- GBP IRS markets are the third largest Interest Rate Derivatives market.

- Almost 100% of volumes are cleared at a CCP.

- Most trades are standardised contracts versus 6 month Libor (IRS) or SONIA (OIS).

- SONIA swaps are frequently forward-starting out of MPC dates and IMM dates.

- 42% of GBP Libor swaps are forward-starting; spot-starting swaps account for only 22% of volume.

- GBP Libor IRS activity is concentrated in 4 maturities – 2y, 5y, 10y and 30y.

- SONIA risk is concentrated in the 1 year tenor.

GBP Interest Rate Derivatives

Today we will take a look at the data behind GBP IRS markets. The BIS triennial survey dates back over a year to April 2016. During that time, they found that GBP IRS made up 9% of Average Daily Volumes and was hence the third largest market in interest rate derivatives, behind only USD and EUR.

Today we will take a look at the data behind GBP IRS markets. The BIS triennial survey dates back over a year to April 2016. During that time, they found that GBP IRS made up 9% of Average Daily Volumes and was hence the third largest market in interest rate derivatives, behind only USD and EUR.

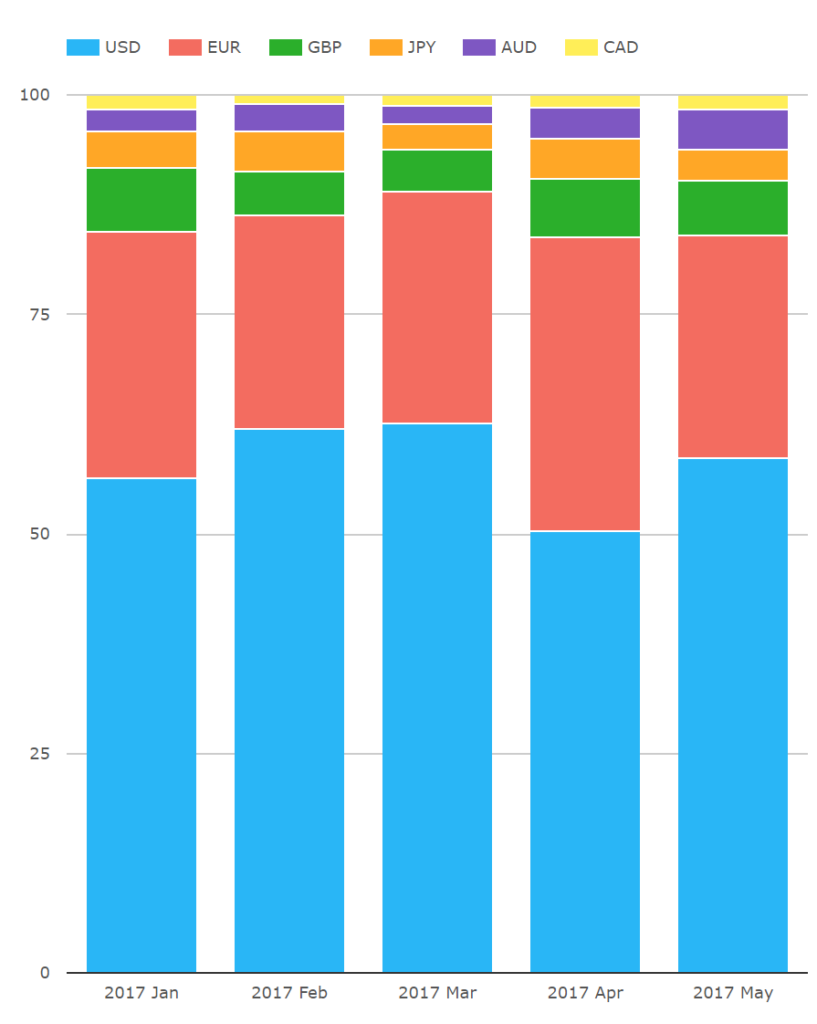

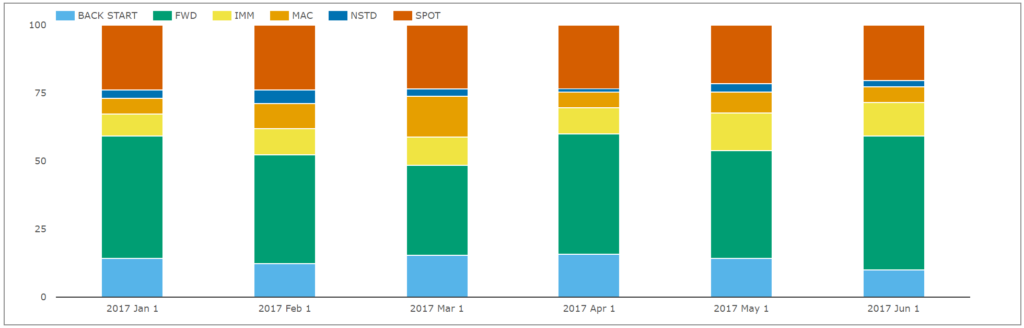

I was surprised that GBP was so large. I expected JPY to be much larger. CCPView provides up to date data, showing that GBP has indeed been the 3rd largest currency for Cleared IRS every month this year:

GBP IRS Clearing

Since April 2016, we’ve had a Brexit referendum, a General Election and a Clearing Mandate. It is probably fair to say that the data behind the April 2016 BIS Triennial Survey has the scope to feel a little bit out-dated.

