Hedging the CME-LCH Basis

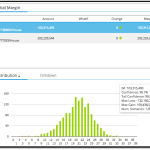

Following on from my article on the CME-LCH Basis Spread, I will now look into the details of hedging this basis with CCP Switch trades. Example Portfolio Lets start by constructing an example portfolio of USD Swaps in which we are net receivers in our account at CME and net payers at LCH. Using CHARM […]

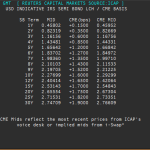

CME-LCH Basis Spread

Recently I noticed that the view statistics for my June 2014 blog on LCH-CME Switch Trades were running at 5 times their weekly average, which I thought was odd. Then on 15-May, I read the Risk article, Bank swap books suffer as CME-LCH basis explodes (subs required) and I understood why. So a good time to re-visit this […]

LCH-CME Switch Trades and Margin Management

Recently we have started to see stories on large LCH-CME Switch trades (aka Basis Swaps) starting to be traded. See LCH-CME Basis Swaps primed for Growth (trial required) and Trad-X volumes hit record highs as platform introduces CCP position switch service. The first article highlights that $2.5b of 18M and $3b of 5Y traded in the […]