One of the challenges we face in a world of mass information is getting our applications to be always open and used on a desktop or mobile device. Even in the Capital Markets domain with six or nine monitors common on a traders desk, it is not easy to achieve this. So much news, information, data and communication competes for that screen real estate.

This challenge is more difficult for trade information in markets where a small number of trades take place in a given day.

Cross Currency Swaps

Lets take Cross Currency Swaps trades in EUR-USD as an example; an important market that we have covered before, see SEFs Enjoy QE-Fueled Volume Boost.

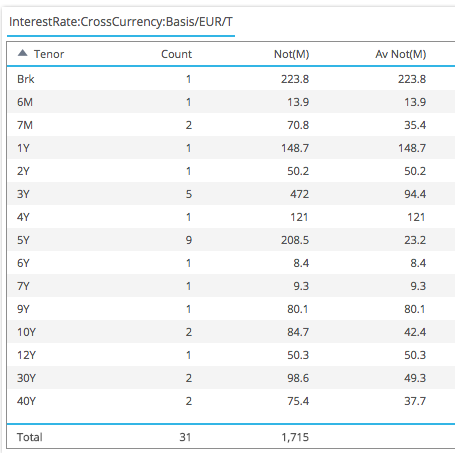

Using SDRView we can see that for yesterday 31-March there were only 31 trades reported in the US, all to DTCC SDR.

Now the gross notional of these trades was >$1.7billion and they were executed between 9:13 AM and 9:00 PM London. Ignoring 3 late trades, we can say that 28 trades were executed between 9am and 5pm London, the main market opening hours. So that is 28 trades over 8 hours or an average of one trade every 17 minutes.

A user would have to be extremely interested in every single trade to have the SDRView application open to get the notification event that a new trade had been reported. And much as we would like to believe their are many users like that, we know there are many more users who would prefer a less intrusive and low screen real-estate method.

SDR Alerts

Which brings me to the new Alerts feature we have introduced in SDRView.

This allows a user to specify the criteria of trades types that he or she would be interested in being notified about (e.g. Product, Currency, Cleared/UnCleared, On/Off SEF, Minimum Notional) and for these rules to be saved in the system and trigger notifications.

For the first version we have chosen Email as the alert mechanism. Mainly due to its ubiquitous nature and the fact that our users login with their email address. Many other messaging and notification technologies exists but suffer from the fact that they may not be available everywhere and may require the capture of specific addresses.

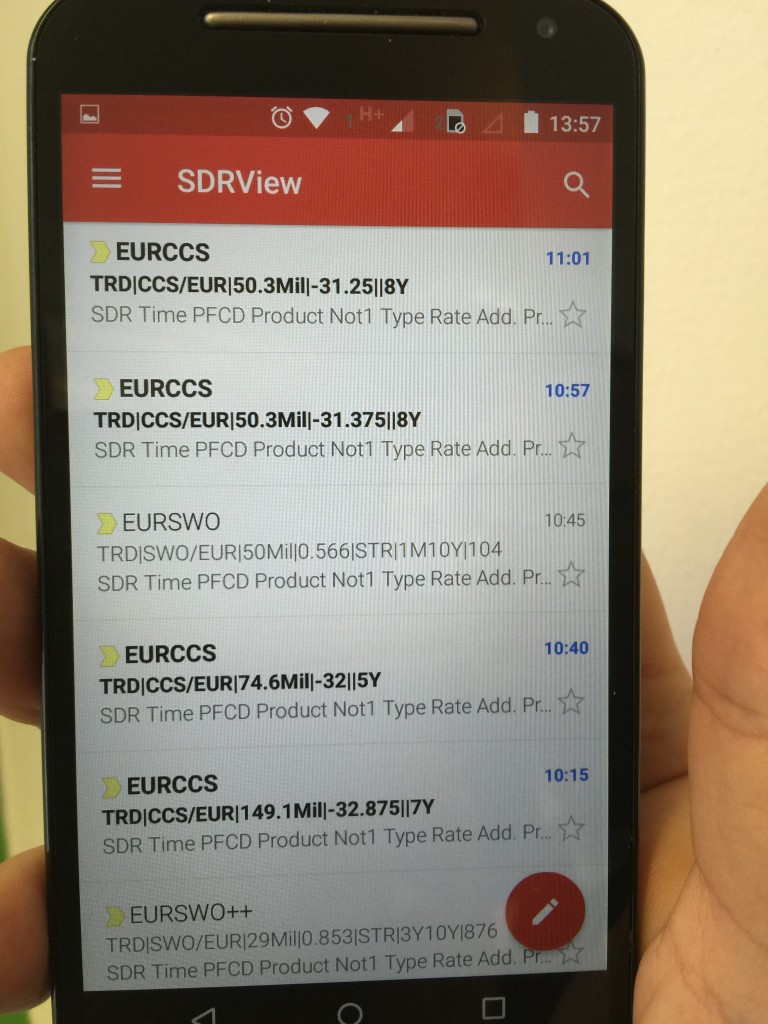

So now our user interested in Cross Currency Swap trades, can use our application to create his/her alert filters, close this down and just keep an eye on their mailbox. Possibly even surreptitiously during a meeting as below on a cell phone.

