Recently I looked at Term SOFR and BSBY Volumes in 2022 and in that article I used a pretty loose definition of Term SOFR; basically anything where the index was not the standard overnight SOFR index. My goal being to isolate the trades not using overnight SOFR.

Today I want to seperate out the use of an Average SOFR (backward looking) and Term SOFR (forward looking) from overnight SOFR.

Definitions

The Federal Reserve Bank of New York each day publishes overnight SOFR as well as SOFR Averages, which are available here. These are backward looking averages, so at the end of each rolling 30-Day, 90-Day or 180-Day period, the daily SOFR observations in the period are averaged and an Average SOFR published.

CME each day publishes Term SOFR rates for 1-month, 3-month, 6-month and 12-month, which are forward looking, so for the period ahead and calculated from CME SOFR Futures, which have been hitting record volumes month on month as volume migrates from CME Eurodollars to SOFR Futures.

CME Term SOFR Rates are available here and an extract of today’s data table shows

Showing both the most recent 5-days of CME Term SOFR rates, the overnight SOFR and the NY Fed Averages, a super convenient page indeed, including the NY Fed SOFR index, which can be used to easily calculate compounded SOFR for custom periods.

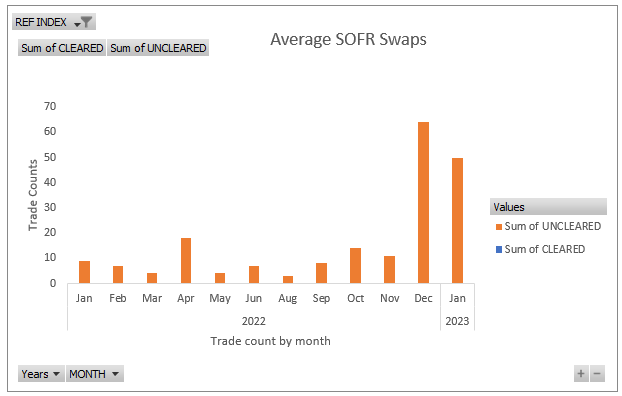

Swap Volumes for Average SOFR

In SDRView, I can group USD FixedFloat Swaps by the Reference Index of the floating leg and export this data to create an Excel PivotChart, selecting only those that look like Average SOFR rates (8 different string representations out of more than 30 with SOFR in the name).

Showing a small number of trades each month, the peak is 64 in Dec 2022 and 50 in Jan 2023.

Let’s compare that to Term SOFR.

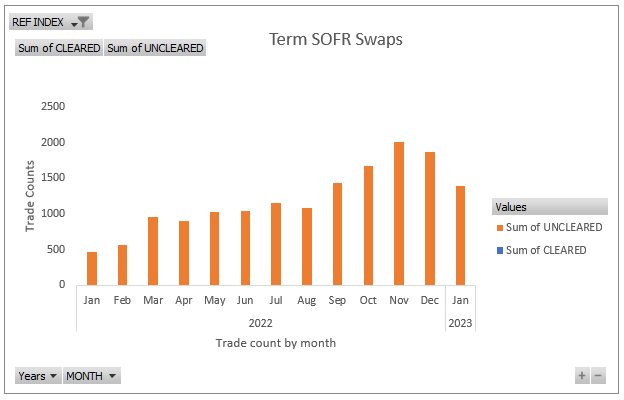

Swap Volumes for Term SOFR

This time I selected 24 different strings that had some combination of Term, SOFR and CME along with abbreviations such as TSOFR or CME-TS – bit of a free for all here – surely there is a kosher ISDA Floating Rate Option definition for CME TERM SOFR by now?

A much higher number of trades each month, a peak of 2,016 in Nov 2022 and 1,864 in Dec 2022 and 1,386 in Jan 2023.

So no competition here at all, CME Term SOFR winning hands down over Average SOFR.

