Mar 2018 SEF Market Share Statistics

In this article I will look at Q1 2018 Swap Execution Facility (SEF) market share for Credit, Foreign Exchange and Interest Rate Derivative asset classes, in a similar format to my 2017 SEF Market Share Statistics. Clarus SEFView has daily volume data published by each SEF, which is filtered, normalised and aggregated to allow meaningful comparison of […]

OIS Volumes – What is the Trend?

We summarise the portion of risk that is traded as OIS across seven major markets. Benchmark reforms around the globe are helping transition trading away from Libor into Risk Free Rates. We can monitor the progression of these reforms by looking at the current state of play in each market. OIS Changes The 1 year […]

USD Libor is changing!

ICE are planning to change the calculation methodology for LIBOR. LIBOR is not currently (April 2018) transaction based – it remains a survey. ICE would like to change this so that it can be based on transactions, but not all Libor tenors see transactions every day. There is therefore a new suggested “waterfall” methodology to […]

Mar 2018 Swaps Review – SDR Data in 9 Charts

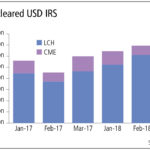

Continuing with our Swaps review series, let’s look at volumes in March 2018, focusing just on SDR Data. Summary: USD IRS volumes in 1Q 2018 are 11% higher than 1Q 2017 USD IRS On SEF Compression, a record month in Feb 2018 USD Swap Curve flattened by 12 bps over the month USD OIS volume exceeded the gross notional of USD IRS EUR, GBP, […]

Segregated Funds, Market Crashes & Under-Seg

Today I want to look briefly at the reported solvency of FCM’s during the most recent market panic. Back on February 5th of this year, the US equities market suffered a volatile day and significant losses. The Dow Jones index had its worst ever one-day loss in terms of points (down 1,175), and other indices […]

Cross Currency Swaps and Libor-OIS

USD can be funded domestically or in international funding markets. These two funding markets create natural links between Libor-OIS spreads and Cross Currency Basis. We saw record volumes in USD Libor-OIS trading over the past three months. We also saw record notional volumes traded in Cross Currency Basis during Q1 2018. However, when we look […]

TraderTV Interview on MiFID II

LIBOR OIS – March 2018 Update

Libor-OIS spreads have recently started to retreat from the wides hit in the middle of March. 1 year Libor-OIS spreads in USD reached as high as 45.25 basis points. They have since traded as low as 40.25bp. Notional volumes across all indices in March hit all time highs, 3 times the levels seen in 2017. […]

Swaps Data: A MiFID-shaped hole

My monthly Swaps Review in Risk Magazine looks at: Global volume in Cleared USD Swaps at LCH and CME US Swap Execution Facility volumes US Off SEF volumes MiFiD II so far failing to provide meaningful data USD OIS Swap volumes The challenge for SOFR Please click here for free access to the full article […]