The Office of the Chief Economist at the CFTC, recently published the research paper “Introducing ENNs: A Measure of the Size of Interest Rate Swap Markets“, which I found very interesting.

This paper argues that gross notional , a common measure of the size of swap markets, does not accurately represent the amount of risk transfer in this market. It introduces a better measure of market size; Entity-Netted Notionals (ENNs).

The paper states that the U.S. swap market has an ENN of $15 trillion, far lower than the gross notional of $179 trillion. This $15 trillion is comparable to the US Treasury market’s $16 trillion, Mortgages $15 trillion and Corporate Bonds $12 trillion.

Lets look at some of the detail. (The full paper is here).

Entity-Netted Notional

The new ENN metric is calculated using the following steps:

- Convert notionals to 5Y Swap equivalent notionals

- For trades between a pair of entities in the same currency

- net the long (rec fixed) 5Y equivalent notionals against shorts (pay fixed) 5Y equivalents

- Sum the resulting net longs (or net shorts) for all entities

Sounds simple enough, so lets consider the rationale for the methodology.

5Y Swap Equivalents

First the conversion to 5Y Swap equivalent notionals.

This is eminently sensible as we know that $100m of a 2Y Swap has far less risk than $100m of a 30Y Swap and summing these to get $200 million gross notional and not knowing the maturity, will lead to a gross understatement or overstatement of the risk position.

While if we converted both to a 5Y equivalent notional and summed, we would have a good sense of the risk sensitivity of this position to changes in the 5Y swap rate.