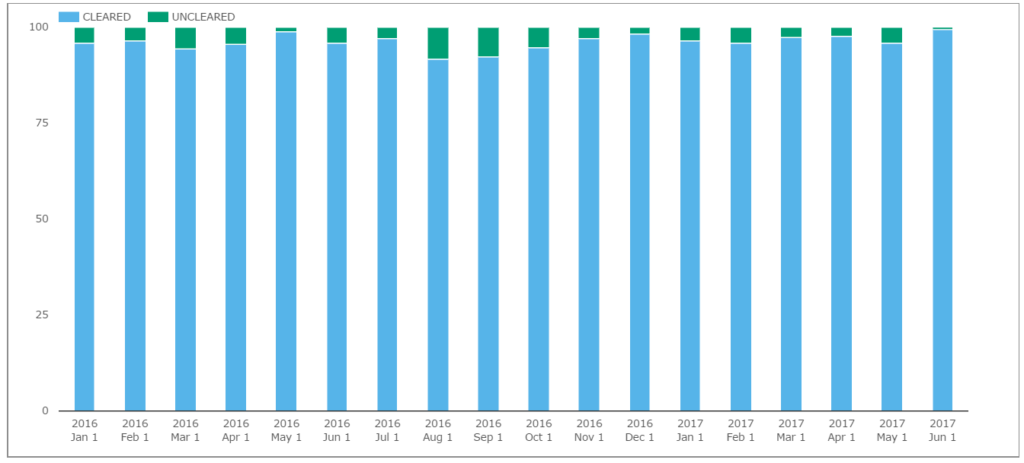

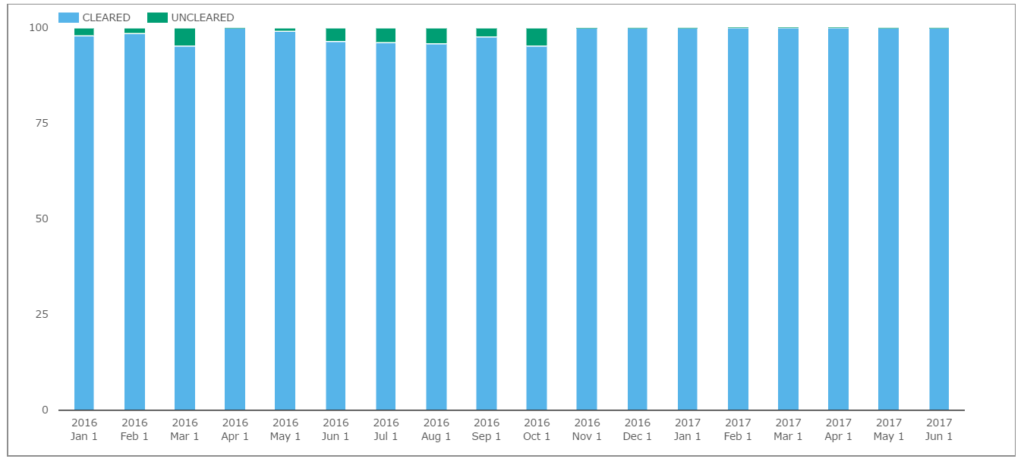

In 2017, GBP IRS markets are overwhelmingly cleared at a CCP. This is surely a result of the successful implementation of Clearing Mandates in both the US and Europe, plus the first wave of counterparties now being captured by the Uncleared Margin Rules.

Our SDRView product captures a reasonable portion of the market, and shows us just how saturated the market for clearing in GBP Interest Rate Derivatives now is:

Showing;

- For the past year, volumes each month reported to the US SDRs in GBP swaps that have been cleared in both LIBOR (IRS) markets and SONIA (OIS) markets.

- In June 2017, 99.52% of GBP IRS reported to SDRs was cleared.

- In June 2017, 99.999% of GBP OIS reported to SDRs was cleared.

- Other products show a similar story. GBP Basis swaps (a floating-floating single currency interest rate derivative e.g. Libor 3m vs Libor 6m) saw 95.6% of volumes cleared; FRAs saw 98.5%.

- Inflation Swaps are somewhat lower, with around 60% of volumes being cleared. We would have to do deeper analysis to look at which indices are being traded versus which are available for clearing to accurately reflect the portion of the target market being cleared.

