CCP Disclosures 2Q 2017 – What the Data Shows

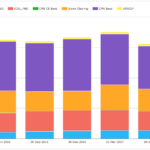

Central Counterparties recently published their latest CPMI-IOSCO Quantitative Disclosures and in this article I will highlight what the data shows, similar to my article on 1Q 2017 trends. Background Under the voluntary CPMI-IOSCO Public Quantitative Disclosures by CCPs, over two hundred quantitative data fields covering margin, default resources, credit risk, collateral, liquidity risk and more […]

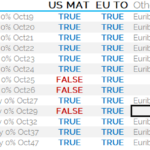

MIFID II – ESMA Finalises the Trading Obligation

ESMA have published the final report for the Trading Obligation. Interest Rate Swaps in EUR, GBP and USD will have to be traded on venue from 2018. There has been convergence with the swaps that are currently MAT in the US, potentially simplifying the global regulatory regime. 8y and 9y EUR swaps versus EURIBOR 6m […]