CME recently put out a press release on their first TriOptima multi-lateral compression cycle, stating $2.2 trillion in gross notional reductions with 44,933 line items removed. (The full press release is here).

So I thought it would be interesting to look at the significance of this.

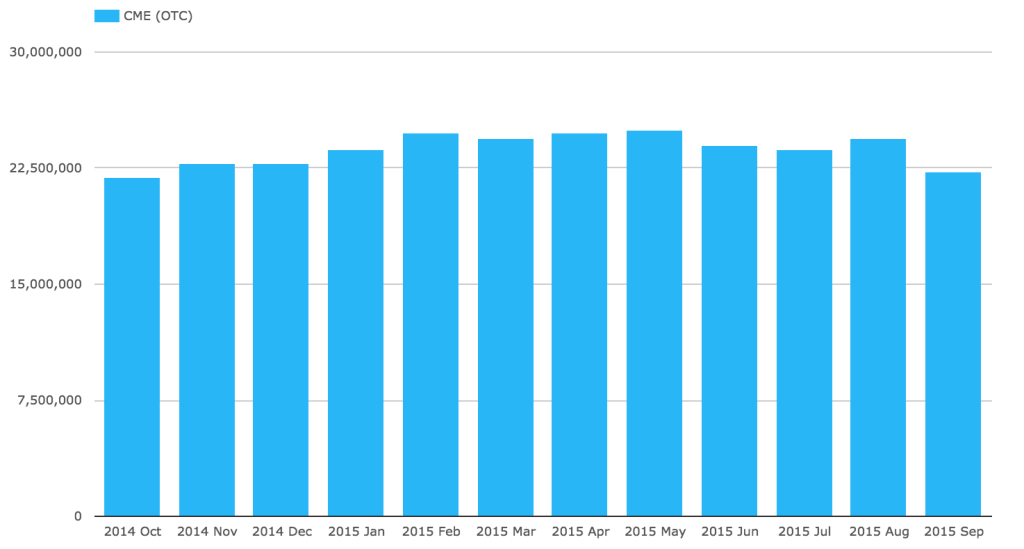

CME IRS Open Interest

Using CCPView, we can look at CME IRS Open Interest for the past 12 months, using the last business day of the month and for Sep 2015, the latest day (4 Sep 2015).

Showing that:

- OI fell from $24.4 trillion to $22.3 trillion in first week of Sep

- Granted new volume in Sep will bring the OI up from $22.3 trillion

- Only 3 other months, Mar, Jun, Jul show falls in OI

- Jun being the largest at $0.9 trillion

- We know from a CME release that this was $1.9 trillion from CME’s own Compression

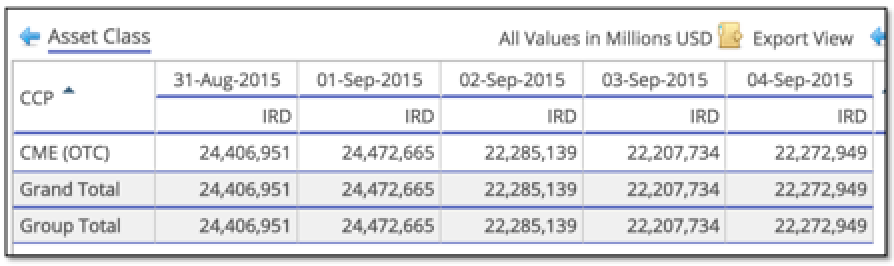

Looking just at the daily numbers for last week.

Showing the steep fall of $2.2 trillion on 2 Sep.

So a very successful run of the triReduce multi-lateral compression and showing the additional value to Clearing Members of this over and above CME’s own compression.

CME Group’s Own Compression

The CME press release also makes reference to CME Group’s compression offering, including via Coupon Blending, having reduced total notional by $11 trillion. An impressive figure, but as no time frame is given, one can only assume this is since inception.

CME Coupon Blending works on trades with the same attributes and effective dates but different fixed rates. It results in two new trades that replace the blended trades, with one at a fixed rate equivalent to the highest rate of the swaps being blended.

This requires participants to be comfortable with holding the new fixed rate trade at an off-market coupon and large, odd notional.

triReduce compression for a CCP, in contrast offers both risk-free (different coupons and same maturity dates) and risk-constrained (different maturity dates, with time-buckets constrained by a DV01 tolerance). The latter is likely to result in a much higher compression efficiency.

Add in that fact that global clearing members will already be operationally comfortable with using triReduce and so it is likely that the triReduce offering will become as significant, if not more significant than CME’s own compression functionality.

LCH SwapClear Compression

By offering triReduce compression, CME is listening to its clearing members and playing catch-up with LCH SwapClear, which has offered this for many years.

