CME recently made a change to its margin model for interest rate swaps, see CME Advisory. This explains that on Aug 25, 2014, the model changed to use shifted log returns from log returns. The link in the advisory further states that “data for each currency will be shifted by 4% before computing log returns …..and reflects a robust, long term approach that yields more desirable outcomes in both low and high interest rate environments”.

Further that “another artefact of this change is that the margins between pay fixed and receive fixed would become less asymmetric”.

It is this last statement that really interested me and this article will investigate the detail of this.

Before the Change

Lets start with looking at the situation before the change, by entering into USD Par Swaps, first a 2Y 150m and second a 5Y 100m, for execution date of 22 August 2014.

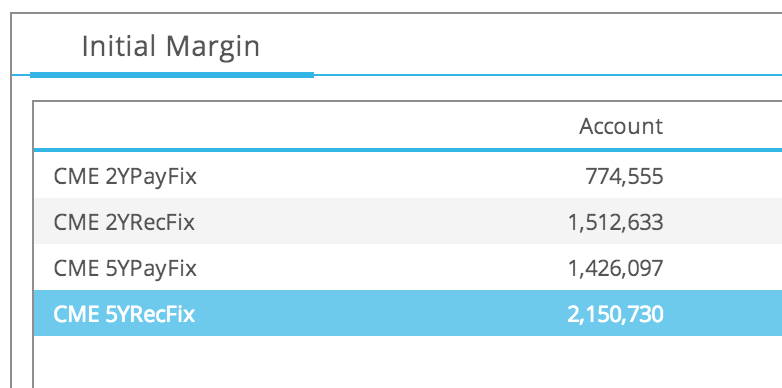

Using CHARM we can determine the Initial Margin on the 22 Aug for both paying fixed and receiving fixed.

From which we can observe:

- 2Y Pay Fix IM of $775k is almost half the 2Y Rec Fix IM of $1.5m!

- 5Y Pay Fix IM of $1.4m is two thirds the 5Y Rec Fix IM of $2.15m!

Both results seem surprising, so lets look at the distribution of Historical Simulation PL results, which determine the IM, to understand why.

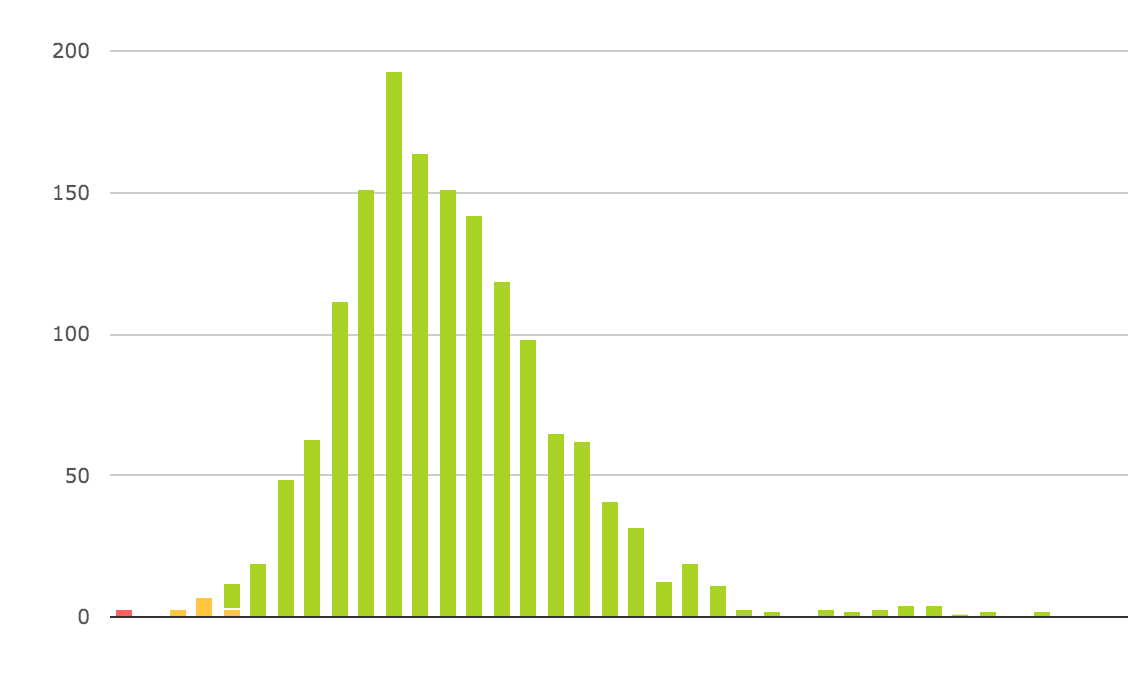

First the 2Y Pay Fix:

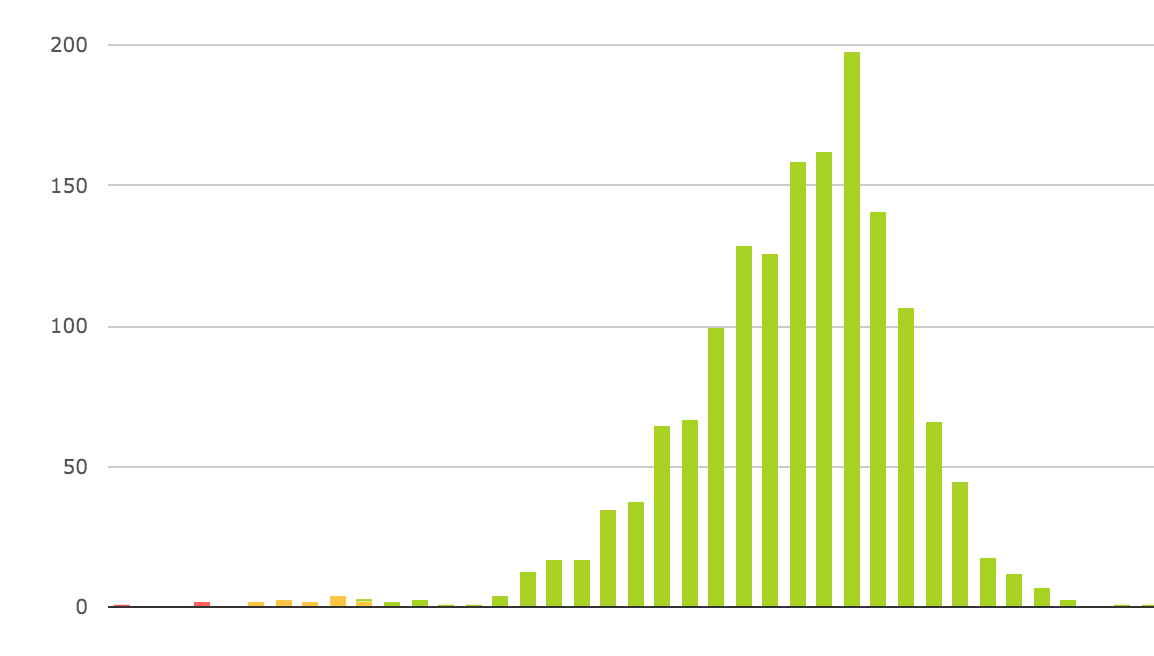

Then the 2Y Rec Fix:

From which can observe:

- Both distributions are heavily skewed

- The Pay Fix distribution has a long tail to the right, on the profit side.

- While the Rec Fix distribution has a long tail to the left, on the loss side.

- As IM is a loss measure, it is the left tail that is important.

- And for CME 99.7% confidence level it is the fourth and fifth largest loss scenarios that determine IM

- These IM Scenarios are much further to the left (more negative) for the Rec Fix

- Explaining why the Rec Fixed IM is much higher than the Pay Fix

We know that a Rec Fix Swap will lose money when interest rates rise. This fact and the above skew implies that the CME historical dataset contains larger positive shock scenarios than negative shock scenarios.

In-fact were we to drill-down in CHARM we would see that for the Pay Fix trade, the IM is determined by the fourth and fifth largest 2Y scenarios that are -23 bps, while for the Rec Fix trade trade the fourth and fifth largest 2Y scenarios are +46 bps. Explaining why the margin is half for the former.

Our intuition would then be that either the historical period (the past 5 and a half years), has more and larger 5-day moves on the upside versus the downside for 2Y or that some large down moves are being discarded from the sample because of the zero floor constraint (negative forwards).