GBP Swaps – What actually trades?

We can use SDRView trade-by-trade transaction reports to look at the structures commonly traded in GBP IRS. When we compare volumes in SDRView with CCPView, we see that trades reported to US SDRs account for about 20% of global GBP IRS volumes. This portion of the market should be broadly representative of the market as a whole.

Libor Swaps

Analysing the start date of GBP Libor swaps is pretty instructive:

Showing;

- 22% of GBP IRS volume by notional is spot starting.

- The highest volume is traded in Forward starting structures, accounting for 42% of volumes this year.

- IMM and MAC trades account for 19% of volumes combined.

- Backward starting swaps – typically associated with either portfolio maintenance or novation activity – account for 13%.

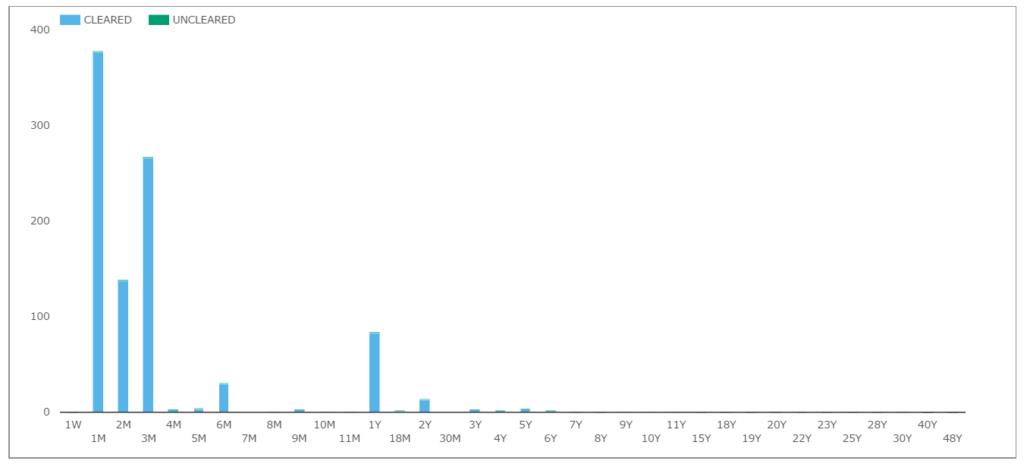

SONIA

The picture is somewhat similar in SONIA markets. 21% of trades by trade count are spot starting (but only 6% by notional), whilst 66% are Forward starting (a massive 92% by notional).

