ISDA SIMM – What changes in v2.6?

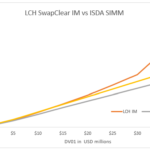

Version 2.6 ISDA has published ISDA SIMM v2.6 with a full re-calibration of risk weights, correlations and thresholds. The calibration period is a 1-year stress period (Sep-08 to Jun-09, the Great Financial Crisis) and the 3-year recent period ending Dec 2022 (or possibly later, but at time of writing I cannot find this specified, so am going […]

ISDA SIMM v25a the first off-cycle release

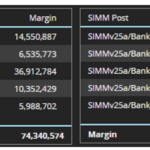

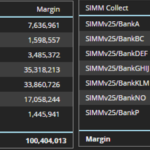

Version 2.5a ISDA has published ISDA SIMM v2.5a with a re-calibration of interest rate risk weights only. This is an off-cycle release, due to the higher interest rates volatility observed in 4Q 2022, compared to that in 2019-2021 and the stress period of Sep-08 to Jun-09; the time period used for the calibration of v2.5. Quarterly industry […]

ISDA SIMM – What changes in v2.5?

ISDA SIMM v2.5 is effective December 3, 2022 Updated with a full re-calibration and industry backtesting Meaning Initial Margin will change for most portfolios In particular, material increases for Commodity and Credit risks To quantify the actual impact of SIMM v2.5 Clarus CHARM can run both SIMM v2.5 and v2.4 on your portfolios And do so before go-live, to […]

IM Model Validation for UMR under EMIR – Backtesting

Last week the EBA published a consultation paper on its its draft Regulatory Technical Standards (RTS) on Initial Margin Model Validation (IMMV) under the European Markets Infrastructure Regulation (EMIR). This is an important and long awaited publication, particularly for the hundreds of firms in the EU that are complying with UMR IM requirements as of Sep 2021 […]

ISDA SIMM v2.4 – Covid Calibration and More

ISDA SIMM v2.4 is effective December 4, 2021 Updated with a full re-calibration and industry backtesting Including for the first time the Covid-19 Crisis time period Meaning Initial Margin will increase for most portfolio To quantify the actual impact of SIMM v2.4 CHARM can run SIMM v2.4 and v2.3 on your portfolios And do so before go-live, to […]

ISDA SIMM v2.3 – What’s Changed?

ISDA SIMM v2.3 is effective December 5, 2020 Updated with a full re-calibration and industry backtesting Initial Margin will change for your portfolios The change can be non-material or significantly higher or lower In this article I highlight some of the changes in risk weights However to quantify the actual impact of SIMM v2.3 You need to run […]

Our Partnership with AcadiaSoft

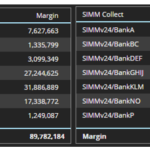

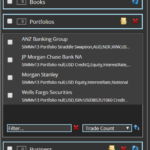

Last week we put out a joint press release, see AcadiaSoft Partners with Clarus Financial Technology to Provide Joint Initial Margin Analytics Service and I wanted to provide more detail on the value of this. Background Uncleared margin rules (UMR) require firms to exchange Initial Margin on bi-lateral derivatives exposures and the financial industry relies […]

ISDA SIMM Concentration Thresholds for IR Risk

We last looked at ISDA SIMM Concentration Thresholds in January 2017, when ISDA SIMM version 1.2 introduced the concept. That blog detailed an Excel implementation of the concentration threshold calculation for interest rate delta risk and proved very popular. The methodology in SIMM v2.2 remains the same, just the thresholds themselves are changed. Today I […]

ISDA SIMM v2.2 – Are you ready?

ISDA SIMM 2.2 is effective December 1, 2019 Updated with a full re-calibration and industry backtesting Initial Margin will change for all portfolios Our clients can check the impact leading up to the effective date And can be confident on implementing SIMM v2.2 on time If you are interested in joining them, we offer free trials […]

LIBOR Fallbacks and Uncleared Margin Rules

LIBOR fallbacks and Uncleared Margin Rules are hot topics across the industry. We highlight the Basel guidance that any amendments to LIBOR contracts as a result of Benchmark reform will not trigger the need to post margin. This is important guidance to ensure the uptake of new RFRs is simple. Two of our big blog […]