For a while now I have wanted to look into what is happening outside the US in terms of clearing of interest rate swaps.

The news late last year that Japan Securities Clearing Corporation (JSCC), was awarded Clearing House of the Year by Asia Risk magazine, reminded me of this intention, so I decided to take a deeper look.

Those of you that read my articles know that I always focus on data and so it is great that JSCC provide an excellent Statistics page. What does this tell us?

JSCC Statistics

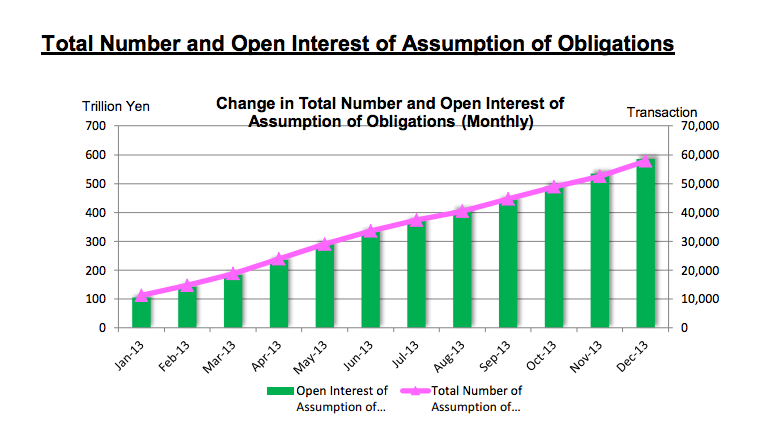

Lets start with a chart.

From this we can observe the following:

- The number of cleared trades has increased from less than 10,000 at the start of 2013 to almost 60,000 at the end.

- An increase of 750%

- The outstanding cleared notional has increased from 70 trillion yen to 585 trillion yen

- An increase of 800%

- Both outstanding increases

- Each month between 4,000 to 5,000 trades are added

- Representing between 40-60 trillion yen in notional

These figures by themselves are enough to explain the reason for the award.

Comparison with LCH SwapClear

It helps to further understand these numbers by comparing with SwapClear, which has been clearing JPY IRS for over 10 years.

From the LCH site, we can find that on COB Jan 13, 2014:

- Notional Outstanding in JPY for Client Clearing is 39 trillion yen

- Notional Outstanding in JPY for All Clearing Volumes is 2,663 trillion yen

As JSCC is launching Client Clearing this year, their existing clear trades represent House business and so the JSCC 585 trillion yen volume should be compared with the SwapClear 2,663 trillion yen number.

On this basis JSCC volume now represents 22% of LCH SwapClear volume.

Both JSCC and LCH are growing volume, so it is hard to project market share to Jan 2015 without more information.

However given that JSCC is expected to launch Client Clearing by March 2014, we should expect a further increase in the JSCC share, possibly to 33% of the LCH one.

What else does the data show?

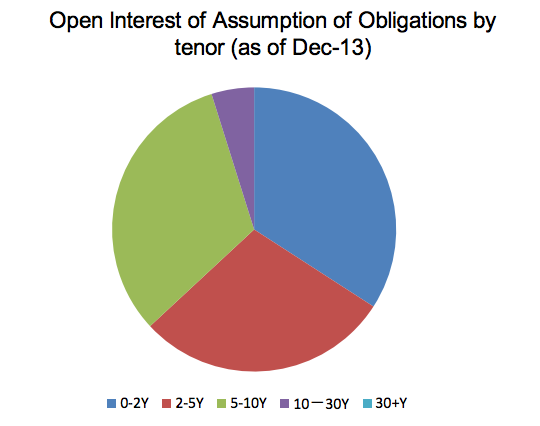

Which shows that the tenor of outstanding trades is evenly split between 0-2Y, 2-5Y, 5-10Y and then less for 10-30Y.

In addition looking at the detail from the Statistics page, we can see that:

- LIBOR vs Fixed is by far the most common trade

- There is low volume in TIBOR vs Fixed

- Basis Swaps, LIBOR 3M vs 6M and LIBOR vs TIBOR are traded in reasonable volume

- There is low volume in TIBOR 3M vs 6M

- No clearing in Zero Coupon Swaps or FRAs (both of which LCH offers).

Summary

JSCC has had a very successful 2013 in Interest Rate Swap Clearing.

Outstanding cleared volume has risen from 70 trillion yen to almost 600 trillion.

Or from less than 3% to 22% of the market leader, LCH SwapClear.

The healthy Clearing Participants list of 21 firms and the launch of Client Clearing by March 2014, augurs well for 2014.