- What role can credit derivatives play in ESG-themed trading strategies?

As we continue to explore the ever-expanding world of ESG-linked derivatives, we look at primary market issuance in 2021 and the links with the CDS market.

Introduction

There are many “beginner guides” to ESG out there. Of the many we’ve trawled through, I suggest checking out the Bond Vigilantes post below:

Looking at ESG from a Fixed Income/Derivatives perspective, I think the best summary I have seen comes from that blog. A simple picture says it all for me:

The left hand side of this chart has been booming in 2021. Bloomberg report that 30% of investment grade public sector issuance proceeds have so far been linked to ESG-linked projects!

That is quite some statistic, and has seemingly come from nowhere. Let’s see what these two sides of the coin may mean for credit derivative markets.

Anyone for ESG CDS?

Starting on the left-hand side of the graphic, I assume it is complex to create a CDS contract that references only the ESG-linked bonds of an issuer. How would that work in the event of default? Could issuers really only default on their non-ESG projects? Seems far-fetched to me.

However, that doesn’t cover another use of CDS – to express a view on credit spreads. It could surely be the case that ESG-linked bonds perform differently to “vanilla” credit. Whether that be due to investor demand or the deemed success of ESG-linked projects themselves, it doesn’t matter. It remains the case that ESG-linked bonds may perform better/worse than their vanilla brethren, even for the same issuer.

You can see the use case for “ESG-specific CDS” from a promoting-ESG aspect as well. ESG projects tend to be capital intensive as they involve creating new infrastructure. These projects therefore involve raising debt, which implies leverage. Raising more debt could lead to a negative impact on an issuers credit rating. Is that really the dynamic we are looking for here? Issuers should be rewarded for investing in ESG projects.

iTraxx MSCI ESG Screened Europe CDS

Whilst we wait for financial engineers to come up with something that addresses the left hand side of the ESG chart, we can at least let the existing ESG CDS index step into the limelight. Introducing the not-so-snappily titled iTraxx MSCI ESG Screened Europe CDS.

Introduced in the middle of 2020, not only did IHS Markit launch the ESG CDS Index, but LCH CDSClear also started to clear it in September 2020!

The Index screens the companies themselves according to the below:

- Value-based screen – excludes all companies involved in weapons, gambling, nuclear, alcohol etc.

- Controversy screen – excludes all companies with an MSCI ESG Controversy score of 0.

- ESG ratings screen – excludes all companies of BBB and below on the MSCI ESG Rating scale.

This leads to an Index that is screened on the companies themselves, as opposed to the bonds it covers. It would therefore sit at a higher level than the diagram previously presented, covering all types of bonds issued by a screened company.

It’s not ideal, but all markets have to start somewhere…

ESG CDS Volumes

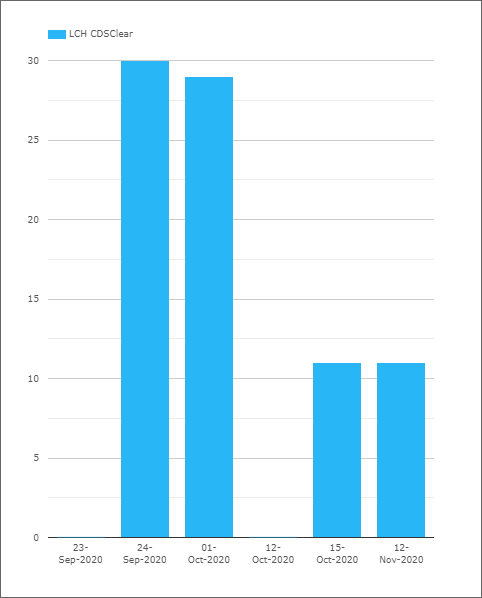

Needless to day, I went straight to CCPView to find the volumes that have so far traded versus this ESG Index:

Showing;

- There have been five days with activity so far. The largest day saw a notional of $30m equivalent.

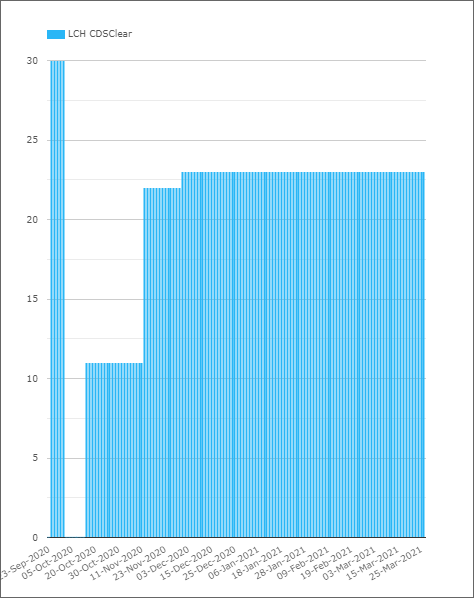

- The next chart shows the open interest. This shows that those first two trades were likely “test trades” as the OI subsequently dropped to zero. However, the other trades have been kept on:

I’m not sure anyone would consider an Open Interest of $23m a rip-roaring success, so I guess this one is off to a slow start.

Why has the uptake of this particular ESG-linked product in the derivatives space been slow? The FT reported on some volumes back in August:

The fact it is now clearable doesn’t seem to have done much to change that. The FT article mentions that custom baskets are more commonly used to express “ESG views”, but of course custom baskets don’t really speak strongly for standardisation in this space.

I would probably go back to the first diagram (again!) and highlight that CDS on ESG-linked issuance is probably what the market needs but doesn’t know it is looking for yet!

Sustainability-Linked Bonds

On what I consider to be a more fundamental level, there are also Fixed Income products that put ESG-linked targets into the pay-off profile. This feels to me like a really strong proposition:

- It creates observable risk factors.

- The risk factors can then be “traded” through either the purchase or sale of bonds linked to specific risk factors.

- It links financial performance directly to ESG targets.

Sustainability-linked bonds may be considered something specific to only direct carbon-emitting industries, such as this issue from a paper mill. But I think that takes too narrow a view of ESG. What about:

- Gender targets. Anyone employing more than 50% men pay 25 basis points more per X% of their work-force that is below the 50% target.

- Gender pay-gap: similar pay-off but based on volume-weighted total remuneration per gender.

- ESG-linked issuance: 25 basis point penalties if less than 25% of issuance each year is not going toward ESG-compliant projects.

Etc etc. The idea here is to create standardised, recognisable risk factors in the primary issuance space. These can then be targeted and traded. It creates benefits for both the investor community and the issuers themselves. It also creates a direct link between ESG themes and financial markets.

Just be aware that some investors may end up wishing for the worst when yields are really low!

In Summary

- Primary issuance of ESG-linked debt is booming in 2021.

- That brings with it a somewhat existential question for credit derivatives markets.

- Should CDS be used solely as a default tool, or is there space to recognise its utility as a thematic tool?

- For ESG-themed CDS, rather than targeting particular issuers, it would be helpful if credit derivatives could identify specific ESG-linked issuance.

- We do at least have the first ESG-linked CDS Index to trade. Volumes have been very small so far.