ISDA Margin Survey 2018

Uncleared Margin Rules (UMR) for IM have now been in place for two and a half years The ISDA Margin Survey Year-End 2018 provides a good overview of the regulatory IM received $83.8 billion at Dec 31, 2018, up from $73.7 billion at Dec 29, 2017, an increase of 14% Timeline for Margin Rules The following diagram from the […]

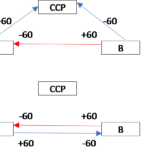

Reducing Counterparty Risk of Uncleared Derivatives

In my previous posts I concluded that uncleared counterparty risk is bigger than traded notional figures suggest and that, so far, UMR has only driven a limited further shift towards clearing. Here, as promised, I take a spin through approaches which complement new trade clearing and can also improve OTC uncleared counterparty risk efficiency. Summary […]

Will UMR lead to a further material shift to clearing?

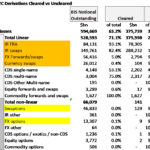

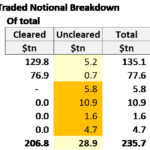

In my previous post Counterparty Risk: Some Way to Go for Derivatives, I concluded that uncleared OTC counterparty risk is bigger than the 80% cleared traded notional volumes might imply. Of all counterparty risk about two thirds (65%) or more is uncleared and about half (49%) or more is linear delta. A lot is riding […]

Counterparty Risk: Some way to go for Derivatives

Ten years after the Great Financial Crisis of 2008, we may interpret figures such as only 18% of new trades in OTC interest rate derivatives are now uncleared, to mean that uncleared derivatives now represent a small amount of counterparty risk. However as I will show in this article, this is not true and there […]

Could the Nasdaq default happen in Rates markets?

What could cause a Rates CCP to lose €100m from the Default Fund? We look at 10y IRS in NOK vs SEK. We find that liquidity add-ons prevent very large positions from being under-margined. Nevertheless, we present a scenario that causes a €74m loss. And then we explain why we really shouldn’t worry about it! […]

Margin Requirements for Non-cleared Derivatives

A new study funded by ISDA on Margin Requirements for Non-cleared Derivatives authored by Professor Rama Cont of Imperial College London, was the topic of much comment and debate at the ISDA AGM. It was also covered extensively in the press, see CFTC, Treasury officials boost ISDA push for IM revamp and ISDA faces member backlash […]

CCP Margin Calculation

Margin Calculations directly from Excel Are you using LCH SMART, CME CORE or ASX Online? Would you prefer to use Excel? For IM & VM Calcs, What-ifs, Optimize and more 14-day trials are available to members and clients Background CCPs provide software tools for their members and clients to estimate initial margin requirements. Generally these […]

Initial Margin, Compression Volumes and why the time to Optimise is now

CCP disclosures show that total Initial Margin held at CCPs is increasing, mainly driven by increasing IM held by clients. We see a steady increase in the number of client accounts at CCPs, which is likely a key driver of Client IM heading higher. Compression volumes from the SDRs have hit recent records, and triOptima […]

Initial Margin Attribution

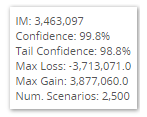

Initial margin is an important portolio measure Attributing it to constituent business units is not simple Diversification benefit between units is a key concept The choice of methodologies can align or mis-align incentives An example explains what you should know Initial Margin and Diversification Benefit IM is a portfolio risk measure and one that is […]

Margin for Non-Cleared Derivatives

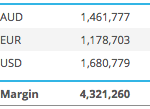

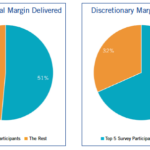

Uncleared Margin Rules (UMR) for IM have now been in force for one year The ISDA Margin Survey 2017 provides a snapshot of IM delivered and received $47.2 billion and $46.6 billion respectively, between Phase One firms (March 31, 2017) I look at how the figures compare to an $800 billion estimate from 2012 What […]