Following on from my article on the Trading Obligation For Derivatives under MiFIR, I wanted to look at more recent documents released by ESMA for MiFID II and MiFIR and found a briefing note released on 12 Jan 2017, titled “MiFID II technical data reporting requirements“.

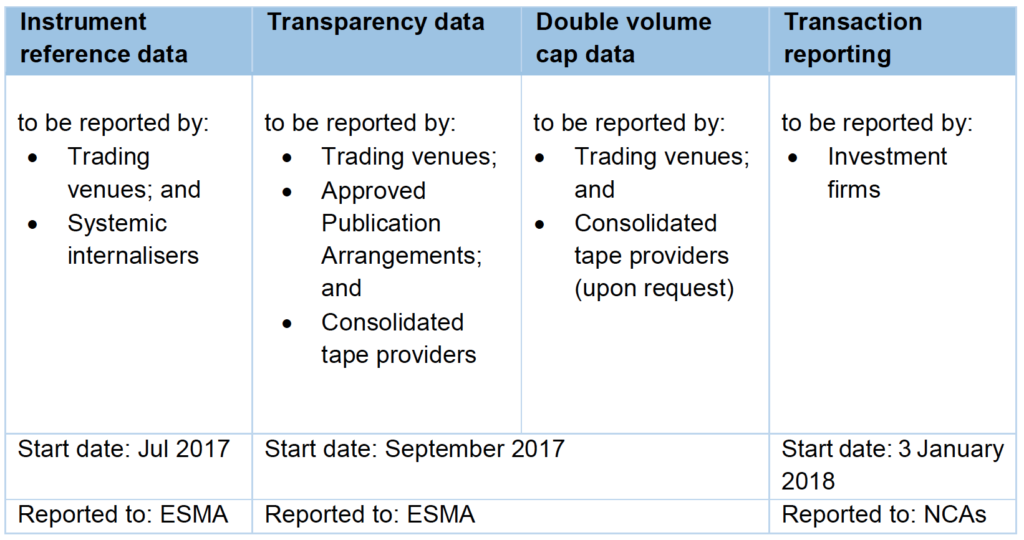

It starts with the following table:

Interesting.

Lets look today at Instrument Reference Data, which has the earliest start date of July 2017.

Reference Data Requirements

The requirements of Article 27 of MiFIR, Article 4 of MAR and related technical standards oblige Trading Venues and Systematic Internalisers to submit reference data for the relevant financial instruments to national competent authorities (NCAs) who will subsequently transmit it to ESMA for publication on its website.

Very interesting.

Now to review the accompanying 106 page document titled, “Reporting Instructions FIRDS Reference Data System”, which is available here for those of you who like to go direct to the source, for others please read on.