After the Change

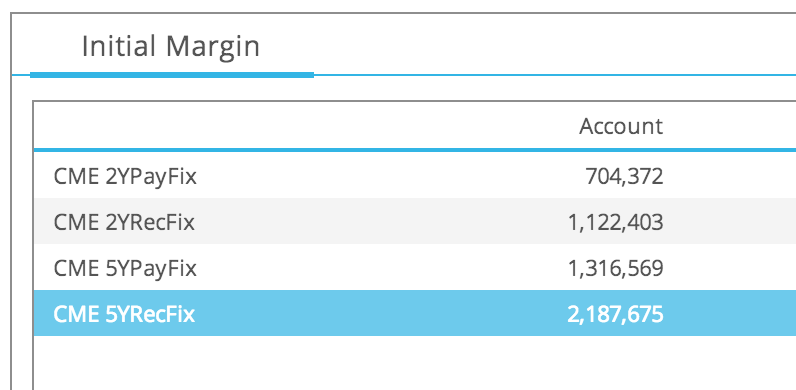

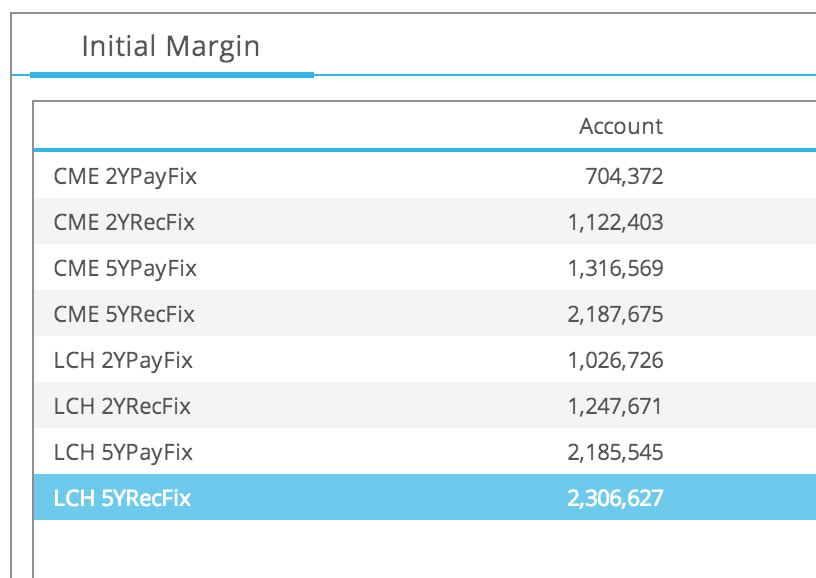

Lets now enter new trades on 26 August with the same characteristics and use CHARM to calculate the IM on 26 August, the day after the CME change went live.

Which shows:

- 2Y PayFix is similar to before $700k vs $775k

- Drill-down shows that the IM Scenarios (4&5) are now -21 bps instead of -23 bps

- 2Y RecFix is now $1.1m vs 1.5m, so 73% of what it was

- Drill-down shows that IM Scenarios (4&5) are now +35 bps instead of +46 bps

- 2Y PayFix at $700k is now 63% of RecFix, instead of 50%

- 5Y IMs are not materially different from before

So at least for the 2Y, we can agree with the CME statement that pay fix and rec fix are less asymmetric after the change.

The fact that 5Y asymmetry is un-changed gives us a clue into what is happening. As 2Y rates are much lower than 5Y rates, it is much more likely that large down scenarios are hitting the zero floor for 2Y than for 5Y, such scenarios are then being capped reducing the size of down moves and resulting in the some of the asymmetry. This effect is reduced with the change to using shifted log returns with a 4% shift.

However the fact that asymmetry remains is an artefact of the the historical market moves in the past 5 and a half years.

LCH Margin

A good way to understand this is to use CHARM to run both CME and LCH margin for the same trades.

Which shows that:

- For Rec Fix Swaps the CME and LCH margins are similar

- LCH are 5% to 10% higher

- Most likely due to LCH using absolute scenarios while CME uses relative scenarios

- However for Pay Fix LCH does not show the same asymmetry as CME

- Pay Fix or Rec Fix has similar IM at LCH

- Pay Fix being 80% to 90% of Rec Fix at LCH

- Compared to 60% at CME

Our intuition would then be that as LCH uses a 10 year historical window (as well as absolute scenarios) versus a 5.5 year window (and relative scenarios) at CME, this longer time period contains a more even distribution of up and down moves.

Some thoughts

Symmetry is a desirable property in any risk measure including Initial Margin. While the asymmetry between paying fixed and receiving fixed at CME has been reduced with this change, it is still very significant and markedly so when compared to LCH.

Such asymmetry can lead to a bias in risk with potentially unforeseen and undesirable consequences.

The fact that it is much cheaper in IM terms to pay fix at CME than to receive fix and much cheaper to pay fix at CME than to pay fixed at LCH, means that firms will naturally tend to prefer to pay fix at CME.

For market participants that have a preference to pay fix (e.g. Mortgage Banks) or those participants that can chose to clear on CME or LCH (e.g. large clients), there is a bias for them to want their trades to be cleared on CME and not LCH.

As Swap Dealers are on the opposite side of this trade, they would be receiving fixed and so suffer the higher CME margin. Meaning that they would expect to be compensated for this by either offering a worse price for a CME Cleared Swap vs an LCH Cleared one or by other means such as fees.

We might even hazard a guess that one of the reasons for CME gaining market share in US Client Clearing over LCH is due to the lower margin requirement for paying fixed at CME.

Summary

CME recently introduced a change to its margin model for IRS.

This introduces a shifted log returns method designed for more robust results in high and low rate environments.

One benefit of this change is to reduce the asymmetric margin between paying fixed and receiving fixed.

We test the before and after model and find this is indeed true for 2Y USD Swaps but not for 5Y Swaps.

A significant asymmetry remains in USD Swaps.

Meaning that paying fixed at CME is much cheaper in IM terms than receiving fixed.

The LCH margin model does not suffer anywhere near as much from this asymmetry.

Asymmetry in a risk measure is undesirable and likely to cause bias in behaviour.

It may or may not be a factor in explaining the gain in CME market share in client clearing.

We expect that in future an increase in margin for paying fixed in USD at CME will be required to reduce this asymmetry.