SDRView provides more detail as to what these Forward starting swaps actually are. If we display notional traded this year by start date, we see the following;

Showing;

- GBP SONIA by notional, broken down by time to start date.

- The most traded forward start date was 5 months from spot.

- However, if we group IMM dates all together, 25% of all volumes were IMM-dated.

- Even more significant are volumes starting on the first day of a Bank of England maintenance period. These account for 45% of volumes.

OIS trades starting on the first day of a BoE maintenance period (and typically running for six weeks until the start of the next MP) allow market participants to express the “purest” view/hedge on monetary policy. At each policy meeting, the MPC meets to determine the Bank Rate during the subsequent maintenance period. These forward structures are colloquially known as “MPC-dated SONIA”.

Tenors

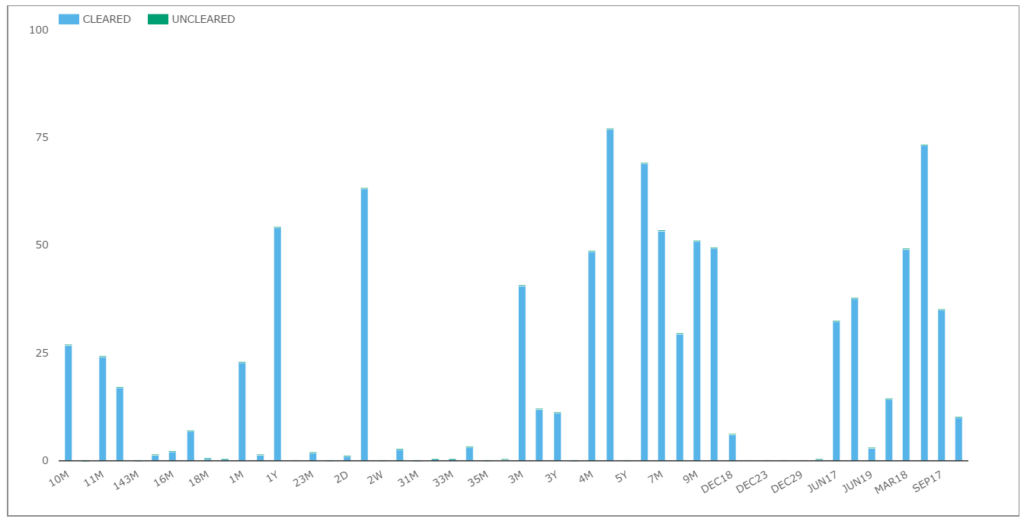

Due to the trade-by-trade nature of the SDRView data, we can also analyse the maturities (tenors) traded. For Libor-based swaps:

Showing;

- A predominantly long-term market

- 10 year maturities are by far the most traded, accounting for 30% of risk traded.

- 5 years accounts for 20% of risk.

- 30 years for 11%

- And 2 year swaps account for 10%.

- These four benchmark maturities hence account for over 70% of all risk traded. That represents a pretty standardised market.

