- Libors and Risk Free Rates are going through a period of change.

- Regulators and industry working groups are identifying their preferred Risk Free Rates in preparation for a post-Libor world.

- Over the next 4 years, derivatives market liquidity will transition into products referencing Risk Free Rates instead of Libors.

- This will impact new trades and legacy trades in OTC derivatives, plus numerous futures contracts.

- We look at the proposals and the data.

ECB to Publish New Rate(s)

It is one of the biggest known unknowns in our markets – how are derivatives markets going to transition away from their reliance upon ‘IBOR indices?

This week, Europe took a step towards this goal, with the ECB announcing that it will “develop a euro unsecured overnight interest rate.”

There will also be a new Working Group created, “tasked with the identification and adoption of a risk-free overnight rate..in the euro area.”

This news prompted me to take a look at the various reforms going on in the major markets as our industry looks to transition (some) liquidity away from Libor-based products and towards Risk Free Rates.

RFRs – International State of Play

Along with the European announcement last week, most of the other major markets have identified their preferred Risk Free Rates.

GBP – SONIA. We have covered the reforms to SONIA here. The Bank of England has been the benchmark administrator since April 2016, and there is a Working Group setting out plans to promote the adoption of Sonia across GBP markets.

USD – BTFR. The ARRC (Alternative Reference Rates Committee) recently announced its’ support for a broad Treasuries repo financing rate. This is a secured overnight rate against US treasuries. I expect (maybe wrongly) that the Fed Funds rate will continue to be published alongside this rate.

CHF – SARON. Switzerland is going to be one of the leaders in this space – either intentionally or unintentionally! The current OIS rate, TOIS, will cease to publish as of December 2017. The market is looking to move to SARON, a secured overnight reference rate, as the alternative. SIX recently organised a conference with some excellent materials discussing the CHF market.

JPY – TONAR. As of last year, the Bank of Japan had recommended using the Tokyo Unsecured Overnight Average Rate as the preferred JPY risk-free rate. They also provide a good overview of international developments in their working group materials here.

AUD – AONIA. Administered by the RBA. Guy Debelle highlighted in a recent speech that the Interbank Overnight Cash Rate acts as the risk-free rate in Australian markets, with the BBSW methodology continuing to evolve to provide a robust benchmark for Libor-like markets.

EUR – EONIA and new ECB rate. Europe has been a little late to the game in identifying the risk free rate for the market to put its’ weight behind. As we covered earlier, the working assumption last year was that the Euribor methodology would be strengthened; a review of Eonia is also currently underway. However, with the recent FSMA/ESMA/ECB/EC joint announcement, it is not clear which rate will become the preferred Risk Free Rate of the new Working Group in the future.

What Happens in the Transition?

For Derivatives markets, as the SNB identified, there are three aspects to the transition towards Risk Free Rates:

1. Legacy Contracts referencing now-defunct rates.

Switzerland is a prime example. CHF TOIS will cease to be published, therefore market participants must decide upon a reference rate to use on TOIS contracts still outstanding from 2018. Market participants can either agree to unwind existing TOIS contracts and initiate new trades referencing SARON to “replicate” the risk, or maybe agree a spread to SARON to create a TOIS fallback rate.

This situation may appear to be unique to Switzerland for now. But in the UK the FCA have announced that they will no longer compel banks to be included in the panel of banks after the end of 2021.

With an eye on that date, and much talk in Andrew Bailey’s speech about transition away from Libor, we will be well advised to keep a close eye on CHF markets until the end of the year to see if they set any precedents.

2. Outstanding Contracts at CCPs remunerating cash collateral using a Risk Free Rate (“Price Alignment Interest”, PAI)

A motivating factor to trade OIS, even if all of your swaps are written versus Libor, is due to the discounting risk on a swaps portfolio. OIS swaps started trading in much longer maturities during and after the Great Financial Crisis as a result of ballooning spreads between Libor and OIS.

It makes a market participant’s life a lot easier if we can use the same forecast and discount curve. But this isn’t always possible – for example in cross currency swaps. To a certain extent, people will always have to use at least two curves. Therefore, healthy and thriving basis markets are the next best thing.

One way to foster healthy basis market activity is if CCPs transition to using the agreed Risk Free Rates for PAI. This creates exposures from legacy contracts being discounted versus the agreed Risk Free Rates. These exposures will change over time (as rates change) and hence create a natural “flow” of activity.

3. New Liquidity in Risk Free Rates

There needs to be an orderly transition of liquidity away from Libor-based products (Futures and Swaps) to the agreed Risk Free Rates.

This is likely to be a slow process. For example, we still haven’t seen a single IRS referencing CHF SARON reported to the US SDRs…..

Derivatives Market State Of Play

There are separate Working Groups actively looking for solutions in the different currencies to make this transition period as smooth as possible.

