In my previous posts I concluded that uncleared counterparty risk is bigger than traded notional figures suggest and that, so far, UMR has only driven a limited further shift towards clearing.

Here, as promised, I take a spin through approaches which complement new trade clearing and can also improve OTC uncleared counterparty risk efficiency.

Summary

- Dealers and specialist market utilities have fashioned new ways to reduce OTC counterparty risk, other than clearing. These include:

- Not trading

- Product substitution

- Uncleared delta hedging

- Risk compression

- Delta clearing

- These approaches bring with them practical challenges:

- Trade set execution risk

- Increased uncleared notional outstanding

- SIMM portfolio eligibility

1. Not Trading

Deciding that trades are no longer economic.

It goes without saying that not doing the trade doesn’t incur the SIMM IM associated with it. It also goes without saying that this is a least desirable outcome because the associated revenue or risk hedge doesn’t materialize unless an alternative way to express the risk is found incurring less funding / capital usage.

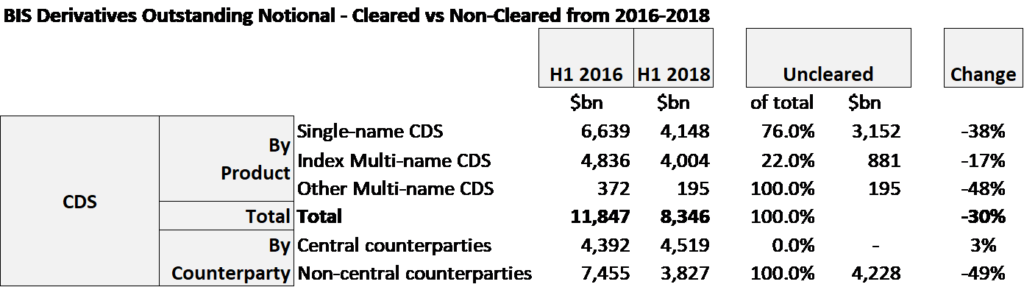

As it happens the macro notionals suggest an example – credit derivatives notionals outstanding declined by 30% from end H1 2016 to end H1 2018.

Looking more closely, cleared notional outstanding remained flat while there was a 49% decline in uncleared trades largely as a result of single names declining by 38%.

It’s worth noting that credit derivatives have their own special punishments in the form of CVA adjustments and higher regulatory percentages in leverage rules along with the regular UMR funding and counterparty RWA costs.

Given other asset classes grew notionals in the same period, it seems clear that a big chunk of CDS market and counterparty risk has been taken off particularly single names. Either single name risk is no longer being hedged or is being hedged by less precise index CDS trades. Since index CDS also declined this is likely a net “risk off” move at the asset class level.

2. Product Substitution

Using a different product to express the risk.

There was a time when listed derivatives substitutes were vaunted as a major contributor to systemic risk reduction – swap futures for IRS and CDS and lately FX futures. Being cleared these have similar counterparty netting benefits to cleared OTC and margin is often cheaper being e.g. 1- or 2-day MPOR.

The above products at CME, ICE and ERIS have maintained steady open notional in the range $25bn to $30bn over the last three years. But if you graph OTC IRS / CDS / FXD on the same scale the futures are almost invisible.

Basis risk concerns and/or market practice inertia seem to have inhibited them from taking off just yet.

3. Uncleared Delta Hedging

Avoid creating unwanted uncleared delta on trade date.