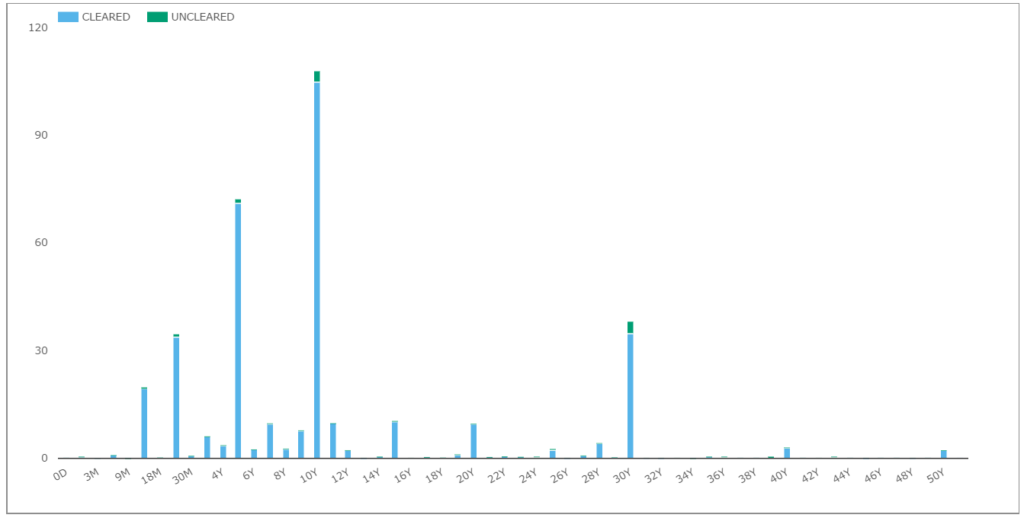

For SONIA swaps:

Showing;

- A predominantly short-term market

- MPC-dated SONIA swaps are recorded as a 1 month term – the nearest benchmark maturity to the six-week structure. This is clearly the most traded maturity by notional.

We can also restate these values in DV01 terms, to achieve a maturity-agnostic view of the risk being traded:

- In terms of risk traded, the 1 year tenor is the most significant, with over 30% of risk traded here.

- 3 months is second, with 24% of risk traded.

- 1 month tenors see 11.5% of the risk.

- Critically, over 82% of all SONIA risk reported to SDRs is of a 1 year tenor or shorter.

Market Conventions

Our trade-by-trade details tell us that in June 2017;

- 91% of GBP LIBOR swaps (by notional) were traded versus the LIBOR 6m index (77% by trade count).

- 14% was traded versus LIBOR 3m (9% by trade count).

- The balance was traded versus LIBOR 1m.

- 99.94% of trades had a Fixed Leg conforming to the Act/365 Fixed day count convention.

- Most trades had their Fixed Leg paid semi-annually (86% by notional, 96% by trade count).

Generally, if you are after the most common product, we are talking about a swap versus LIBOR 6m, that pays the Fixed Rate every six months on an ACT 365 Fixed basis.

For SONIA trades, it is even more standardised. All trades reported in 2017 have had an annual coupon (or a zero-coupon if less than one year maturity) on an ACT 365 Fixed basis.

