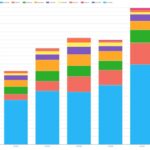

Q1 2025 CCP volumes and share in CRD and FXD

This blog reviews the volumes and central counterparty (CCP) market share of cleared credit derivatives (CRD) and FX derivatives (FXD) in Q1 2025. Comparing Q1 2025 with Q1 2024, we see 44 percent overall volume increases in cleared CRD – index, single-name, and swaptions. Comparing Q1 2025 with Q1 2024, we see 31 percent overall volume […]

What’s new in AUD swaps in 2025?

This blog looks at another year of AUD swaps activity, continuing from the blog with a similar title published at about the same time last year. Should you want more information on AUD swaps, the blog linked above contains links to several other blogs on the topic. AUD market total size First, we extend the […]

Rates IM optimization

Background Several points are listed here for convenience. Feel free to skip to the next section now and refer to them later. According to the ISDA margin survey, uncleared SIMM IM collected exceeded $350 billion at the end of 2024, a large slice of which is incurred by rates derivatives portfolios. Capitolis kindly confirmed that […]

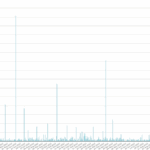

SOFR swap SEF volumes – 2025 to end May

This blog follows the recent pattern of intra-year SOFR swaps SEF volumes blogs to complement the full-year reviews in 2023 and 2024. Given recent market dynamics, I was curious about the activity levels so far in 2025. Please note: SDRView includes MTFs and OTFs as well as SEFs in its platform scope. For brevity, we […]

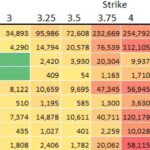

Swaption volumes by strike – Q1 2025

This post looks at USD swaptions activity in Q1 as part of our regular quarterly coverage, the last of which was Swaption Volumes by Strike Q4 2024. Swaptions basics If you are uninitiated in swaptions, here are some basics: Now, on to the post. Swap market context Q1 2025 saw the following daily price moves […]