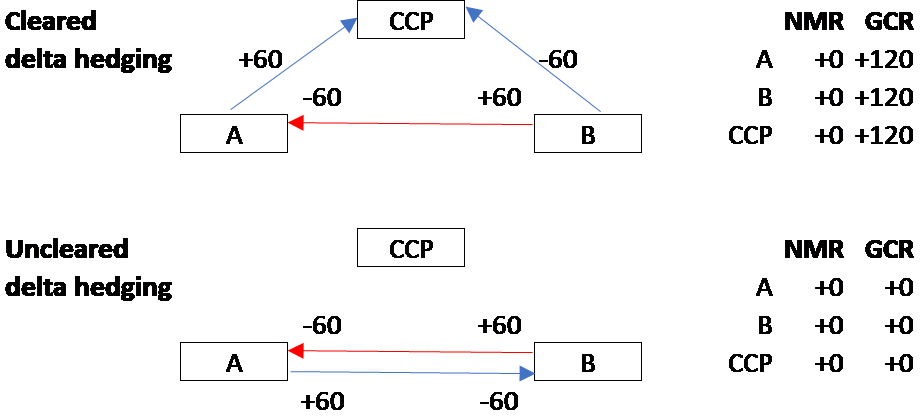

Options contain vega for the option volatility and delta for the underlying swap or FX forward. Traders sometimes want to trade only vega. Here they trade a package comprising a swaption with delta hedged out with a vanilla IRS with same characteristics as the underling of the option but in the opposite direction.

In the cleared delta hedging case, the IRS clears (blue arrows) which leaves unwanted uncleared delta counterparty risk embedded in the swaption (red arrow). The net market risk (NMR) is flat but the gross counterparty risk (GCR) is not.

In the uncleared delta hedging case, the IRS remains uncleared and flattens both market and counterparty risk, leaving only the vega risk (not shown).

4. Risk Compression

Counterparty risk offsets via multilateral market risk neutral trade sets.

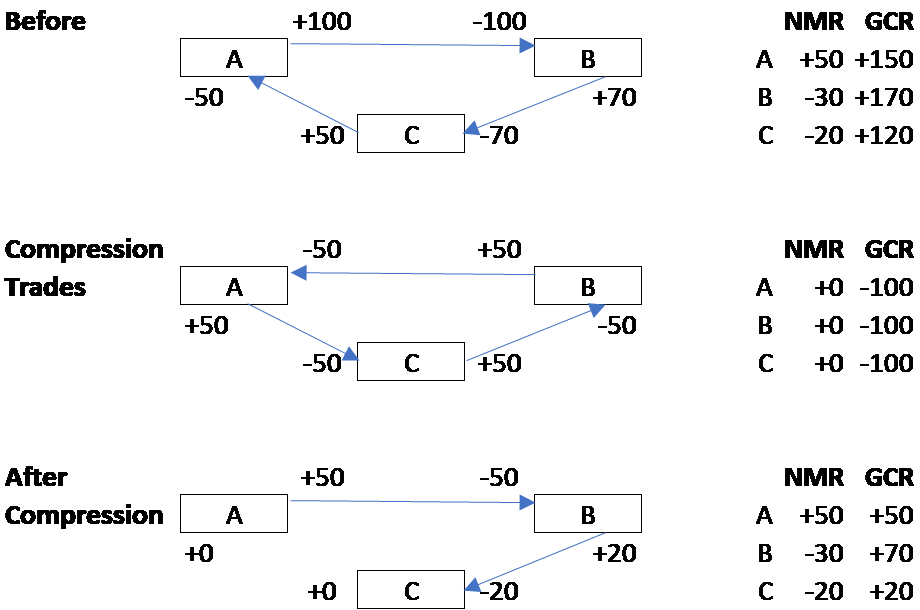

Suppose parties A, B and C have 3 trades on between them as in the Before picture below. By putting on the Compression Trades all three parties reduce their gross counterparty risk (GCR) closer in magnitude to their net market risk (NMR) whilst not changing the net market risk.

This is a trivial example of a much more complex general case of n parties with a mixture of longs and shorts vs one another – there are lots of permutations and combinations of scenarios.

The example does still show the key point – that without a third-party vendor each counterparty only sees its risk facing counterparties, not the other risk those counterparties have facing other parties. As an example, in the above case party B would like to compress 70 units of risk and cannot know that that doesn’t work for party C.