This is important because the derivatives markets are far from homogeneous across different currencies.

Whilst there will be some element of co-operation amongst the Working Groups (because contracts such as Cross Currency Swaps will be affected by more than one currency at a time), different markets will have different idiosyncracies to deal with.

For example, take Futures markets:

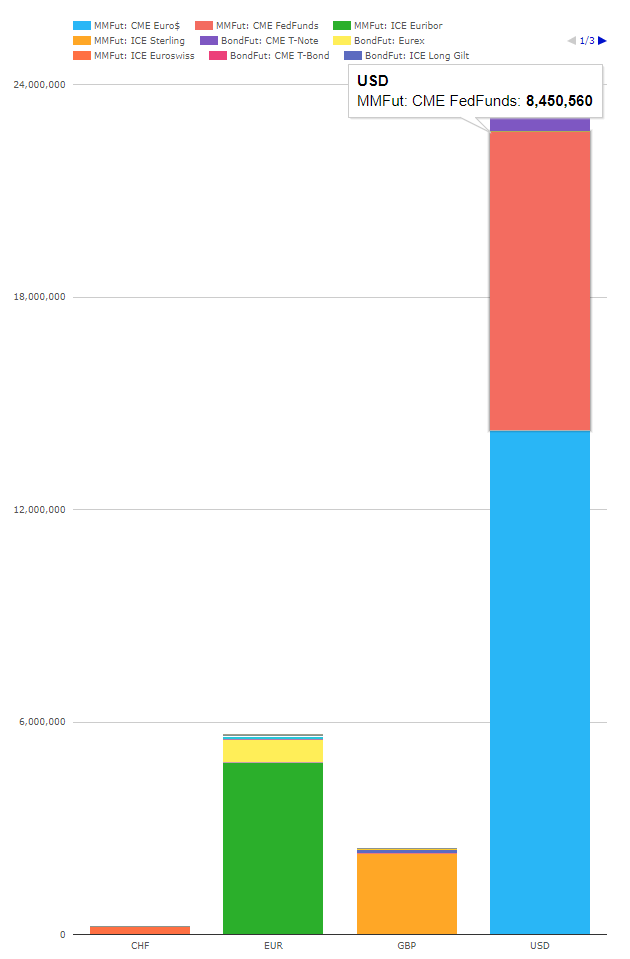

Showing;

- Notional-equivalent Open Interest as at September 2017 across the major Rates products.

- Only USD has a successful OIS-based futures contract that has meaningful volumes.

- Open Interest in USD Fed Funds is about 1/2 that of the Libor-based Eurodollar contract.

- This is good – it proves that OIS-based futures contracts can be successful and (maybe) provides a template to follow for future OIS contracts in other currencies.

- However, we must note that the ARRC has chosen a different rate to the one underlying Fed Funds futures contracts as their preferred Risk Free Rate.

- Futures liquidity in USD contracts could therefore be more bifurcated than in other markets – from Libor AND Fed Funds contracts.

And in terms of volumes traded in OTC markets, if we look at current OIS volumes in major currencies:

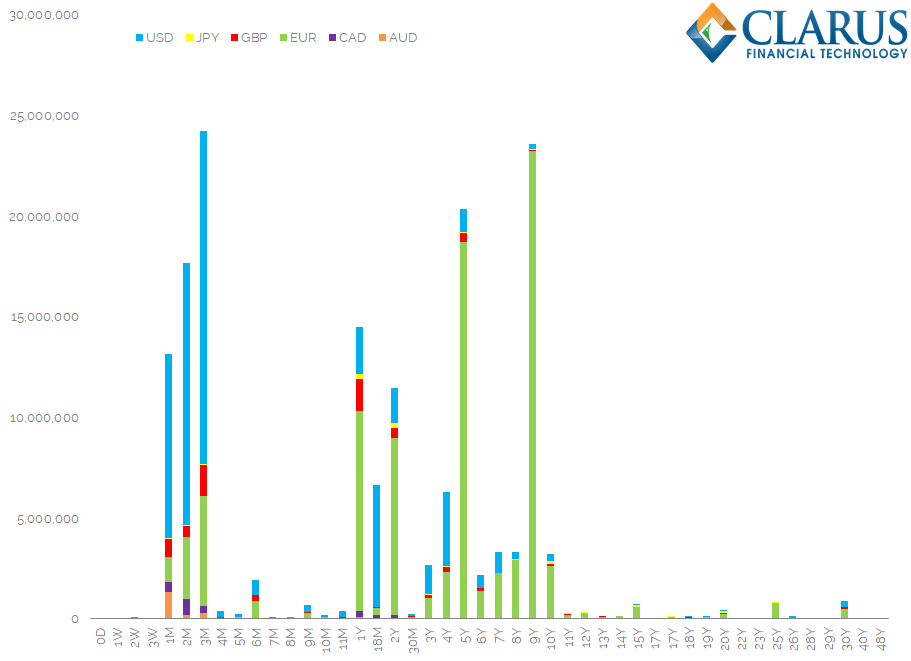

Showing;

- Short end volumes are very much dominated by USD-denominated products (remember this is from SDR data).