FIRDS System

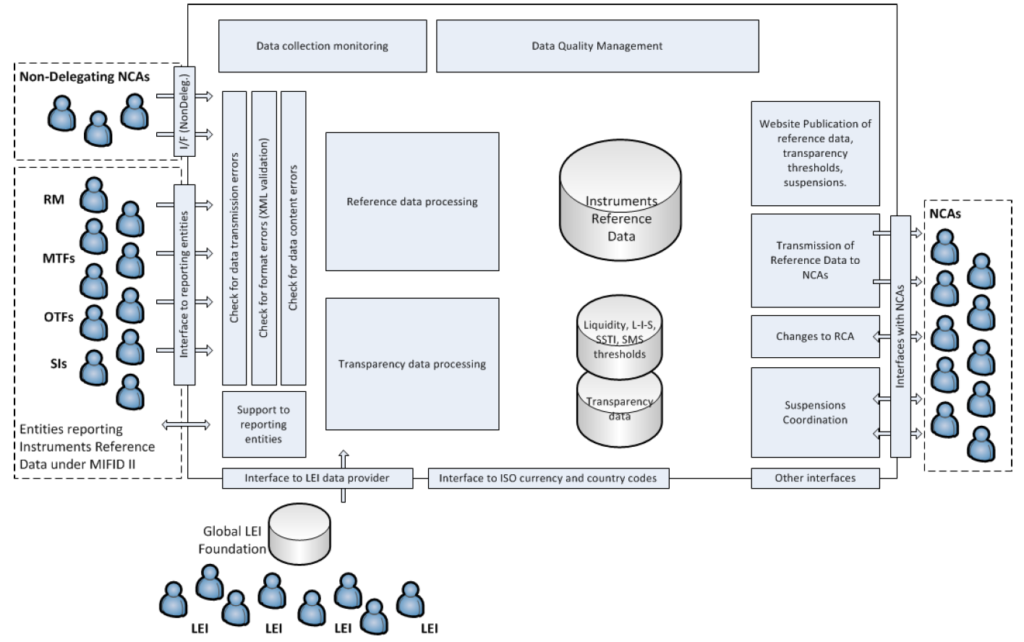

ESMA has developed and is currently operating a Reference Data System, which covers requirements for reference data collection and publication, collection and processing of additional data to support the MiFIR transparency regime and suspensions’ coordination, as shown in the following diagram.

As per regulatory requirements,

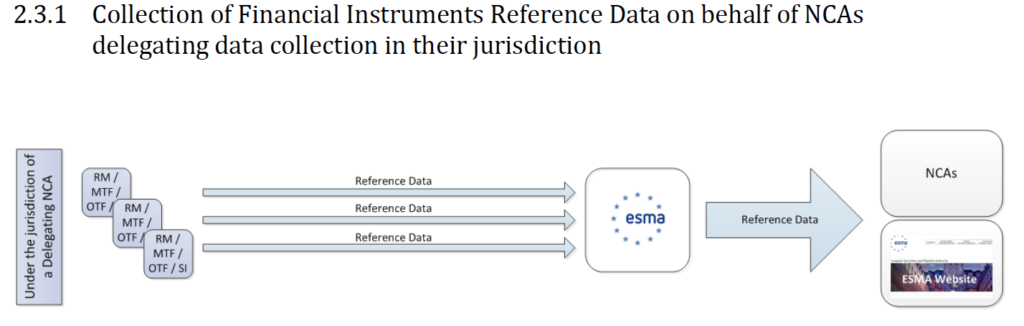

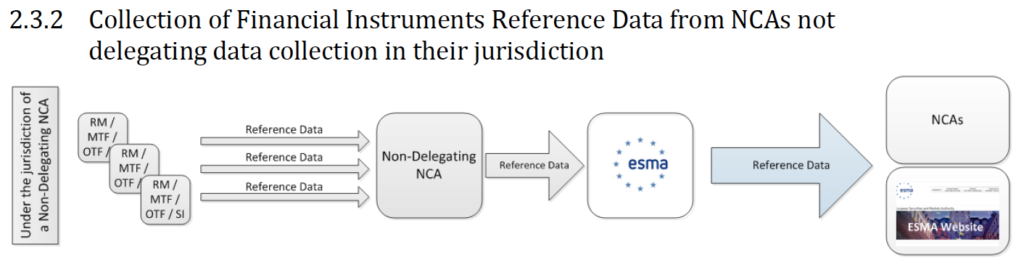

- Trading Venues/Systematic Internalisers provide reference data to a National Competent Authority (NCA);

- Competent Authorities provide that information to ESMA;

- ESMA publishes that information on its website for public access and to NCAs as downloadable files.