In order to overcome this problem, the risk compression vendor confidentially collects from each participant their view of risk (i.e. risk factor sensitivities per risk factor and tenor point) per counterparty. They centralize this information and apply a network optimization algorithm which covers all the permutations not shown above and proposes trade sets which maximize reduction of GCR whilst keeping NMR constant (within tolerances agreed) across the network of participants. Vendors who do this include TriBalance, LMRKTS, Quantile, CapitaLab.

For risk compression (unlike 3 and 5), the risk reduced can be vega as well as delta.

5. Delta Clearing

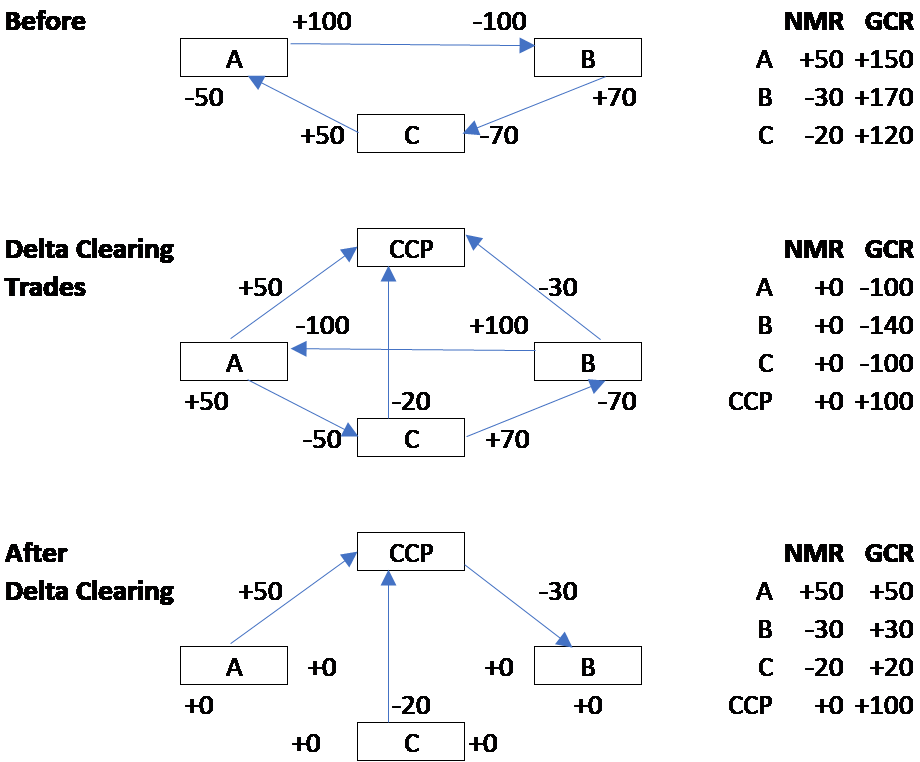

Converting uncleared delta into cleared swaps.

We can convert the delta in uncleared portfolios to cleared swaps. Suppose we start with the same 3 trade delta positions as in section 4 and suppose the risk positions are specifically delta positions embedded in trades which cannot themselves clear. Now let’s offset the counterparty delta risk by putting on uncleared opposite direction swaps to reduce uncleared risk and a further cleared swap in the same direction as the original delta position.

The two trades are flat market risk and we have effectively converted uncleared counterparty portfolio delta and the associated SIMM IM into cleared swaps. Ignoring the rest of the CCP portfolio for simplicity, CCP IM will usually be approximately 40% lower than SIMM IM. Factoring in risk netting with the rest of the CCP portfolio will further reduce risk and CCP IM.

Based on this Risk article on synthetic swaps, this is already happening. Unlike risk compression, this approach is doable by a single pair of counterparties without a third-party utility (e.g. A and B can convert 100 units of uncleared delta to cleared delta without C being involved).

Note however that this can be manually intensive due to the need to agree counterparty portfolio delta risk between each pair of parties. This can be hampered by market data or modelling differences between the two parties. A somewhat iterative process of either reconciling SIMM IM or trial and error proposals of conversion trades may take several iterations to get to an agreed set of trades to use to convert the delta to clearing.