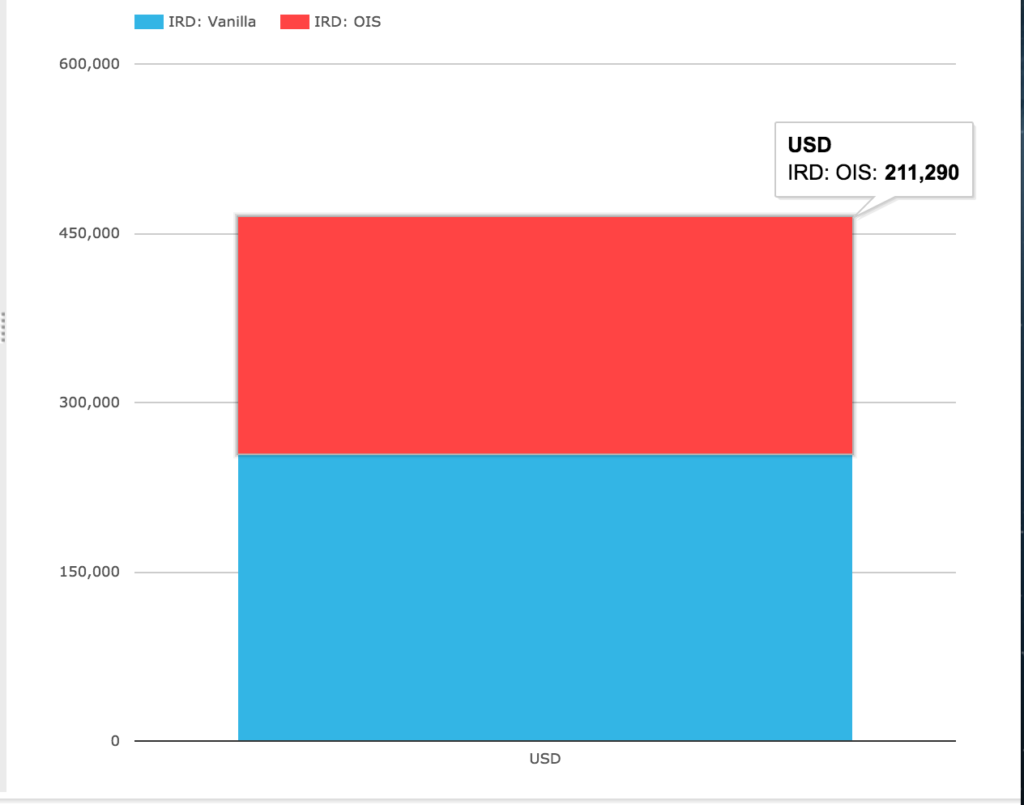

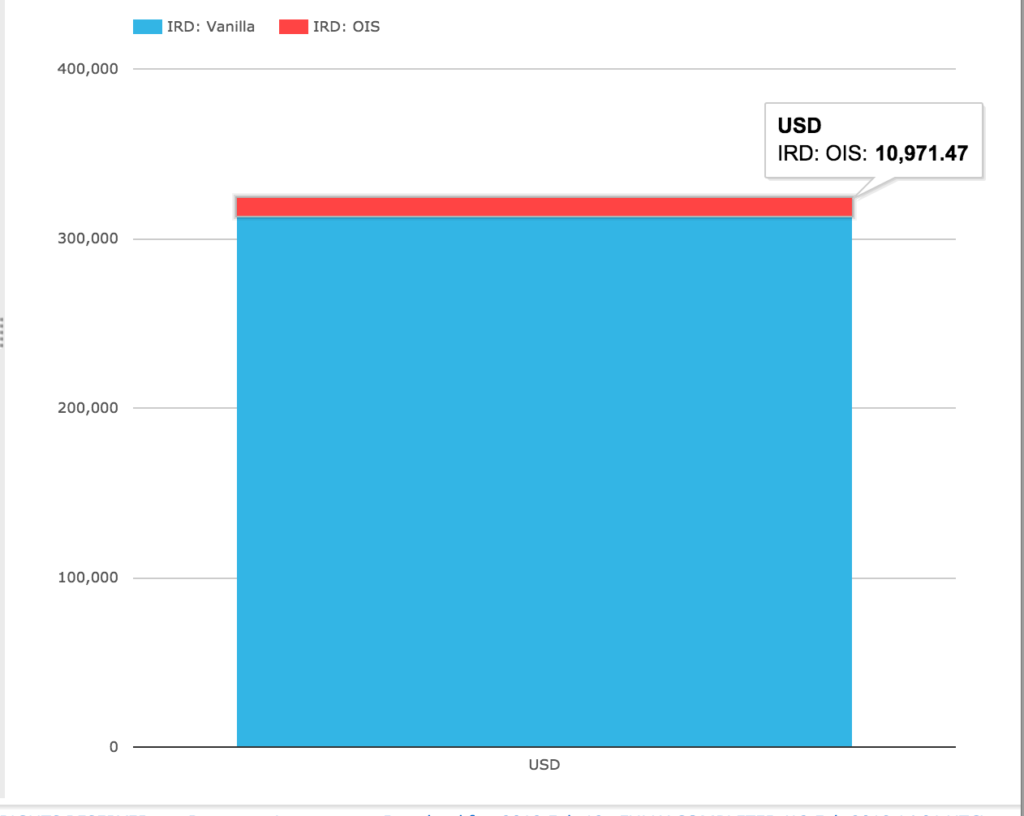

The situation is even starker when we are comparing Vanilla Swap and Overnight Index Swap notionals.

Showing a gross notional in USD OIS of $211 billion and USD IRS of $254 billion.

Lets convert both to 5Y Swap Equivalents.

Showing that USD IRS is now $313 billion and USD OIS is only $11 billion!

Giving us a much better sense of the risk position in these two products; one which is far from the parity implied by the first chart.

So converting to a 5Y Swap Equivalent as a measure is eminently sensible and is also easily convertible to the DV01 measure common in Swaps trading.

(Note to CCPs, in CCPView we collect cleared swap volumes with maturity tenors from some CCPs but some CCPs publish volume without maturity. Come on, really, in this day and age? Everyone needs maturity tenors, otherwise they are adding apples and oranges or is it bananas. 🙁 )

Netting example

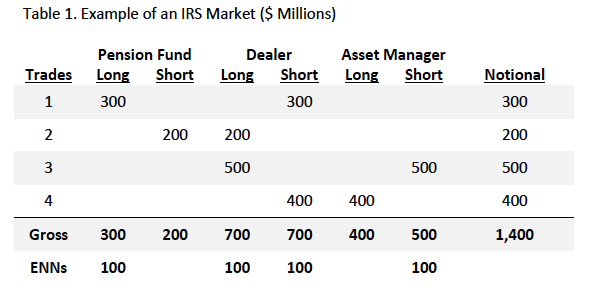

To understand the netting steps in the calculation, lets take the example given in the research paper, with all notional amounts expressed in 5Y equivalents.