Two EUR 50 million trades 8Y trades within a few minutes of each other, the first at -31.375 bps the second at -31.25 bps. Interesting.

Terminations

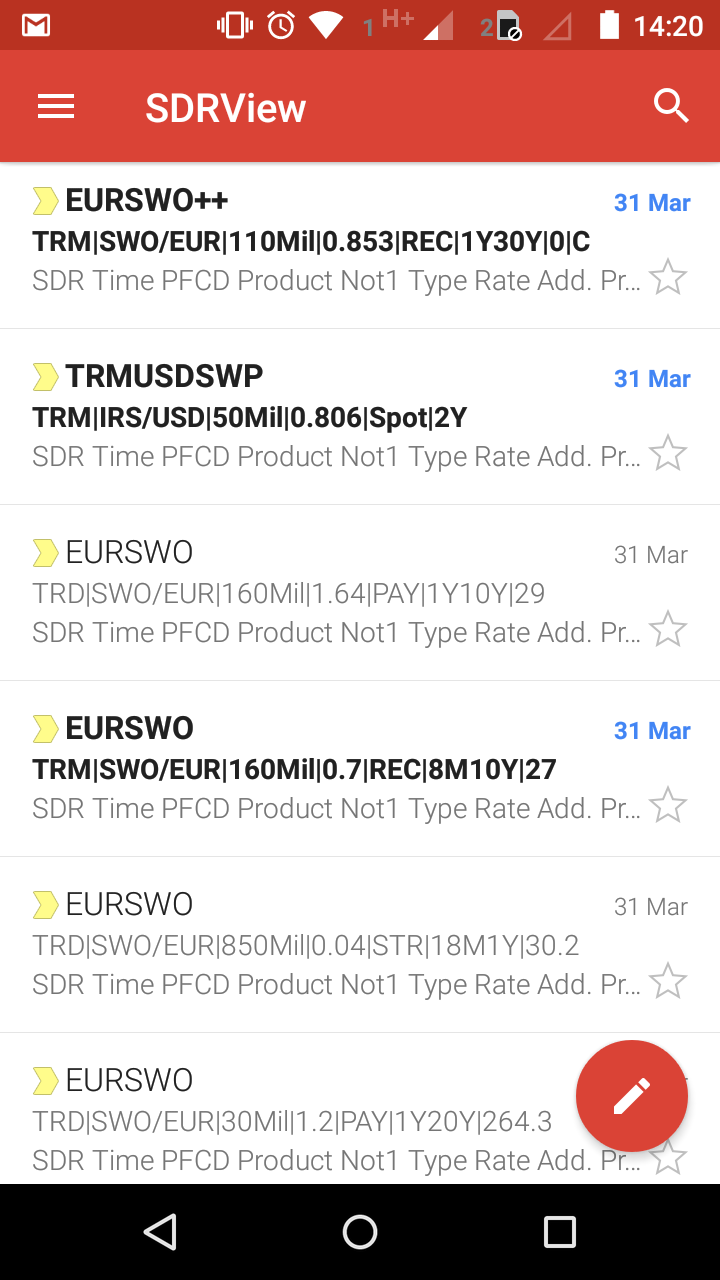

Alerts are also available on Termination trade events. These are events were existing trades have been terminated for an agreed fee (so very different to the compression list trades we have blogged about) and interesting data that hitherto we have not exposed in SDRView.

So for example it is now possible to be alerted when a EUR Swaption is terminated.

The fee paid for these allows us to back out the volatility used to price the termination for a strike that is no longer at-the-money and an expiry that is no longer standard. So providing interesting input data for volatility smile calibration.

Conclusion

Those of you who read our blogs will know that we are great proponents of the value of SDR real-time public dissemination.

Anything that gets this data quicker into the hands of users that may act on it or be informed by it, has to be a good thing.

Even if it means filling up your email in-box!

Best to re-learn those email filter and routing commands. (You have been warned).

Coming to a mail-box on your cell phone shortly.