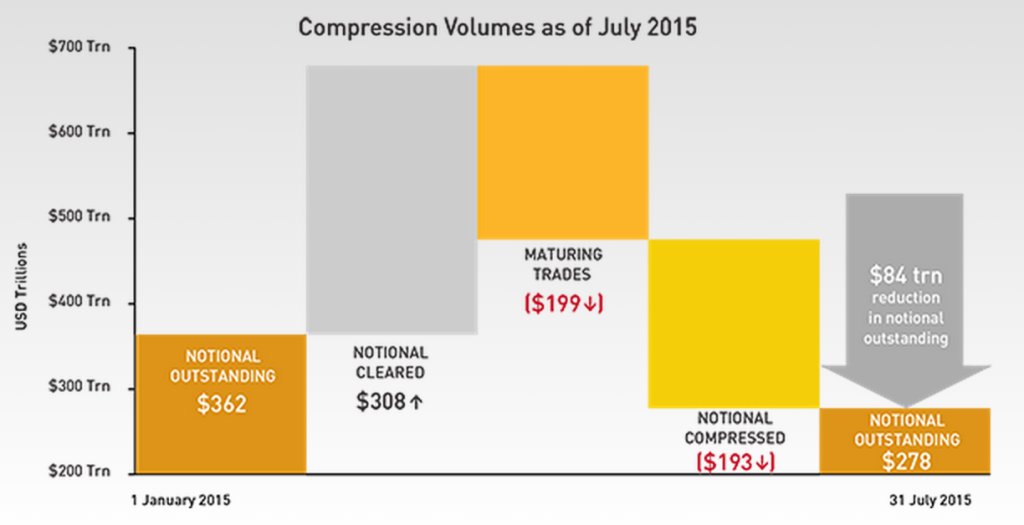

The following chart from the SwapClear website is interesting.

Showing $193 trillion of notional compressed between 1 Jan 2015 and 31 Jul 2015.

Now SwapClear do not break-out how much is TriOptima or LCH’s own Compression (see Solo and Duo).

However we can make an estimate by looking at triReduce own statistics here, which show about $130 trillion of compression on CCPs as of 31 Aug 2015. As triReduce at JSCC is a little under $1 trillion and allowing for the one extra month, we could estimate that $114 trillion of the $193 trillion at LCH, or 60% was TriOptima.

LCH, CME, JSCC

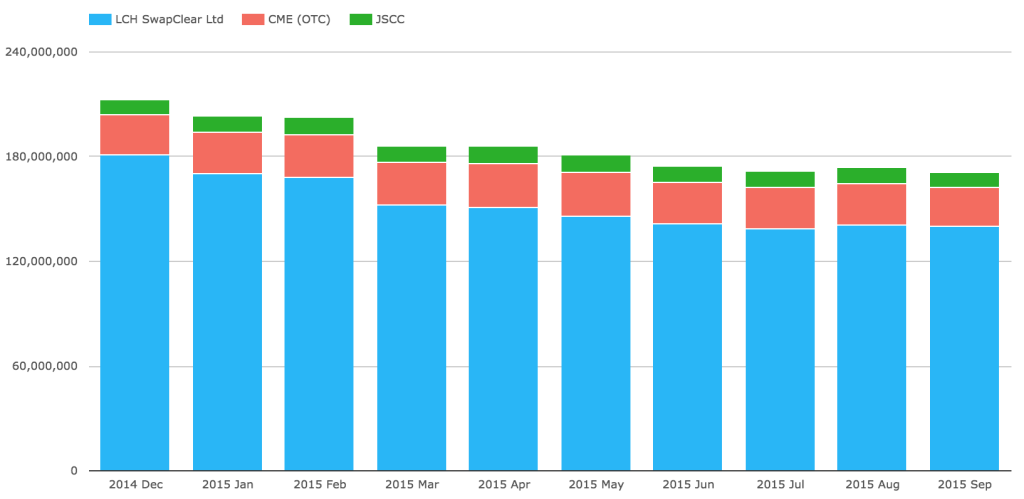

Using CCPView, we can look at 2015 and the 3 major IRS CCPs which offer Compression, LCH, CME & JSCC.

(Note our numbers are single-sided, so for LCH in July, we show $139 trillion as opposed to $279 trillion).

Showing that from 1 Jan to 4 Sep, the Outstanding Interest across these has dropped from $213 trillion to $171 trillion, driven entirely by a $41 trillion reduction at LCH, with CME and JSCC largely flat (so new volume has offset compression).

It will be interesting to see now that TriOptima is available on each of these CCPs, how OI will develop over the remaining months of 2015.

You only need to wait for a follow-up blog, or check for yourself in CCPView.

Interesting to see that trioptima compressed around 9% of oustanding notional at CME versus more like 30+% at LCH this year. Is that more evidence that CME positions tend to be directional, with less “in-out” dealer-to-dealer flows? Will be interesting to see if these ratios stay static with the basis, or as more CME is compressed, CME-LCH basis tightens?