- A Pension Fund is long $300 million and short $200 million against a Swap Dealer

- An Asset Manager is long $400 million and short $500 million against the same Swap Dealer

Adding these amounts will gives us $1.4 trillion as gross notional, which grossly overstates the market risk transfer in the example.

The ENN of this example is:

- The Pension Fund is net long $100 million against the Swap Dealer

- The Swap Dealer is net long $100 million against the Asset Manager

- Summing the net longs gives an ENN of $200 million

We could have done this calculation using the net shorts, to get the same ENN of $200 million.

Table 1 from the paper illustrates this nicely.

Rationale for netting

In terms of risk transfer, the $200 million of ENNs can be described as the sum of two risk transfers: the pension fund transfers the risk of $100 million notional to the swap dealer, and the swap dealer transfers the risk of $100 million notional to the asset manager.

The paper goes on in more detail to say that it could be argued that as the swap dealer is just intermediating, the risk transfer should be $100 million. However it rejects this view as intermediation often involves maturity mismatches.

Tables in the research paper

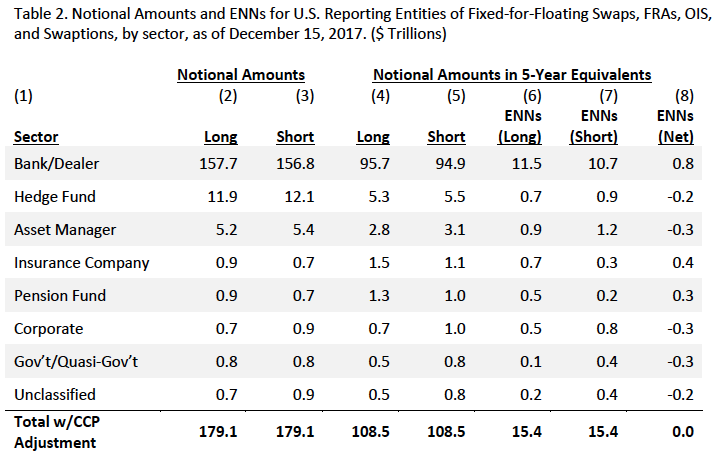

Using data reported by US Entities to Swap Data Repositories as of December 15, 2017, the paper presents notional amounts and ENNs by sector.

Showing:

- The gross notional amount of $179 trillion and 5Y equivalent as $108 trillion

- Insurance Companies and Pension Funds are the sectors where notional is < 5Y equivalents

- As we would expect given the longer term requirements of these

- The total ENN is $15 trillion

- Columns 6 and 7 show that there an enormous amount of netting, particularly for Bank/Dealers, which the paper attributes to intermediation and clearing

- Column 8 is also very interesting as it shows the net market risk held by each sector

- Bank/Dealers are net long (rec fixed)

- Insurance Companies and Pension funds are also net long

- Asset Managers, Corporates, Govt and Hedge Funds are net short (pay fixed)

- The paper argues that these accord with expectations for these sectors

General Applicability

As Derivative markets are largely about transfer of market risk, the ENN measure certainly seems better than gross notional in this regard.

The question then is, will it become more widely used?

I think that depends on a number of factors:

- the data required to calculate,

- the complexity of the calculation,

- ready availability and use of ENNs in one jurisdiction

- persuading others to calculate and use

- ….

As the public transparency data from SDRs does not have entity information (and neither should it to preserve anonymity), it is not possible for us at Clarus to calculate ENNs. So we will have to continue to use gross notional or gross DV01 or gross swap equivalent.

Only regulators with access to private trade data have the entity (LEI) data for each party to the trade and consequently are in a position to calculate ENN.

The methodology in itself does not seem complicated, but one test is whether it is simple enough to automate for the CFTC to start publishing ENNs on a regular basis.

And then whether other jurisdictions express interest in doing the same.

I expect a Bank could also calculate ENN for its trades, but don’t see much value in this, given that Banks already have good measures of risk transfer to compare businesses and markets e.g. Greeks, Value-at-Risk, Stress tests.

Final Thoughts

It is good to see public research using SDR data.

We would like to see more research and by more jurisdictions.

Good research improves understanding and influences policy.

Creating value from the massive investment our industry has made in trade reporting.

Value that is not generally obvious when data goes to regulators, never to emerge.

Kudos to the CFTC economists for producing interesting research using SDR data.

I look forward to hearing more about ENNs.