Regular readers of this blog will know that we are strong proponents of Central Clearing and since 2013 have written numerous articles on this topic for OTC Derivatives in Interest Rate, Credit and Foreign Exchange.

In the past year or two, there has been increasing attention on central clearing for Bonds and Repos, so it is with great interest that I read a recent a Bank of England Staff Working Paper (No 1026) titled, “The potential impact of broader central clearing on dealer balance sheet capacity: a case study of UK gilt and gilt repo markets.”

It is full of interesting analysis and data, so well worth a read. At thirty-three pages, it does take some time, so in today’s blog I wanted to highlight what I found interesting. However given my selection bias, I would encourage you to read the full working paper available here, after reading this blog.

Clearing in Government Bond Markets

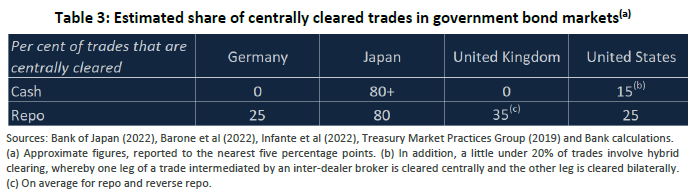

Let’s starting with data given in the paper on the current extent of clearing in government bond markets.

Showing:

- No clearing in Cash (Gov Bonds) in Germany and the United Kingdom

- Japan with the vast majority of Cash & Repo trades cleared (>80%) at Japan Securities Clearing Corporation (JSCC)

- United States, with 15% of UST (plus 20% of hybrid, see b above) and 25% of Repo at the Fixed Income Clearing Corporation (FICC)

- Germany and United Kingdom with 25% and 35% of Repo cleared, at Eurex, LCH SA and LCH Ltd.

Establihing the current state, which is certainly a far cry from the @ 95% levels we see in Interest Rate and Credit Derivatives.

Liquidity Deterioration in a Crisis

Section 1 of the paper covers episodes of signficant liquidity deterioration in Bond and Repo markets:

- September 2019, a spike in US money market unsecured and secured funding rates, with the Federal Reserve NY conducting overnight repo operations to alleviate pressure

- March 2020, the Covid-19 pandemic, a flight to safety followed by a dash for cash as manifested in forced selling even in the most liquid government bonds, with liquidity supply constrained by the ability or willingness of dealers to intermediate due to balance sheet constraints

- October 2022, the UK LDI funds stress event, which we covered in a series of blogs (see here).

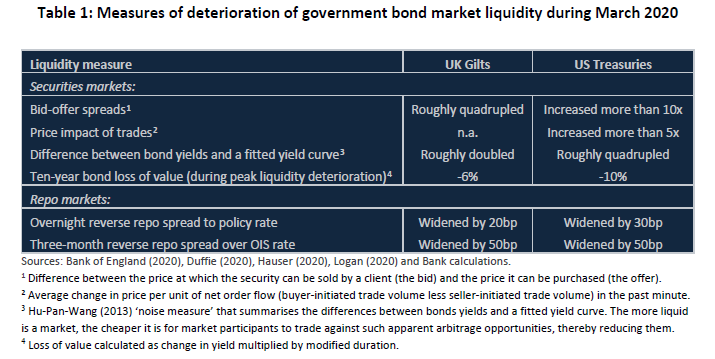

For the March 2020 crisis, an interesting table is presented.

Showing the massive widening of spreads, price impact of trades and yield changes.

This section then explains that the three episodes have many similarties and reflect the vulnerabilities that have grown since the Great Financial Crisis of 2007-08, namely:

- The growth of investment vehicles where the demand for liquidity can surge as a result of liquidity mismatches or leverage (fixed income open-ended funds, hedge funds)

- Increased margin requirements for derivatives (larger margin calls, requiring higher liquidity)

- Assets warehoused by securities dealers have hardly grown in the 2008-2020 period, while government bond markets hace grown much faster

And that policy makers have been working in three areas to reduce such vulnerabilities:

- Work to increase the resilience of non-banks to future liquidity shocks by dampening surges in liquidity demand of certain institutions

- Enhance market intermediation capacity, by considering ways to enhance dealers capacity to intermediate in a way that does not reduce their resilience. More use of central clearing is one of the approaches in this.

