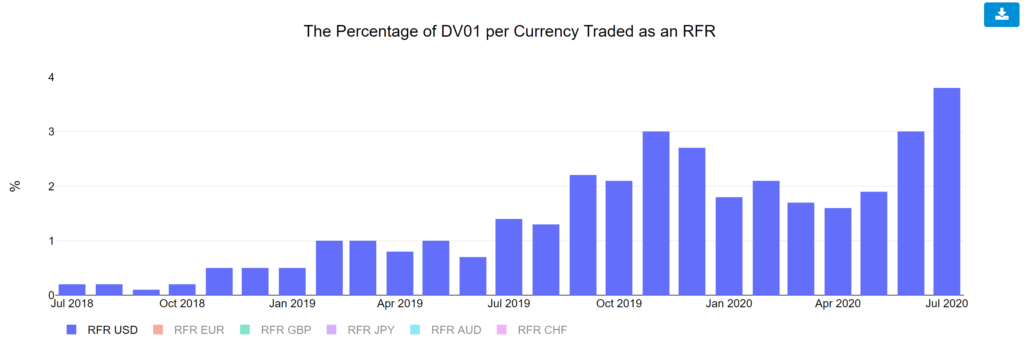

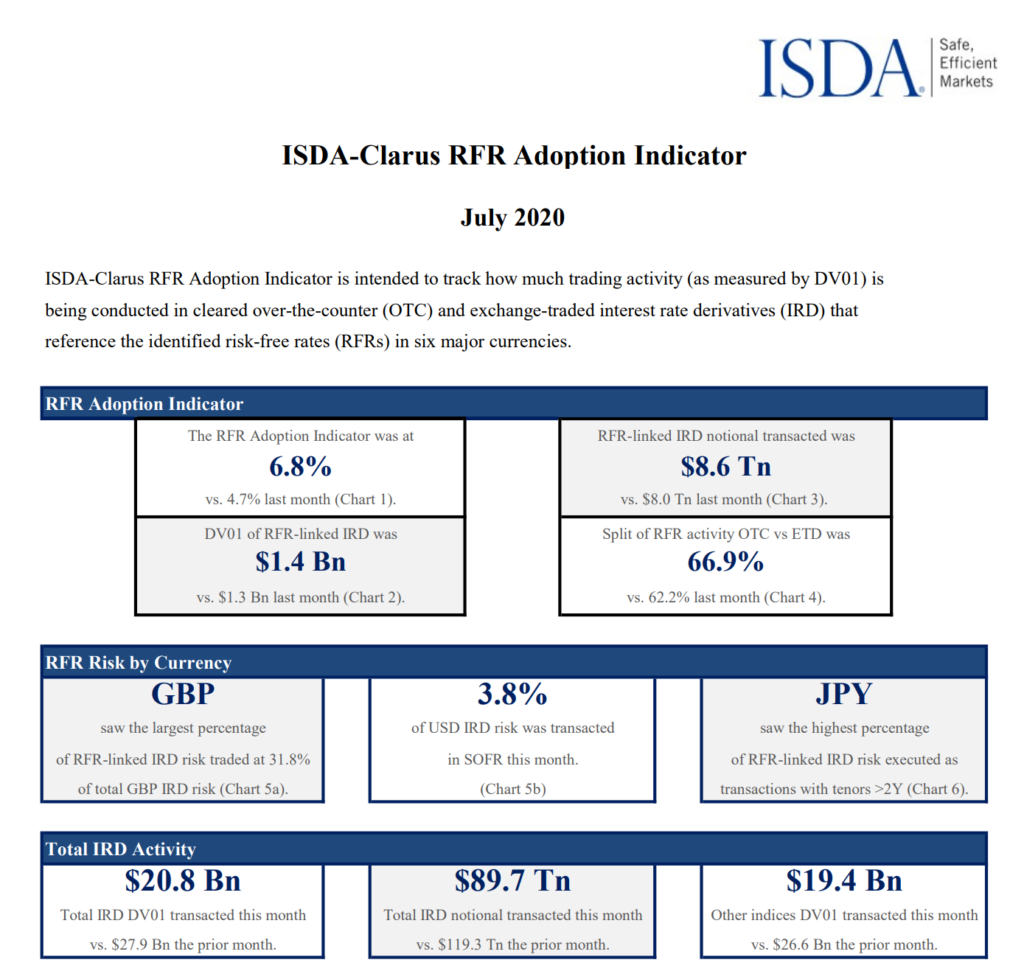

The ISDA-Clarus RFR Adoption Indicator has been published for July 2020. The headlines are:

- The RFR Adoption Indicator was at 6.8% in July 2020.

- This moved higher from 4.7% the prior month, reaching the highest level since February.

- Of particular note, 3.8% of all USD risk was traded in SOFR. This was higher than the previous month (3.0%) and sets yet another record for SOFR risk.

- The discounting switch to €STR at CCPs occurred in the final days of the month, therefore had a small impact on the amount of €STR risk traded.

- JPY again saw more long-dated risk (>2Y) than any other currency.

Did the SOFR Basis Spike Drive Activity?

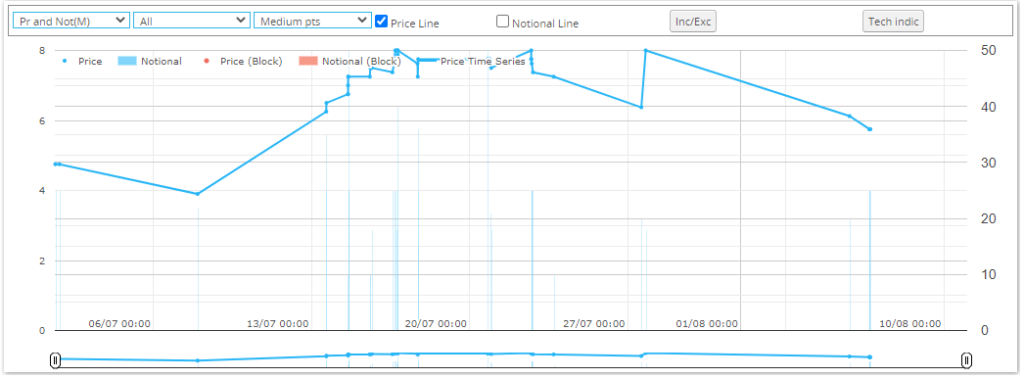

In USD RFR markets there was a significant move higher in the basis price between SOFR and Fed Funds during July. The 30Y basis, for example, was as low as 4 basis points at the beginning of the month. This consistently traded higher to reach 8 basis points by month-end:

This is a big move, when you consider the 30Y was down at 2 basis points as recently as June.

The 10Y SOFR-Fed Funds basis is also back to the highs it reached last year, at around 3.5 basis points. Seemingly gone are the days of negative SOFR-Fed Funds basis.

This price volatility can sometimes drive increased trading activity. Will this increase in activity be sustained as market participants prepare for the discounting switch at CCPs?

Interactive Charts

The ISDA-Clarus RFR Adoption Indicator can now also be accessed at rfr.clarusft.com. Here, you will find interactive charts and the ability to export the data. Let us know any comments/feedback below. It is best viewed in landscape format on a mobile device.