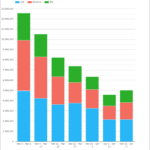

CME Volumes

CME volumes have hit $200Trn in some months this year. This is in Interest Rate Derivatives alone. The mix is roughly 60/40 Bond Futures versus Eurodollar futures. CCPView has now introduced volumes measured on a per contract basis, allowing for cross asset class comparisons. Interest Rate Derivatives CME is huge in Interest Rate Derivatives. Just […]

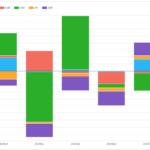

Market Share in EUR Swaps

The recent news that ESMA to recognize three UK CCPs from 1 January 2022, has been well covered in the press e.g. see Reuters. The equivalence decision for a time limited period of 18 months, from 1 January 2021 to 30 June 2022, applies to ICE Clear Limited, LCH Limited and LME Clear Limited. And […]

Margin Calls During COVID-19

John Maynard Keynes said in the 1930s; The market can stay irrational a lot longer than you can stay solvent. Keynes Since March 2020, the bounce-back in almost all “risky” assets since the nadir of the crisis has been breathtakingly sharp: Motivated by Amir’s blog last week on Initial Margin, I got to wondering how […]

CAD CORRA Futures and Swaps

We last covered CAD Rates Markets and CORRA Reform in Oct-19, so I wanted to look at what’s new and in particular the news that TMX launches CORRA Futures. Background on CORRA The Bank of Canada took over the calculation and publication of the Canadian Overnight Repo Rate (“CORRA”) on June 15, 2020 , subsequent […]

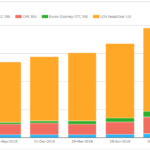

What Is the Total Size of Rates Markets?

Rates markets have grown to stand at over $350tn in monthly volumes. Our data product, CCPView, provides transparency data covering 93% of these global volumes on a daily basis. We benchmark our data versus periodic BIS data below. Data analysis needs to be timely and accurate. Contact us today for a CCPView subscription. During recent […]

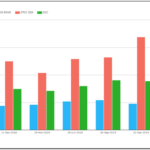

US Treasury Market Volumes During COVID

We have started collecting post-trade transparency data for US Treasury trading. I’m sure a lot of market participants have been analysing this data already. Our particular Clarus angle is to compare these UST trading volumes against the rest of the Rates trading landscape – specifically Bond Futures (at CME) and versus cleared Interest Rate Swaps […]

US Treasury Volumes and Market Size

Post-trade transparency in US Treasuries has arrived. CCPView now includes volumes across US Treasuries, Futures and Swaps. This reveals that the true size of the Rates market in the US is $12.5 Trillion per week in notional equivalents for medium and long-dated interest rate products. We can also monitor the split of trading across different […]

CCP Quant Disclosures 4Q19 – Default Resources

4Q 2019 CPMI-IOSCO Quantitative Disclosures for CCPs have just been published and while we are still focused on the Covid-19 pandemic and resulting market volatility, I thought it would be interesting to see what the data shows as of a Dec 31, 2019, before we had any idea what was coming. So a little different to […]

CCP Quantitative Disclosures 3Q19 – Skin in the Game

Clearing Houses 3Q 2019 CPMI-IOSCO Quantitative Disclosures are now available, so lets look at what the data shows, similar to my CCP Disclosures 2Q 2019 article. Summary: Initial Margin for IRS is up 17% in the quarter and 45% in a year Each of the four major IRS CCPs increasing IM Client IM is significantly up IM for ETD up […]