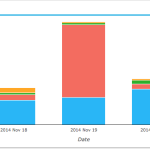

EUR IR Swaps: Huge Spikes in Volumes

The advantage of a dashboard view is that it can quickly highlight interesting information. Looking at the SDRView Res dashboard this morning, I was surprised to see the following: Showing massive EUR IRSwap volumes on 19-Nov and 21-Nov, which were larger than USD volume on those days! Very strange as this never happens. Remember in SDRView […]

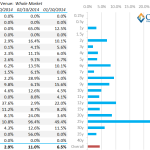

CFTC Block and Cap Sizes

Aka “Everything you wanted to know about Block and Cap sizes but were afraid didn’t know who to ask.” Since the inception of SDR trade reporting took hold, there has been a concept of capped trade sizes. The general idea being that transparency is good, but too much transparency can be damaging. The CFTC understood […]

What I learned at SEFCON 5

I had my doubts about SEFCON 5. I had even told one of the sponsors weeks in advance, tongue in cheek, “SEF’s are live and ticking, what’s there to talk about?” I knew better, and I indeed learned a few things. I’ll detail a few of the hot topics. Many of these came up multiple […]

AUD Swap Market

Having blogged for a good few months now, it becomes second nature to look for different lines of analysis within the major markets that we haven’t yet covered. As a result, we find new ways of developing the existing products and adding to the layers of data. However, always searching for that something new can lead us […]

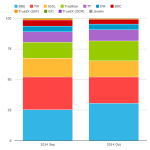

Butterflies and Spreads SEF Market Share

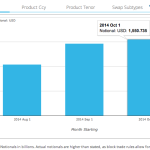

History in the making….. October 2014 was another record month for volumes traded on-SEF. Following on from Amir’s blog, we can see that October on-SEF USD IRS volumes hit a record, breaking $1.5trn for the first time: DV01! Using a new version of SDRView Researcher for USD Swaps, we can also run these numbers in […]

October Volumes in Interest Rate Swaps

Now that all October data is in, I wanted to update my blog of Oct21, Record Volumes on SEFs in September and October. USD IRS ON SEF VOLUMES Lets start with a chart from SDRView Res. Which shows that as we expected October volumes are higher with greater than $1.55 trillion versus $1.46 trillion […]

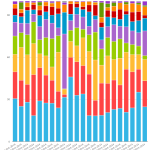

Market Share in the Swaps Market

Interest Rate trading volumes are going up and up – October 14th last week saw nearly 2.5 times the Average Daily Volume trading when compared to the past year. As volumes move higher, it is important to appreciate where those volumes are coming from and what it means for your business. As a result, we […]

Record Volumes On SEFs in September and October

Recent weeks and months have seen record volumes traded On SEFs, so I wanted to update my July Blog; A Six Month Review of Swap Volumes. USD IRS On SEF Volumes Lets start with On SEF USD IRS plain vanilla volumes by month in SDRView Res. Which shows that: September was a record month […]

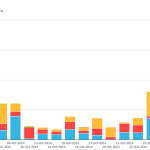

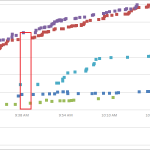

Swaps and the Flash Crash 15th October 2014

Did SEFs Survive the Crash? Yesterday’s events reminded everyone, everywhere of what trading in ‘08 and ‘09 was like. And yet Swaps trading has changed completely since then. In theory, we should now see continuous trading across SEFs with a degree of liquidity constantly available. The market conditions yesterday were the first real test of […]

Mechanics and Definitions of Spread and Butterfly Swap Packages

(a.k.a. Spreads and Butterflies Part Zero) Interest Rate Swap markets are jargon-heavy. Traders live and breathe the language. Professional investors pick-up the nuances over time and the vicious circle of incomprehensibility is complete. However, now that Swaps markets have transitioned to electronic trading, will we see market-standard terms adopted across asset-classes? As a result, will […]