An emerging utility – Bilateral Risk Services (BRS) hopes to help. BRS partially automates risk agreement through pareto optimal risk representation on a basis signed up to by participants. This solution may yet have its day as we move from 30-40 entities after UMR 1-3 to perhaps a few hundred entities / funds after UMR 4 (September 2019) and several thousand entities / funds after UMR 5 (September 2020). Automation will increasingly be at a premium.

6. Practical Considerations

Trade set execution risk, increased uncleared notional outstanding and SIMM portfolio eligibility.

Trade set execution risk (applies to 4 and 5)

Execution of the trade set is required completely and “simultaneously” – meaning within a short space of time like a few seconds or minutes. Otherwise market risk imbalances would sit unresolved. There can be hundreds or thousands of trades in the trade set. The obvious solution is to pipe the trades as non-price forming items through SEFs / MTFs. For example, CapitaLab passes its risk compression executions to its affiliated SEF – BGC.

Increased Uncleared Notional Outstanding (applies to 3, 4 and 5)

The uncleared trades proposed are new trades which offset existing portfolio counterparty risk. Firstly, this means that uncleared notional will increase – increasing the uncleared % of notional outstanding. Careful communication will no doubt be required among market participants, trade associations and regulators to put this increase in the context that counterparty risk and therefore systemic risk is truly being reduced. Secondly, uncleared bank leverage will increase (worsening leverage ratios). There is hope that this effect can be kept in check via two approaches:

- Use of IMM dates to maximize line-item compression: Risk and line-item compression vendors are arranging for risk offset / replacement trades to use IMM dates to maximize subsequent ease of line-item compression (reducing notional outstanding again). The hope is that line-item compression be applied to uncleared portfolios as well – IMM date only compression may even be doable by counterparty pairs on their own without third party utilities.

- Implementation of SACCR: SACCR replaces the more punitive CEM for US banks in 2020 and non-US banks soon after that. PFE netting within asset class and maturity bucket is more risk sensitive than the current net to gross ratio under CEM resulting in lower calculated leverage.

SIMM portfolio eligibility (applies to 3, 4 and 5)

In order to reduce SIMM portfolio delta risk and IM, the offsetting trades need to be subject to uncleared margin rules (UMR) – i.e. not FX forwards – and free of a clearing mandate – i.e. not vanilla fixed float IRS or index CDS. The Risk article linked above outlines the solution – “synthetic swaps”.

A synthetic swap consists of a pair of put and call options whose underlying and cash flows are the same as the swap we would have executed but for the fact that it cannot be traded in the SIMM portfolio. Vega is eliminated from the synthetic swap by setting put and call strikes to be equal (along with the other economics of the underlying). This leaves delta risk and cash flows equal to the underlying swap. The examples are:

- IR delta: synthetic fixed float IRS = a pair of put and call IR swaptions = an IR swaption collar

- Credit delta: synthetic index CDS = a pair of put and call CDX swaptions = a CDX swaption collar

- FX delta: synthetic FX forward = a pair of put and call FX options = an FX option collar

Note: for FX delta in particular, there is a further approach – NDFs. Though available to clear, NDFs are subject to UMR and not clearing mandated. NDFs by nature don’t have a deliverable FX pair and this is a factor in making the choice between synthetic forward and NDF.

Conclusion

For UMR, there are now a richer set of counterparty risk reduction approaches available than a few years ago.

Some of these approaches are already being used while others are still evolving or maturing.

It is not obvious from publicly available data how much of each approach is taking place. However, we have our eyes peeled for data that shows volumes and other characteristics of one or more of the approaches.

Going forward I will also be on the look-out for answers to the following two questions:

- which of these approaches would suit smaller banks and buy side firms, and

- where is the balance between new trade clearing and these complementary approaches.

Any comments, questions or feedback, please let us know or add a comment below.