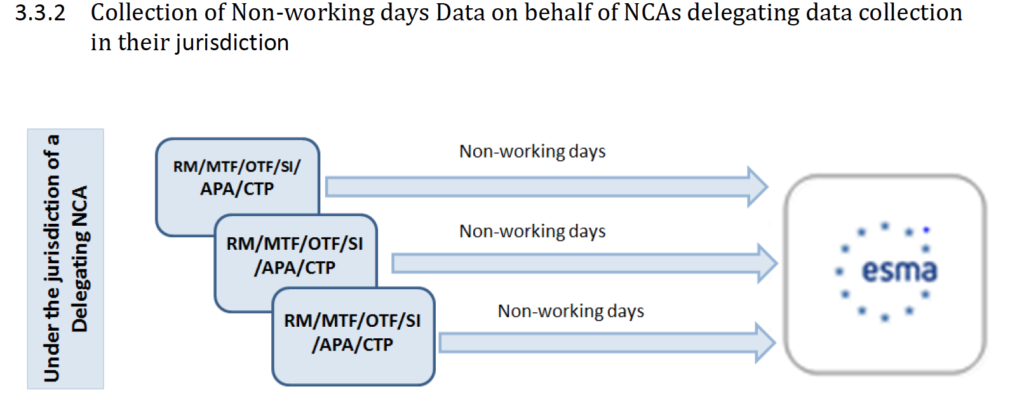

Some National Competent Authorities have delegated to ESMA the tasks of collecting data directly from Trading Venues and Systematic Internalisers on their behalf.

The FIRDS System requires reference data to be sent by TVs, SIs and NCAs using a standardised ISO 20022 XML format, which it processes, applies quality checks and stores in a central database.

Upload Interface

Each day, by 21:00 CET, a TV/SI is required to send instrument reference data files for:

- all instruments admitted to trading on Regulated Markets (RM) that are still valid or for which a request for admission to trading has been made;

- all instruments traded on a MTF or OTF, including where orders or quotes were placed between 18:00 CET on the previous day and 18:00 CET on that day on that MTF or OTF;

- all instruments traded on a Systematic Internaliser including where orders or quotes were placed between 18:00 CET on the previous day and 18:00 CET on that day on that Systematic Internaliser where the underlying: (i) is a financial instrument traded on a trading venue, (ii) is an index or a basket composed of financial instruments traded on a trading venue.

Timings for NCAs are a little complex, generally between 21:00 CET and 23:59 CET, see the page 12 of the “Reporting Instructions FIRDS Reference Data System” document.

Download Interface

This interface is used by National Competent Authorities (NCAs) to retrieve files of which there are four types available:

- Full reference data file, the full reference data received from NCAs, RMs, MTFs, OTFs and SIs before the applicable previous cut-off time, for all instruments that are still valid and that have been admitted to trading on RMs, including where a request for admission to trading has been made, or that are traded on a MTF, OTF, or SI.

- Delta reference data file, containing all differences between the current day full file and the previous day full file, listing instruments additions, terminations, modifications and instruments terminated but reported late.

- Invalid records reference data file, which contains all records that are not part of the full file anymore. This includes instruments that are no longer valid, as well as out-of-date versions of records that have been modified over time.

- Feedback files, which provide the NCAs, TVs, SIs with feedback on the reference data they sent to ESMA as well as reminders.

XML Format

The “Reporting Instructions FIRDS Reference Data System” document specifies the XML format using XML Schemas (XSD) and these may be downloaded as zip files from the ESMA website.

As these formats are meant for machine-consumption and not human-consumption, I shan’t try and summarise them here.

However we do need to know what instrument reference data fields are being collected and made available.

