Recently we have started to see stories on large LCH-CME Switch trades (aka Basis Swaps) starting to be traded. See LCH-CME Basis Swaps primed for Growth (trial required) and Trad-X volumes hit record highs as platform introduces CCP position switch service.

The first article highlights that $2.5b of 18M and $3b of 5Y traded in the week of 16-20 June and the second introduces the Trad-X CCP position switch service, which is run as a weekly auction.

In this article I will look into the rational and mechanics of such trades.

Background

As the volume of Cleared Swaps on CME has grown significantly to almost $10 trillion open interest in USD, Swap Dealers with accounts at both CME and LCH now have significant USD Risk and Initial Margin posted to both CCPs.

LCH-CME Switch trades are a way to reduce the Overall Initial Margin without changing the Overall Interest Rate risk.

Lets use an example to illustrate how this works.

Initial Margin

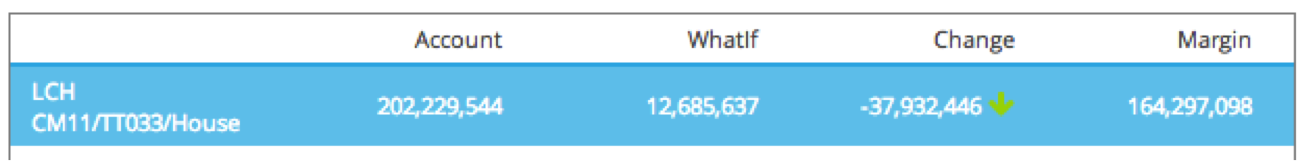

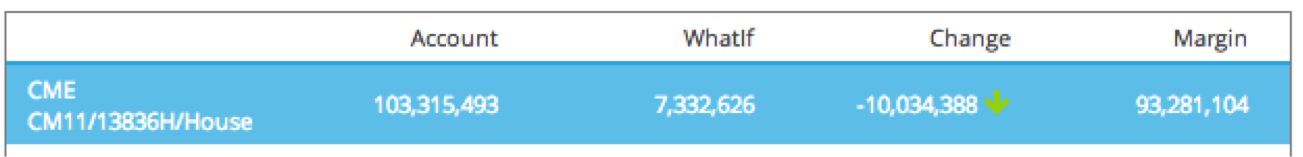

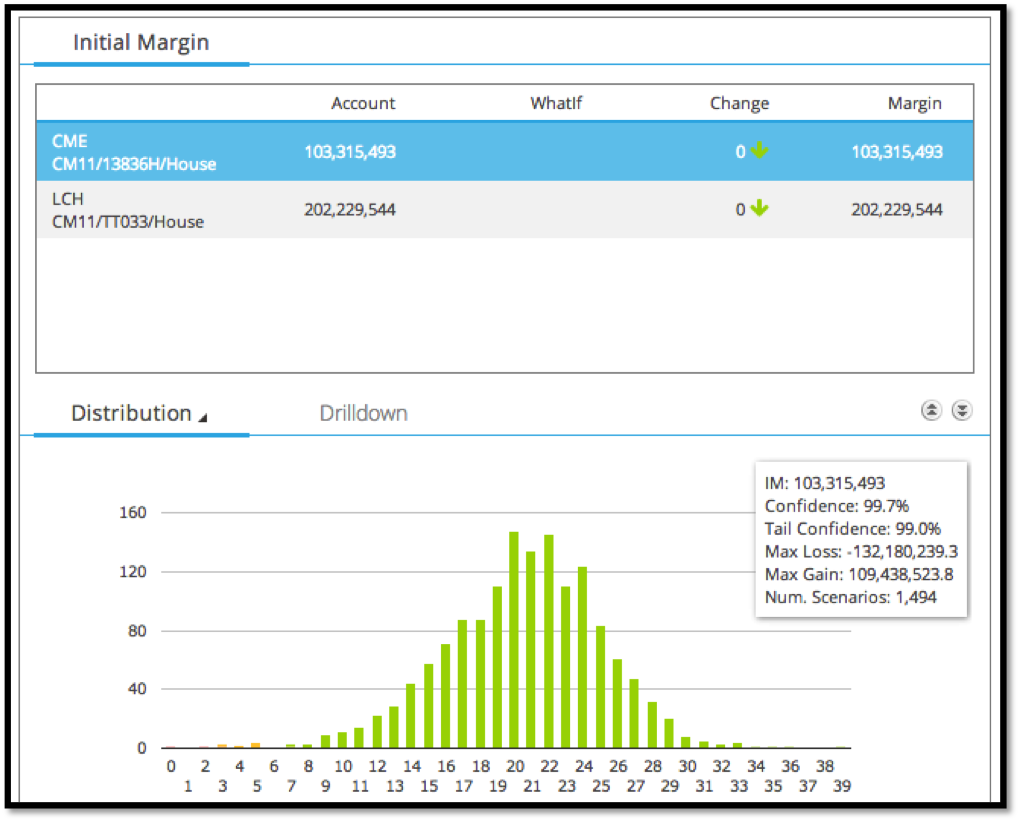

Lets assume that we as a Swap Dealer have $103 million IM in our house account at CME and $202 million at LCH.

