- Initial margin is an important portolio measure

- Attributing it to constituent business units is not simple

- Diversification benefit between units is a key concept

- The choice of methodologies can align or mis-align incentives

- An example explains what you should know

Initial Margin and Diversification Benefit

IM is a portfolio risk measure and one that is not additive or sub-additive, meaning that we cannot calculate IM independently for each trade in a portfolio and sum these IM’s to get the portfolio IM.

For any non-trivial real portfolio the IM is less than the sum of the individual trade IM’s as risk offsets between the trades result in portfolio diversification.

This is commonly referred to as diversification benefit in the literature for Value-at-Risk, which is the underlying methodology for most Initial Margin models for OTC Derivatives and Listed Derivatives.

Clearing Accounts

Given the above it generally makes sense for Clearing Members and Clients to have a single account at a Clearing House, as this would attract the lowest margin. The only reasons for not doing so would be legal segregation or operational constraints.

Posting IM requires cash or securities to be delivered to the Clearing House and there is a cost for a business to provide and maintain this margin.

Attribution IM to its Source

However a single account will have trades that are executed and managed by different units of the firm.

For a bank these could be legal entities in different countries, or distinct businesses units (e.g. Treasury and Markets) or distinct desks (Swaps, Options, Prop trading, etc.) For a client these could be distinct legal entities or distinct funds with their own ownership or profit share.

In either case it is best practice or a requirement to attribute costs back to the units that generate those costs. As only then will incentives be aligned for these units to not get a free ride on some of their costs.

How to Attribute IM?

So the question then arises what methodology can be used to attribute IM to constituents units.

Here there is a rich academic literature in Value-at-Risk to turn to with concepts such as Marginal VaR, Incremental VaR Component VaR, Conditional VaR etc. For a few of these see RiskMetrics, Glyn Holton, Philipe Jorion. (Unfortunately conflicting names are in use, so one person’s Marginal is another’s Incremental, making it important to check the definitions).

For the more practically inclined, lets construct an example to illustrate key concepts.

A Hypothetical Example

Lets create a portfolio with the following 3 trades:

- USD IRS 10Y 100m Rec 2.19%

- EUR IRS 10Y 90m Pay 0.86%

- AUD IRS 10Y 145m Pay 2.93%

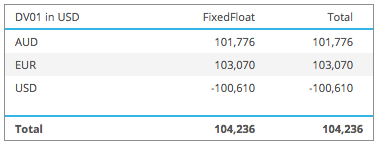

Using CHARM or Microservices, we calculate the DV01 risk of these on 27 Sep 2017.

Showing that AUD DV01 is offset by USD DV01 and we are left with the EUR DV01 (all amounts in USD), so the overall net portfolio is positive $104k, meaning it would gain this amount if swap rates rise by 1 bps.

While I have used single trades here, each trade could represent a separate unit (e.g. a Desk or a Fund that holds only AUD, another only EUR and another USD) and the example still holds.

Initial Margin

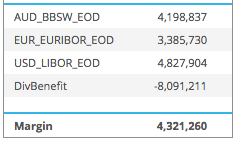

Using CHARM we now calculate the LCH SwapClear IM of this portfolio.

Showing that:

- The overall account portfolio margin is $4.3 million

- The stand-alone margin for each trade/currency is $4.2m, $3.4m & $4.8m respectively

- The sum of these three rows would be $12.4m

- Meaning there is a Diversification Benefit of $8m to explain the portfolio margin of $4.3m

Can we use these for Attribution?

The question now is could we simply use these numbers to attribute to each unit, which in our case is a currency?

Well we could, provided we take a view as to what to do with the diversification benefit of $8m.

For some firms, this benefit should not be attributed back to each unit but taken by a central unit (e.g. an XVA desk or Group Level), which makes sense as the firm would want each unit to concentrate only on its business and not worry about the impact on the overall business, while a central unit could manage this benefit.

In this case we can use the $4.2m, $3.4m & $4.8m numbers for each unit and attribute the $8m benefit to a central unit.

For other firms, the diversification benefit should be attributed back to each unit as it is the best way to allocate actual costs back and could incentivise trades and behaviors that benefits the overall firm.

Attributing Diversification Benefit

The question then arises is how to attribute this diversification benefit to each unit, so that the sum of the unit IMs is additive to the portfolio IM.

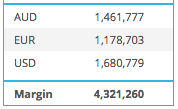

One approach would be to use the contribution of each unit row to the portfolio IM result; I call this Component IM (others may call it something else). The way to think abut this is that IM is driven by the tail-loss scenarios of the P&L vector (that underlies an Historical Simulation based IM model), so each unit row’s contribution to these tail-loss scenarios are what we need for attribution.

Lets get these from CHARM.

These satisfy the requirement that they are additive as the portfolio margin is $4.3 million.

However they attribute a negative number of $1.4 million to the USD unit row!

We know that the DV01 for the USD row is of the opposite sign to the AUD and EUR ones, so in this sense it is an intuitively correct result.

However do we want to attribute negative IM and negative costs (i.e. a profit) to one business unit?

Probably not.

So we need a method that is both additive and does not result in negative amounts.

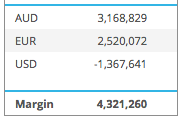

A convenient method and one that works well in the real-world is to weight the diversification benefit in proportion to the stand-alone IM of each unit row.

Now we have IM amounts for each that are positive and add up to the portfolio IM.

Each amount is also similar in magnitude, which is intuitive given the similar DV01 risk for each, but different enough to account for pay or receive and the volatility in each currency .

So we could use these as the IM to attribute to each unit.

Incremental, Marginal and Component

Next I had intended to look in more detail next at which other method could be used for attribution; the Incremental, Marginal and Component VaRs I referred to earlier.

However am now up against the deadline to publish this article, so you are spared till a future week. 🙂

What do you need to Attribute IM?

Now we now the key concepts in how to attribute IM, lets turn to what you need to be able to attribute IM.

The functionality you need is:

- The ability to calculate IM for constituent units of the trades in the account

- The ability to attribute the diversification benefit

You may be able to ask the Clearing House or Clearing Broker to do this for you.

Or calculate yourself using the software tools at your disposal.

Or you could ask us at Clarus to do for you.

Please feel free reach out to us.

Attribution of IM is important and becoming more so.