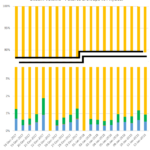

Tradeweb APA Data and the Trading Obligation

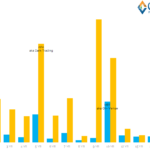

Well done Tradeweb for making APA and MTF data available to Clarus for analysis. Our APA analysis casts transparency over the off-venue market for the first time. 7,000 IRS trades, over €800bn in notional and €400m in DV01 to look at. We take this data to estimate the uptake of the European Trading Obligation in […]

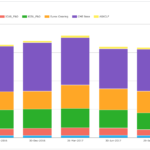

2017 CCP Market Share Statistics

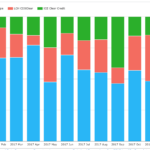

In this article I look at 2017 CCP market share for OTC Derivatives in Credit, FX and Interest Rates. Clarus CCPView has daily volume data published by each CCP, which is filtered, normalised and aggregated to allow meaningful comparison of market share statistics. Summary: IRD LCH SwapClear has >90% share in CAD, EUR, GBP, USD and 86% […]

Tradeweb MIFID Data – Interest Rate Swaps

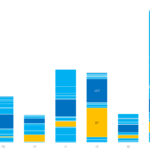

Many thanks to Tradeweb for responding to our requests for access to weekly aggregated data. EUR IRS were by far the most traded Interest Rate Derivative across the Tradeweb MTF. Over €16bn in EUR IRS was transacted in the week 9th-16th January. Tradeweb volumes are equal to those reported by Bloomberg’s MTF for the same […]

MiFID II Data – Interest Rate Swaps on D2D Venues

We have written quite a few blogs this month on the challenges of getting meaningful public transparency data on Swaps and other Derivatives. Today, three weeks after the MiFiD II implementation date, I thought I would write up what I can find for EUR Interest Rate Swaps from the public sites of the major D2D […]

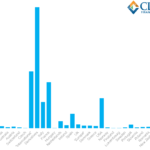

Bitcoin Volumes

It’s been an exciting time in crypto-currencies since my last couple Bitcoin articles last year. As a quick recap: Bitcoin Meets OTC Derivatives – Oct 24, 2017 (Bitcoin price was $5,500) – We discussed how the infrastructure for institutional investment in this space was ready. And we took a look at implied volatility of BTC […]

MIFID II Data – Bonds on Bloomberg

Or: What I learnt about Bunds today ISINs have made a mockery of OTC derivative transparency under MIFID II. So it makes sense to look at an asset class that ISINs work for – Bonds! Bloomberg is a venue that makes their data usable to the public. €6bn of Bunds traded on Bloomberg last week. […]

CCP Disclosures 3Q 2017 – What the Data Shows

Central Counterparties recently published their latest quarterly CPMI-IOSCO Quantitative Disclosures and in this article I will highlight what the data shows, similar to my article on 2Q 2017 trends. Background Under the voluntary CPMI-IOSCO Public Quantitative Disclosures by CCPs, over two hundred quantitative data fields covering margin, default resources, credit risk, collateral, liquidity risk and […]

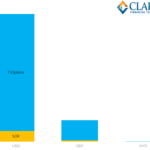

MIFID II Data – $4trn in Compression

Compression providers are now required to make data publicly available. $3.5trn of IRS notional was compressed last week according to European data. 38% of transactions submitted for compression were successfully modified. This data complements existing data from both Clarus CCPView and SDRView. A total of $4trn was compressed last week across both European and US […]

Bloomberg MTF Data – Week One

Some MTFs provide weekly aggregated volume data under MIFID II. We examine Bloomberg’s EUR IRS data after the first week. Clarus data shows that out of a global market of €450bn, useable public MIFID II transparency data provides insight into €8bn of the total market. This is beyond disappointing. Dodd Frank data provides more transparency […]

MIFID II – Why ISINs for OTC Derivatives are Bad for Transparency

One of the goals of MiFiD II is to improve transparency of price and volume in financial markets and the implementation date of January 3, 2018 finally gave me an opportunity to look at the post-trade data made publicly available by Trading Venues and Approved Publication Arrangements (APAs). This data relies on ISINs for OTC […]