FTX’s Direct Clearing Model application to the CFTC

After a 3-year hiatus it was great to attend FIA Boca again, not only to meet up with customers, contacts and colleagues but also to get a sense of the topics d’jour in Cleared Derivatives. The two that stood out for me were the high profile of Crypto firms and Cloud technology. Cloud, as our […]

The First Cross Cryptocurrency Swap?

Well this is something! Babel Finance have not only completed what is maybe the first ever cross currency swap in cryptocurrencies, but they even chose to make it a mark-to-market swap! Let’s look into what this transaction is. Disclaimers I think this is my first blog on crypto/defi, so there may be some errors on […]

STIR Trading Volumes – Will They Recover?

LIBOR cessation appears to have reduced activity in certain short dated futures markets. CHF and JPY used to see volumes of $1.5Trn per month notional equivalent. But these two markets have seen reduced activity in 2022. However, GBP short term interest rate futures activity has been robust. We outline differences in hedging needs for dealer […]

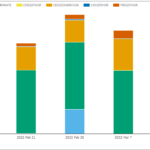

SBSDR – Credit Derivative Volumes

Following on from my blog, SEC Security-Based Swap Data Repositories Are Now Live, and now with 5 weeks of data published, I wanted to take a deeper look at the data for Credit Derivatives. CDS and TRS in USD Let’s start by looking at trades reported to the DTCC and ICE repositories by US persons […]

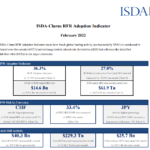

SOFR Adoption Hits New Highs

The RFR Adoption Indicator hit new all time highs in February of 36.3%. Nearly 100% of the GBP, JPY and CHF markets are now traded vs RFRs. SOFR adoption has increased to 33.4% of overall USD Rates risk. The increase in RFR activity has happened in very active markets. February 2022 saw the most amount […]

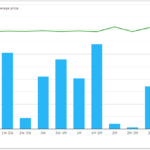

RUB NDF Trading Continues

Following on from our blog last week, RUB Derivatives are still trading, I wanted to take a deeper look at the data for USDRUB Non-Deliverable Fowards. SDRView In SDRView we can look at USD/RUB FX derivatives traded by US persons in the month of February 2022. NDF, by far the largest with 10,939 trades and […]

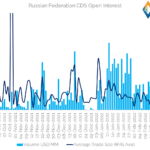

Russia CDS Trades are now showing in SBSDR Data

CCPView data shows that Open Interest in Russia CDS has decreased 13% from $9.4bn to $8.1bn. Over the same time period, average trade size in Russia CDS has decreased from $8.5m to below $5m. More trades are happening than we have seen previously, with February seeing nearly 1,000 trades. There was a single trade at […]

RUB Derivatives Are Still Trading

Derivatives transparency allows us to monitor the continuing activity in RUB markets. Interest Rate Swap activity in RUB spiked in response to the central bank action this week. And Russia is a component of the CDX.EM CDS index, where trading continues despite huge event risks. FX markets are a little more opaque, but we see […]