Using our CHARM product we can re-calculate each accounts IM as below:

Further we can then explain the curve positions that contribute to each margin.

Further we can then explain the curve positions that contribute to each margin.

Doing this in Charm shows as that:

- The LCH account margin is determined by the six largest loss scenarios

- The worst of these is for the historical date 13 Nov 2008

- With a loss of $204 million

- This loss is attributed to curve and tenor

- Showing that the 10Y position is the largest contributing factor with $127 million

- Because our 10Y DV01 is 1,700,00 and in this scenario the 10Y rate dropped 63 bps

A similar drill-down for our CME account would show that 10Y contributes $25 million and has a DV01 of -624,000.

CCP Switch Trade

So our DV01 on LCH and CME for 10Y are large and in opposite direction.

Consequently if we could pay fixed at CME and receive fixed at LCH in large size, we would reduce both DV01s by an equal amount, leaving the overall 10Y DV01 un-changed and more importantly this would reduce both IMs.

From SDRView Pro we can see that the standard size 10Y Swap is $50 million, the block size is $170 million and on average $6-10 billion gross volume trades in a day.

Lets assume we can find a counterpart willing to do the opposite trade to us (as they have the opposite position) and lets assume this is a $285 million notional trade with DV01 of 250,000.

- Paying fixed at CME has a Dv01 of +250,000, which will decrease our 10Y CME DV01 from -624, 000 to -374,000.

- Receiving fixed at LCH has a DV01 of -250,000, which will decrease our 10Y LCH DV01 from 1,700,000 to 1,450,000.

- The overall 10Y DV01 remaining un-changed at 1,076,000

If we were to execute this trade, using CHARM we can see the impact on both IMs.

- Our LCH house account IM would drop by $38 million

- Our CME house account IM would drop by $10 million

- An overall drop of $48 million

- On an overall margin of $305 million, this is a 16% drop

Which is excellent.

We could do more 10Y trades, up to a further $425m notional (374k DV01) to reduce the margin even more.

(Note: There can be a small basis spread (<0.1 bps) between CME and LCH rates, which would need to be monitored over time).

The Benefit

A reduction in IM of $48 million is very significant.

- Firstly as it means we can reduce our funding cost of collateral.

- Secondly as it serves to decrease our CCP default fund contribution.

The brokerage for executing the trade is paid on one side and not both, making the trade attractive even in large size.

And even better there is a benefit to the market at large.

By reducing our overall aggregate IM, we are reducing the large amounts held by CCPs, which in turn leads to a reduction in systemic risk. A point that has been raised a number of times by the industry with regard to the enormous amounts of cash and securities concentrated at a small number of Clearing Houses.

What is there not to like about the trade.

A win-win for all concerned.

Swap Dealers, SEFs, CCPs and Regulators, all benefit.

Which SEF?

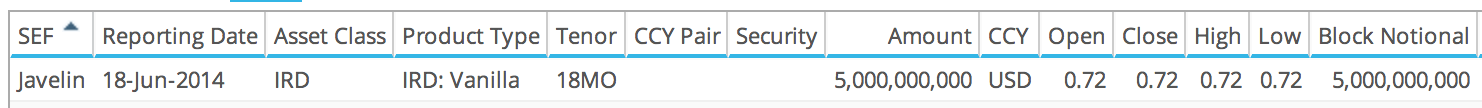

Using SEFView, we can attempt to find which SEFs executed these CCP Switch trades.

Given the reported size of $2.5b in 18M and $3b in 5Y, this is not too difficult.

First the 18M.

Which shows that Javelin reported $5 billion 18M on 18-June for CME/LCH Swaps, double the $2.5 billion; presumably as the sum of each of the component trade notionals.

The the 5Y.

Which shows that GFI reported $3.28b on an LCH Swap and $3billion on CME Swap.

So Javelin and GFI are off the mark early on these trades. Not sure whether these were electronic or voice brokered. We do know that Trad-X and trueEx have also recently done or about to do these trades. The revenue opportunity is excellent as we expect these trades to be executed in very large size.

May the best solution win.

Ideally an electronic auction, as that would best serve to match large orders on a periodic basis.

Summary

LCH-CME Switch trades are now starting to trade.

Many Swap Dealers now have large IM posted at CME & LCH for USD Rate risk.

Switch trades can reduce the overall IM without changing the overall interest rate risk.

CHARM can quantify the IM reduction of possible trades.

If counterparts with opposite positions can be found, CCP Switch trades are very attractive.

They serve to reduce funding costs and default fund contributions.

And may be executed in very large size.

The week of 16-20 Jun, saw Javelin and GFI execute such trades; $2.5b 18M and $3b 5Y respectively.

Trad-X have also recently launched their CCP Position Switch Service.

SEFView can show the venue, size and frequency of such trades.

We look forward to monitoring and reporting LCH-CME Switch trade volumes.