We were recently asked to find evidence of Risk Participation Agreements (RPA) in the public swap data. If you are like me, your first question is “what is a risk participation agreement?” Having now done a bit of research on the topic, I thought it worthwhile to share my findings. And also answer the question of whether they show up on the SDR data.

Syndicate Loans

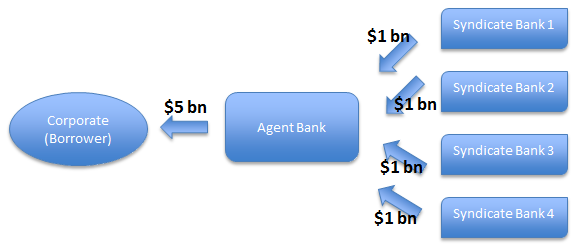

It all begins with a syndicate loan. A syndicate loan is pretty basic. A borrower (think of a large corporate) needs to raise a huge amount of cash to do something like perform an acquisition, likely an amount well above any credit line they have with any one bank. Think of a large number like $5 billion, whereas their credit lines are well below that.

Instead of going out to 5 banks to raise enough cash, they instead ask one bank to act as an agent to orchestrate the loan via multiple other banks. So in our example, the Agent bank contacts 4 other banks, and each of them (including the Agent) provide $1 billion each. It would look something like this:

Of course there are fees involved, and interest payments back to the Agent bank, etc. All of this is governed by a Loan Participation Agreement. Easy peasy. Presumably, the borrower in this case gets a much better deal than having to negotiate the individual loans with all 5 banks themselves.

In full disclosure there are different types of syndicated loans, but they all follow this general form.

Where there is a loan there is a swap

Imagine now that there is an interest rate swap attached to this loan, that is, between the borrower and the agent bank. Also, continue the assumption that the credit line between the borrower and the agent bank is also not sufficient to cover the entire swap.

What seems to happen here is that the Agent bank will enter into the swap with the borrower, and assume the full market risk (interest rate risk) of the transaction. However, the agent bank requires help from (I believe the same) syndicate banks to cover the creditworthiness of the swap. So the Agent asks each syndicate to cover (I believe the same) portion of the credit, as was allocated in the loan.

So if I have this right, if the borrower defaults on the swap:

- The Agent bank calculates their loss on the swap (replacement value). Say the swap had a MTM of $30 million.

- The Agent keeps whatever collateral they have from the borrower. Say they have $10 million in value on hand.

- The Agent asks each syndicate to cover their portion of the uncovered loss. The total loss here is $20 million, so each participant is responsible for 20%, so $4 million each.

Of course the syndicate banks (participants) need some compensation for extending this credit, so they demand some fee up front from the Agent. All of these terms are covered in the “Risk Participation Agreement” which basically states:

“I (Agent bank) will pay you (Participant Bank) some fee up front so that if this borrower defaults, you pony up some cash to cover my losses.”

Of course that is my LegalZoom version of an RPA – please do not use this for your own risk participation agreements.

So, you can see that that an RPA is generally similar to a single name CDS, granting credit protection against the default of a single name. I suppose if I have my facts straight, however, it is slightly different as a proper CDS would have periodic premiums instead of the one up front fee, but the intent seems the same.

Can we see them

There seems to have been debate on these back in 2011 – of note is this comment letter from an industry group to both the CFTC and SEC on the subject. I vaguely recall the debate they refer to – regarding the definition of a swap, a securities based swap, a mixed swap, etc, etc.

What was decided on these? The honest answer is, I don’t know. If any readers know how these are now interpreted, please let us know.

But that doesn’t mean I didn’t try to find them in the existing SDR data on SDRView. If you read my blogs, you’ll know I have an outstanding question about why some single name credit swaps show up in the CFTC SDR at all. But it never hurts to try.

Using SDRView, for the month of June 2016, I can see only 3 single name credit swap trades against North American entities – all of them 10+ year protection against corporates. Could they be RPA’s? I think not, as they seem to have monthly payments instead of a single up front fee.

I also see a taxonomy for “Fixed Recovery Swap” – which after a quick google seems to tell me that these are more akin to an RPA, given that the payout is some discreet amount without having to factor in recovery, etc. Unfortunately the data on these is thin to none.

Summary

- Risk Participation Agreements are a simplified single name CDS contract, effectively an insurance policy against a specific credit event.

- There was debate on whether these should be called swaps, and that debate seems to have stalled.

- I can find no evidence of RPA data on any SDR.

If you have any insight to share with us on this, please get in touch.