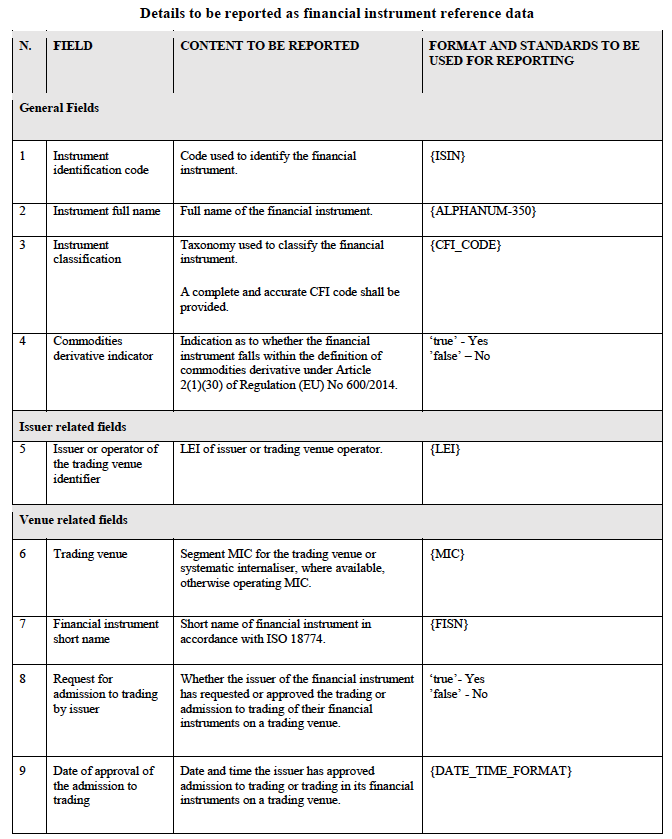

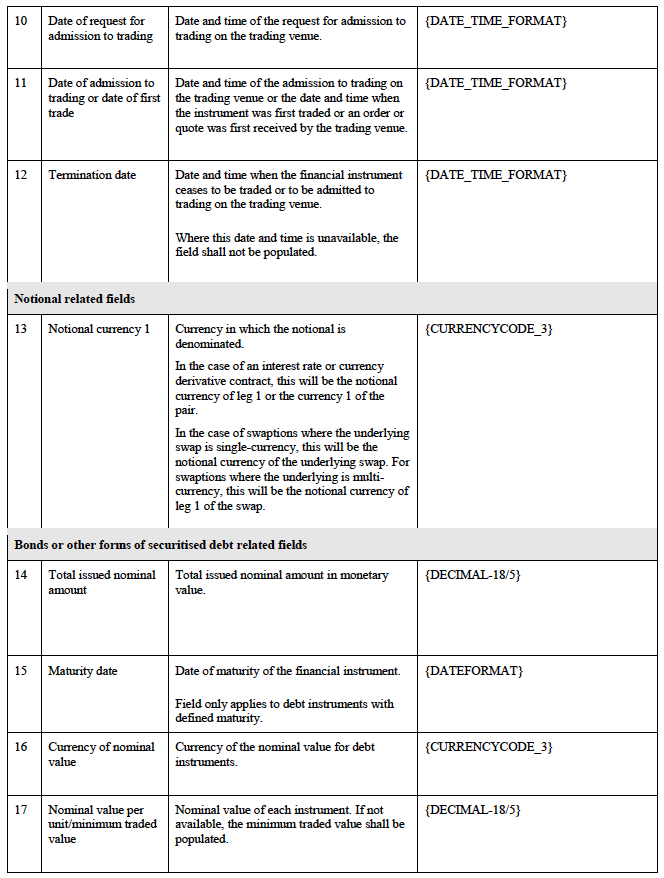

For that it is easiest to turn to Annex I of the RTS document and page 460 for RTS 23.

Table 3 of RTS 23

General Fields

Important fields in this section are:

- Instrument code, ISIN

- Instrument full name

- Instrument classification, ISO 10962 CFI Code

- Issuer LEI, in ISO 17442

- Trading Venue, MIC in ISO 10383

- Instrument short name, FISN code in ISO 18774

- Currency of notional

Bond fields

Important fields in this section are:

- Total issued amount

- Maturity date

- Currency

- Fixed rate

- FRN – Index and Term

- Spread for an FRN

- Seniority of the Bond

So all very helpful reference data for Bond instruments.