GBP Asset Swaps

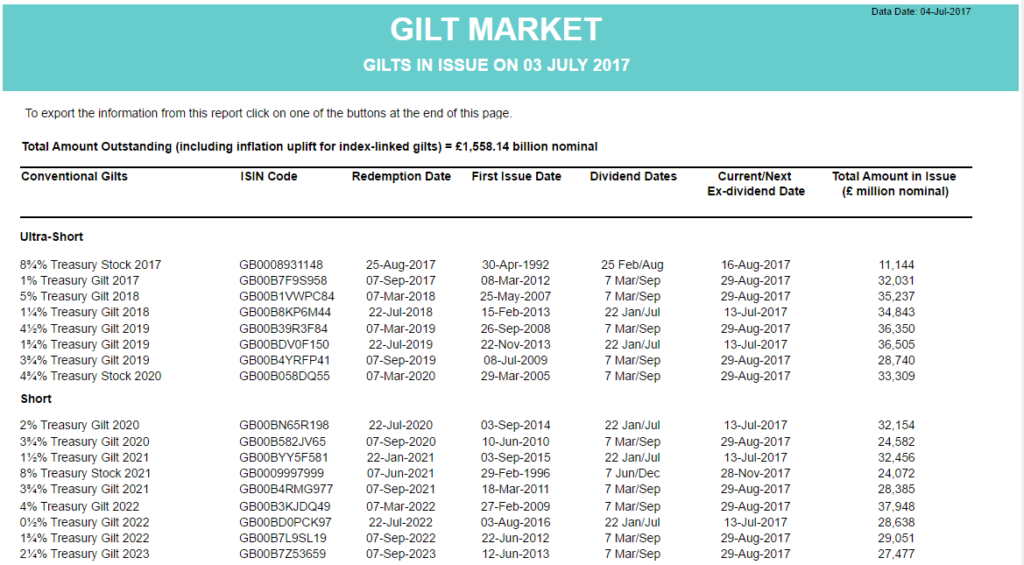

As we did for other European markets, we can identify Swaps with matching maturity dates to outstanding Gilts. In the UK, the DMO provides an excellent resource for cross-referencing outstanding gilt issues.

Cross referencing these maturity dates with Libor and SONIA trades reported to SDRs in 2017 shows that;

- Matched maturity asset swaps in GBP Libor swaps account for around 5% of trades (over 7% in DV01 terms).

- In SONIA markets, matched maturity asset swaps are more prominent, accounting for 10% of trades on a trade count basis.

GBP Futures

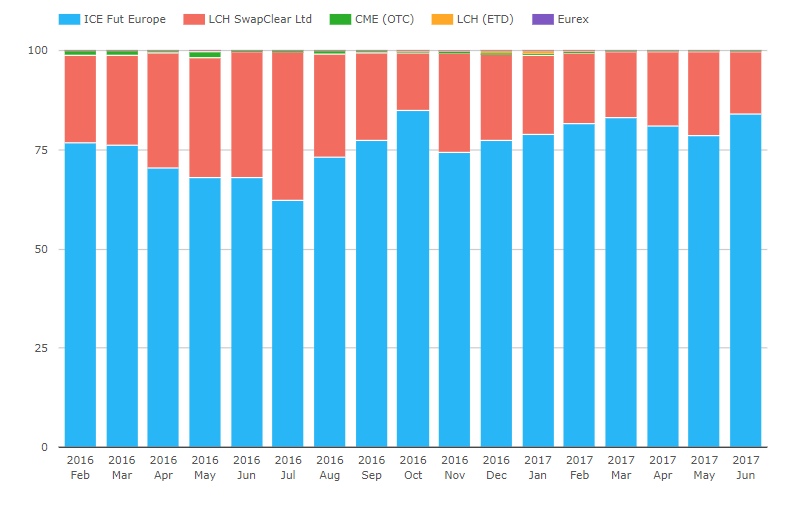

Finally, it is worth putting all of this into perspective versus the futures markets. CCPView allows us to compare OTC markets with Futures markets. We can hence look at the volumes traded in both GBP STIR contracts (ICE Sterling, a.ka. Short Sterling) and the Gilt futures (also traded at ICE):

Showing;

- On a monthly basis, we see about 75% of risk traded at ICE, mainly in Short Sterling contracts.

- The vast majority of the rest of the volume traded is in GBP OTC contracts cleared at LCH SwapClear.

The measures we use here – volume traded each day – are not directly comparable as the velocity of trading (speed and amount of risk recycling) in futures markets is typically much higher than we see in OTC markets. However, it puts OTC volumes into some kind of perspective.

In Summary

- GBP swap markets are the third largest interest rate derivatives market in the world.

- They are now highly standardised, with nearly 100% of volumes being cleared in both Libor- and SONIA-based products.

- Most SONIA risk trades in the 1 year tenor, and MPC-dated contracts are frequently traded.

- Most Libor risk is much longer dated, with the 10 year tenor the most active.

- Monitoring markets in this manner allows us to stay on top of current trends.

- It will be interesting to see how the BoE work on RFR reform impacts this data in the future.