- Design of central bank tools to address market dysfunction including making them available to a broader range of market participants, while ensuring they remain as backstops and do not encourage new risk taking.

More use of central clearing is the focus of the paper, with the hypothesis that this can the mitigate liquidity deterioration observed in market episodes.

Noteworthy is the fact that in September 2022, the Securities and Exchange Commission (SEC) proposed rule changes to mandate and faciliate additional clearing of UST and repo transactions (see here).

In addition, in October 2022, the Financial Stability Board (FSB) recomended countries to explore ways to increase the use of central clearing in government bond and repo markets (see here).

Central Clearing, Netting and Counterparty Credit Risk

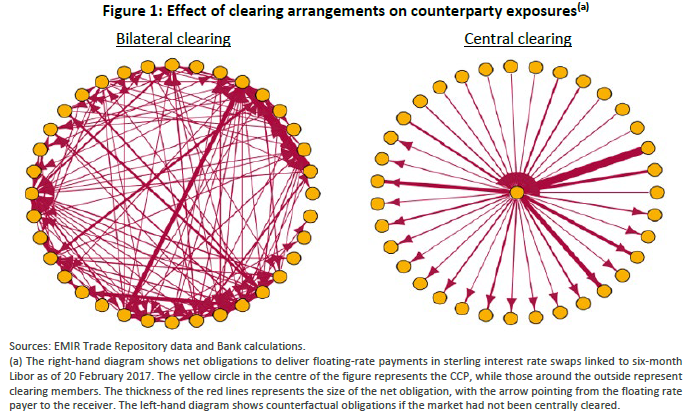

Section 2 starts with a diagram, which in a myriad of forms, all readers of this blog should be familiar with.

The massive reduction in settlement obligations that netting and central clearing provides over bi-lateral.

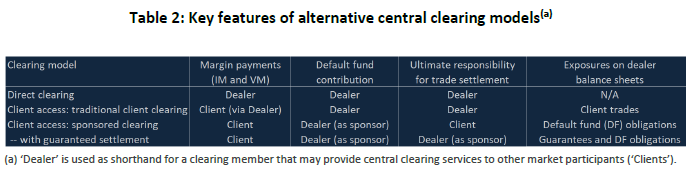

Followed by a nice table summarisng features of central clearing models, which is important in considering wider adoption.

Effect of expanding Gilt Clearing on Dealer Balance Sheets

Section 3 presents a quantitative analysis of netting benefits for dealers with more central clearing in the gilt market. The quantification resting primarily on capital and leverage ratio, anther topic that we have covered multiple times (see here).

Central clearing with it’s multi-lateral netting massively reduces settlement obligations, which in turn reduce credit risk capital and leverage ratio metrics.

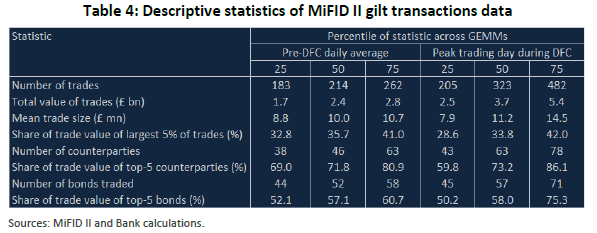

Using MiFID II data on gilt transactions reported to regulators by market makers (GEMMs) , with the following descriptive statistics:

Showing the number of trades, value, size and share of counterparties.

The analysis then leads to a quantification of the reduction in Total Leverage Exposure from reduced settlement obligations under central clearing, for both a pre-Crisis period and for the peak-day in the Crisis (March 10, 2020).

Showing for each anonymous market maker and aggregate, the possible reduction in Leverage Exposure, both pre-crisis (PC) and peak-day (PD). In aggregate, this is 34 basis points of Leverage Exposure pre-crisis or 67 basis point on peak-day. Importantly central clearing would have reduced the surge between the pre-crises average and peak-day from 55 bps to 23 bps of LEM (difference in height of solid orange bars).

There follows a detailed section on balance sheet, which delves into accounting treatment, so for the sake of brevity, I will skip that. Suffice to state that it says that had Basel III rules been in place at the time of March 2020, they would have had the same effect as comprehensive central clearing.

Effect of expanding Gilt Repo Clearing on Dealer Balance Sheets

Section 4 follows the structure of the prior section but for Repo.