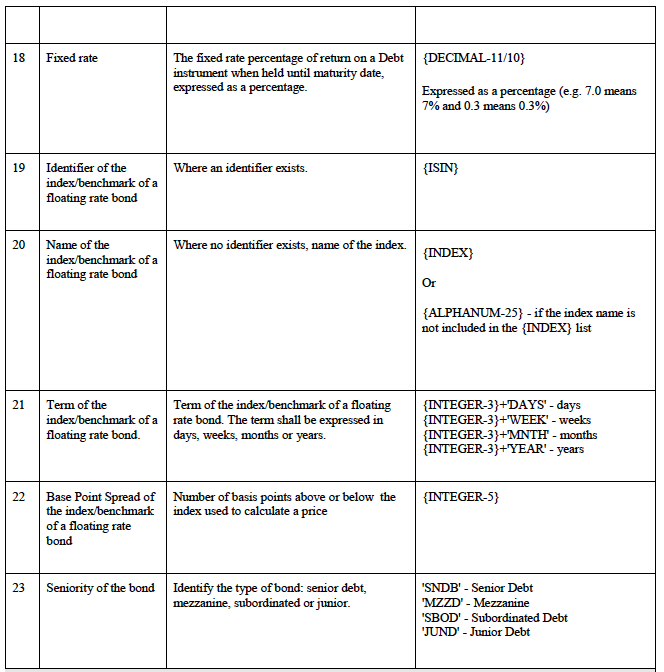

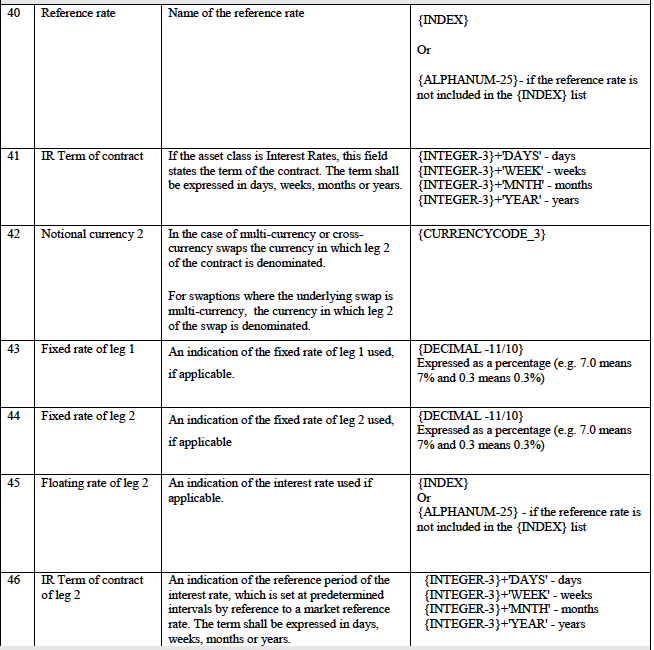

For Interest Rate Derivatives, the following is given in Table 3.

Showing:

- Reference rate e.g. LIBOR

- Term e.g. 5Y

- Currency 2, for Cross-Currency Swaps

- Fixed rate, if applicable

- Floating rate

- Term of the reference rate e.g. 3 Month

All good except Fixed rate looks odd here!

Surely the intention is not for every Swap trade, where the price of the trade (analogous to the price a bond is bought or sold at) is the fixed rate of the Swap, to be a distinct ISIN. That would require far too many new ISINs every day and ones that were regularly needing to be deleted.

Lets assume for sanity’s sake that Fixed rate is left blank for standard vanilla swaps that trade on TVs.

Before we end, there is one last section in the document.

Non-Working Days Data

A Trading Venue (TV), Systematic Internaliser (SI), National Competent Authority (NCA), Approved Publication Arrangement (APA), Consolidated Tape Provider (CTP) has to report to ESMA the full list of its non-working days.

Presumably this holiday data will also be made available by ESMA to NCAs and on its website.

Summary

In July 2017, ESMA will start collecting instrument reference data.

This will be provided each day by Trading Venues and Systemic Internalisers.

Either direct to ESMA or via their National Competent Authority (NCA).

ESMA will make this data available to NCAs.

ESMA will also publish this data on its website.

For Bonds the instrument reference data will be very useful.

In a future blog I will look at the Transparency data collection and publication.