A couple weeks ago, we released an article about the evolving infrastructure in the OTC derivatives industry to support Bitcoin, with the conclusion that much of the plumbing was coming together for institutional sized investment. In industry parlance, this involves swaps, SEF’s, DCO’s, custodians and liquidity providers.

Futures products, probably the most readily understood derivative, was only a side-note. We mentioned CBOE’s vague plans for a Bitcoin future some time in 2018, but I didn’t have much confidence, given the lack of details provided at the time. I did do some thorough googling at the time, but only press releases and murmurings.

Fast forward 2 days (a long time in the world of Crypto), and CME announced their plans for a Bitcoin future, theirs launching “by the second week of December” according to Terry Duffy, CME CEO. They seem to believe they will beat CBOE Futures Exchange (CFE) to the game.

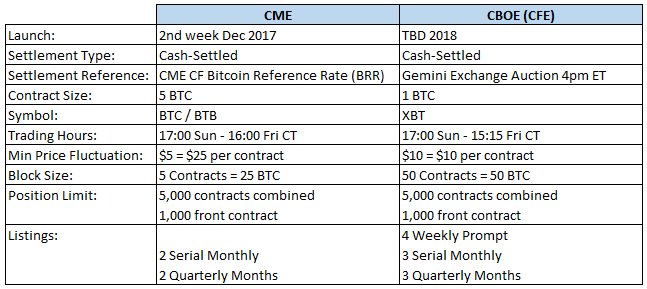

I was glad to see contract specs for both futures are now available online, both CME’s, and CFE’s. So we’re well past the press release stage for both of these products. I decided to do a brief comparison.

Comparing Bitcoin Futures

I put together the following table on key metrics:

Let’s step through some of the noteworthy points here:

- CME’s contract is 5 BTC, CFE’s is 1 BTC.

- Minimum price fluctuations are quite large. If I read these correctly, the tick size will be in $5 increments at CME ($25 per contract), and $10 at CFE. This seems crazy large for something with bid/offers on physical exchanges of a penny. As a comparison, the CME Comex Gold (GC) contracts are 100 ounces, with 10 cent price increments, meaning the price increment for each contract is $10 (compared to BTC of $25). Though at current market rates, GC contracts are 100x$1280 = $128,000, compared to the CME contract of 5x$6800 = $34,000. So the BTC tick sizes are 2.5x larger than GC, even though the notional lot size is ¼ that of GC. Doesn’t seem right.

- Block sizes on the other hand, seem crazy small, 25 BTC at CME. I presume EFRP’s will be available, meaning you can trade off-exchange (OTC) and convert it to a futures position, as long as you trade above this limit. So that equates to only ~$160,000 worth.

- Both are cash settled. CME reference their own reference rate (BRR) and CFE reference the Winklevoss brothers’ Gemini daily auction.

- CME BRR uses a daily 3-4pm Ldn time VWAP (slightly more complex) from 4 constituent physical bitcoin exchanges (currently Bitstamp, Coinbase’s GDAX, itBit, and Kraken).

- Gemini uses a twice-daily physical auction by institutional participants. 4pm NY and 7pm Singapore.

Both approaches to determining a settlement price are open to argument. A multi-exchange VWAP might be hard to replicate/hedge against. And if you go not-so-far-back in Bitcoin history, there were cases of exchange-specific liquidity issues that led to price disparity on the order of 10-20% between exchanges (no sellers at troubled Mt Gox). Lastly, the Gemini auction seems to be a bit thin on some days; there are a few recent days where the auction consisted of 0.05 to 0.10 BTC, so a few thousand dollars in an auction could move the fixing price of (presumably) billions of dollars in derivatives?

Both approaches to determining a settlement price are open to argument. A multi-exchange VWAP might be hard to replicate/hedge against. And if you go not-so-far-back in Bitcoin history, there were cases of exchange-specific liquidity issues that led to price disparity on the order of 10-20% between exchanges (no sellers at troubled Mt Gox). Lastly, the Gemini auction seems to be a bit thin on some days; there are a few recent days where the auction consisted of 0.05 to 0.10 BTC, so a few thousand dollars in an auction could move the fixing price of (presumably) billions of dollars in derivatives?

Price Limits & Margin

Once interesting characteristic of a futures exchange is the concept of price limits, where circuit breakers can halt trading. CME has stated there will be a few price limit bands, with a 20% increase/decrease stopping trading until the next session.

While Bitcoin has certainly had its days of +/- 20% movements, the upshot of this is that the brokers and exchanges can have some certainty around the amount of margin.

Speaking of which, neither exchange/clearinghouse are publishing the margin rates for these futures, so we are not yet able to use our Microservices to compute these costs. But the estimates seem to be in the 25-30% range. So, above the circuit breaker level.

What this means for investors, is that to gain exposure to 5 BTC, you can trade on a physical exchange which means:

- At todays prices, fork over 5x$6800= $34,000

- Secure the bitcoin, meaning:

- Leave it on the exchange, which is riddled in history with bad results / credit risk

- Transfer to a wallet you control (not “easy” for the common investor)

- Employ some custodian to handle your coins

Or, you can trade the future and fork over just ~$10,000 and trust the same broker that handles your S&P futures. That is, unless your broker is JP Morgan, because Jamie Dimon would fire the employee who handles Bitcoin.

Summary

The bitcoin space is moving quickly. It wasn’t only 2 weeks ago we proclaimed progress in OTC derivatives, and now we have a fairly certain, imminent, launch of futures.

I should note that both CME and CFE products seem to be pending regulatory approvals. But it seems futures will readily beat any ETF’s to the game.

Watch this space.

http://www.hl.co.uk/shares/shares-search-results/x/xbt-provider-ab-bitcoin-tracker-eur – There is already a bitcoin ETF