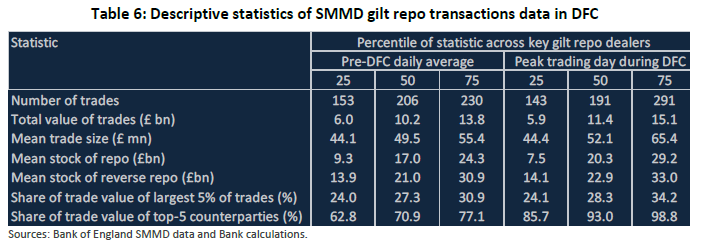

The Bank of England’s Sterling Money Market Daily (SMMD) data collection of transaction level reporting showing the number of trades, value, size and share of counterparties.

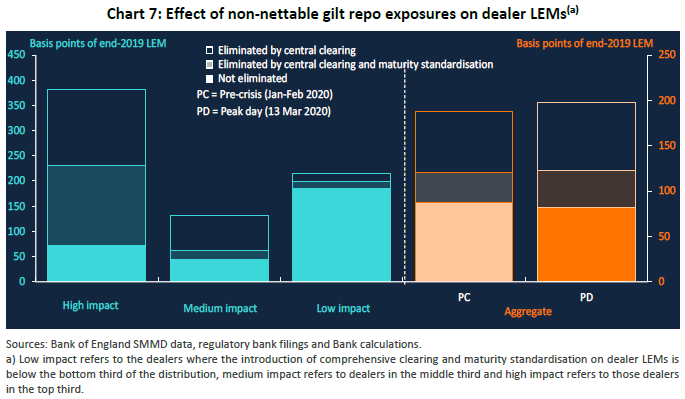

And then a quantification of balance sheet impact.

Central clearing could have reduced the impact by 70 basis points on an average pre-crisis trading day or by 75 basis points during the DFC, a reduction of 37-38% (heights of the top parts of orange bars).

There follows a discussion on standarisation of repo and reverse repo maturity dates, which range from overnight to 1-year, which would further increase netting and free up balance sheet.

An overall reduction of 5.8 basis point in the Leverage Ratio from central clearing and standardisation of dates is detailed, with a discussion culminating with the statement that while this may seem relatively small compared to total buffers, this extra capacity could be material in the capacaity of the repo desk.

Potential Benefits and Costs

Section 5 is a discussion on potential benefits and costs, most of which have been evidenced in other products such as Interest Rate Swaps or Credit Default Swaps.

Benefits

- Enhanced dealer intermediation capacity

- Reduction of settlement obligations and fails

- Reduction of counterpary risk (VM, IM, DF), more for Repo as minimal in Bonds due to DVP

- Standardisation of terms (contracts, haircuts)

- Buy-side and All-to-All trading

Costs

- Other constraints on dealers may be the limiting factor on intermediation

- Risks for CCPs in the expansion, on credit and liquidity risk

- Margin requirements, increasing cost and liquidity needs

- Concentration risk in a small number of dealers

- Impact on dealer business models

Conclusion

The paper concludes with a two-page summary, which I would highly recommend you read, in addition to the abstract of course (see here). My (selective) summary follows:

- Policy interest in central clearing of bonds and repos has grown.

- Episodes of dysfunctional markets and constrained dealer intermediation is the catalyst.

- More central clearing could help by reducing impacts on dealers balance sheets and capital.

- An estimate of the reduction in leverage exposure and boost to leverage ratio is quantified.

- In Repo markets there is a material gain, which could lead to more intermediation capacity in non-stress and stressed times.

- In Bond markets, with Basel III adoption, central clearing would no longer impact leverage ratios.

- So while reduction in settlement obligations for Bonds is welcome, it is unlikely to boost intermediation capacity.

- Central clearing has other potential benefits and costs, as evidenced in a number of markets.

- Ongoing policy work remains to be completed.

We plan to cover this topic more in future.

In the meantime, please read Staff Working Paper No 1026.

Hi Amir, when bonds are hedged with XCY Swaps, clearing of bonds and clearing of notionals of the XCY Swaps should be linked and lead to a Delivery vs. Clearing, with no matter whether it’s centralized clearing or any near clear Service. kind regards

Armin

Good point