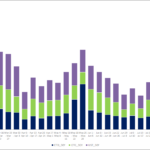

US Treasury Quarterly Refunding: Traded Volume Data

Clarus data for August 2020 shows a big increase in 30Y traded volumes in Rates products. This was specifically in USTs and exchange traded derivatives. Long-dated OTC derivatives did not see the same increase. The 20Y and 30Y US Treasury auctions, as part of the quarterly refunding cycle, were clear drivers of this volume. However, […]

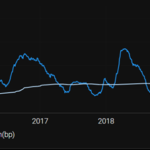

Valuation challenges for non-cleared derivatives

The past few months I have been looking closely at the potential for valuations challenges over the last months and days of LIBOR with a potential cliff and wall as we approach December 2021. The rather benign pricing in the market predicts a very gradual ‘glide’ into the end but this may not actually be […]