Also just for clarity sake, in Jan 2023, we also see 612 FixedFloat Swaps that reference USD-SOFR-Compound with a reset frequency of 1D, all with platform ID of XXXX, XOFF or BILT, meaning traded off venue, which I would think should be reported as OIS.

And a quick comparison of the 1,386 Term SOFR Swap trades in Jan 2023, with standard OIS SOFR Swaps of which there are 53,700 trades in the month, shows the relatviely niche nature of Term SOFR for Swaps.

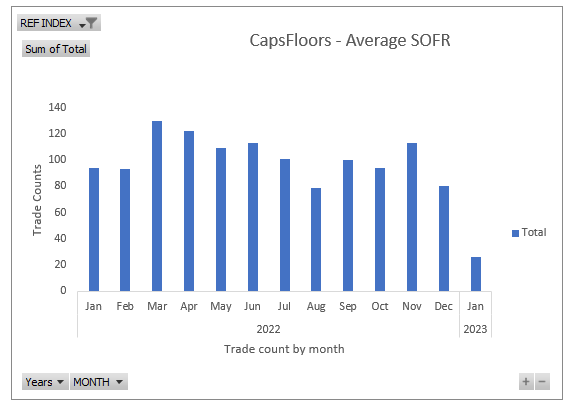

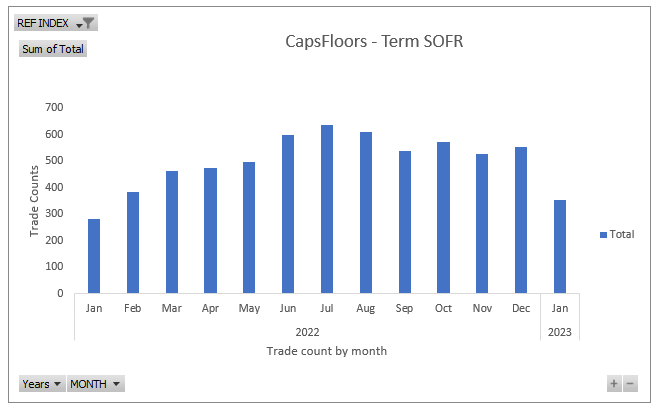

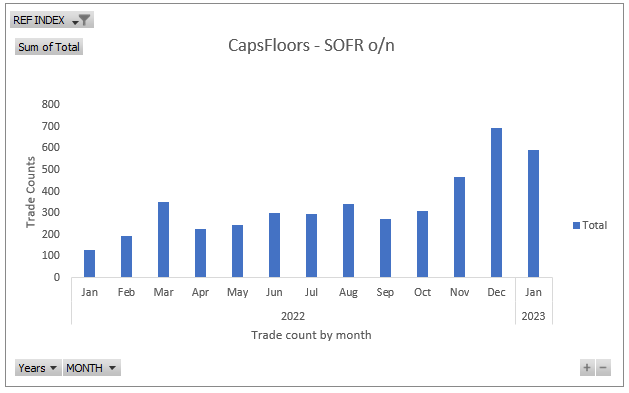

What about CapsFloors?

Starting with Average SOFR, then Term SOFR and then o/n SOFR.

Most months in 2022 with just over 100 trades and a low of 26 in Jan 2023.

Most months in 2022 with 500-600 trades and a low of 350 in Jan 2023.

Most months in 2022 with 200-400 trades, a high of 690 trades in Dec 2022 and Jan 2023 with 590.

So unlike Swaps, CapsFloors show significant trades in each of O/N SOFR, TERM SOFR and Average SOFR.

That’s all I have time for today.

If you are interested in this data, please contact us for an SDRView demo.

USD-SOFR CME Term https://www.fpml.org/coding-scheme/set-of-schemes-2-1.xml

Thanks for this Kirston.

USD-SOFR Average 30D

USD-SOFR Average 90D

USD-SOFR Average 180D

USD-SOFR CME Term

USD-SOFR Compounded Index