keep it as simple as possible […]