- EUR products are very liquid even after the one year tenor, all the way out to nine to ten years. This is a unique tenor profile for OIS swaps.

- CAD, AUD and GBP OIS markets are all small.

We can see the differences in maturities traded between markets more clearly in the chart below:

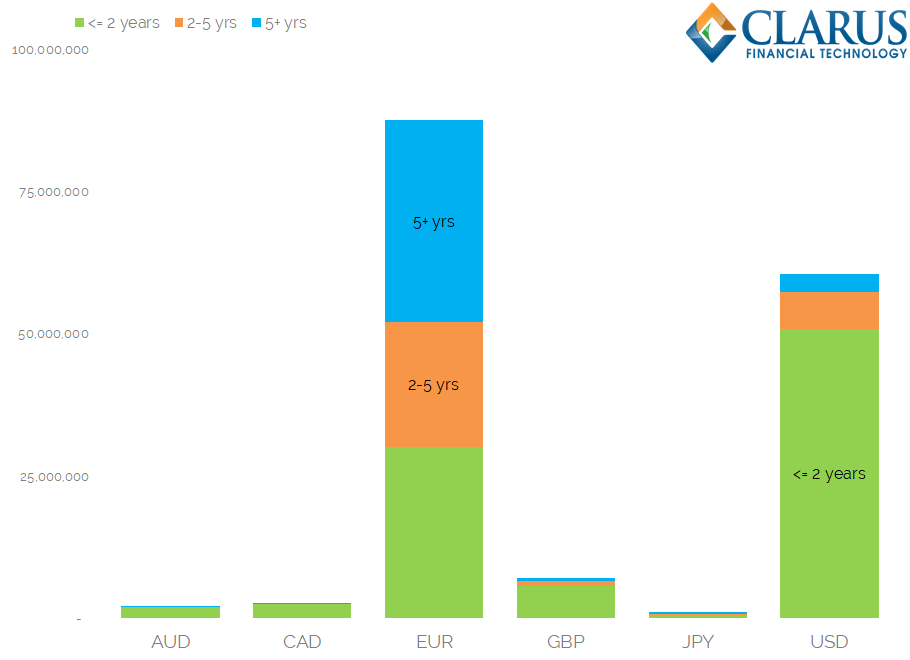

Showing;

- By order of magnitude, we can see how much more active EUR and USD OIS markets are than the other currencies.

- These volumes are measured on a DV01 basis, providing a maturity-agnostic measure of risk. By this measure, EUR OIS markets are larger than USD OIS markets.

- It is only EUR markets that have OIS liquidity beyond the two-year maturity.

- We have looked at this (a long time ago) through the lens of Invoice Swaps versus the Bund contract. Check out our blog here – it is just as relevant today as it was back in 2014!

The Transition Plan?

Based on our charts above, would a one-two punch be sufficient to deliver liquidity in any given Risk Free Rate?

- Design a futures contract based on the existing Fed Funds contract. If it worked in USD….

- Provide invoice spreads from the major bond futures contracts in each currency to the underlying Risk Free Rate. If it worked in EUR….

We’ll leave it to our readers to comment below for any further suggestions….

Good overview, Thanks Chris.

What do you see as a solution for the bond Market ?

The bond market has outstanding isues with maturity longer than 4 years and issuers / bondholders the bonds might be swapped.

There will have to be a fall-back to Libor of some description if it is no longer published. The particular problem that issuers of FRNs could face is that the fall-back as defined in their bond offering is different to the fallback as defined in their swap documentation. In which case, they would have little choice other than to unwind the existing swap and reinstate with a new one….just one reason why the market should be motivated to keep on publishing a form of Libor, irrespective of where liquidity in derivatives actually lies.

Who in the market would be motivated to submit and publish a Libor Rate? Sounds like a good idea unless your the one who actually has to submit the rates. Hence the reason for reform. I’m not sure what the solution is but agree the paperwork will keep legal team busy.

And far more than swaps to worry about… plenty of commercial contracts and an ocean of debt all tied to LIBOR, and as with OTCD the questions are which new benchmark and how to transition? Of course plenty of work for the lawyers, but ironically most if not all their partnerships’ capital is funded by private loans which are… yup, prime examples of debt tied to LIBOR. While EMIR and MiFID II have finally (6+ years later) locked the EU on intercept with US’ DFA to cement the fragmentation and regionalization of OTCD, rate rigging may do the same to financing global business without so much as a G20 meeting.