- Brexit has moved over $4Trn in derivatives out of UK/European execution venues and onto US SEFs.

- Interdealer volumes in EUR and GBP products executed on US SEFs have increased by ~10 times in 2021.

- This is a consequence of certain products subject to a Trading Obligation in Europe (and the UK) executing on US registered SEF platforms.

- Clearing behaviour has not changed at all.

Brexit was essentially a “no-deal” trade agreement for the UK financial services industry. There have been some articles in the FT and Risk, plus a recent data analysis from Markit describing the impact of Brexit on trading behaviour. The Markit analysis is well worth a read. By means of introduction, I will borrow part of the Markit article and state that the “no-deal”:

[L]eft many firms with conflicting and incompatible DTOs in the EU and the UK without equivalence (albeit based on identical rules) and no apparent option other than to trade the relevant derivatives on a US Swap Execution Facility (SEF), or in Singapore.

20 January 2021 by Kirston Winters, Managing Director − MarkitSERV, IHS Markit

We’ve not seen any useful charts to go with the data, so here are five charts that shows what has and hasn’t happened since Brexit:

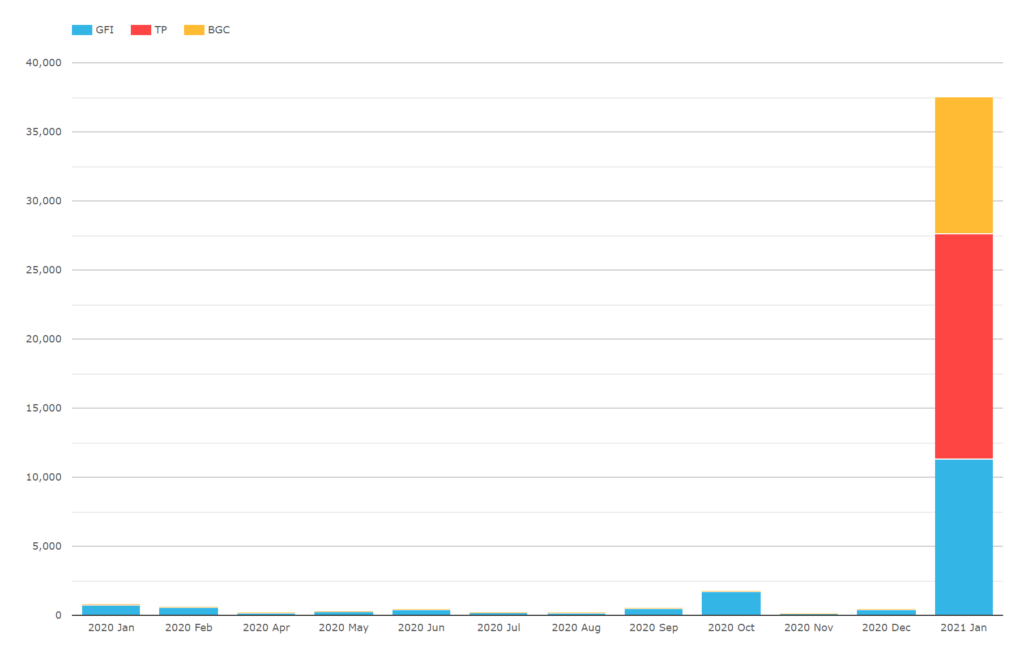

SEFs have started trading European CDX

Showing;

- EUR denominated CDX activity on D2D SEFs since January last year.

- GFI did have some tiny volumes (up to $1.7bn in a month) last year.

- However, since Brexit, volumes have mushroomed on GFI, TP and BGC interdealer SEFs.

- $37.5bn notional has traded so far this year.

- TP has traded the largest share, at $16bn.

- All of this volume comes from the iTraxxEurope indices:

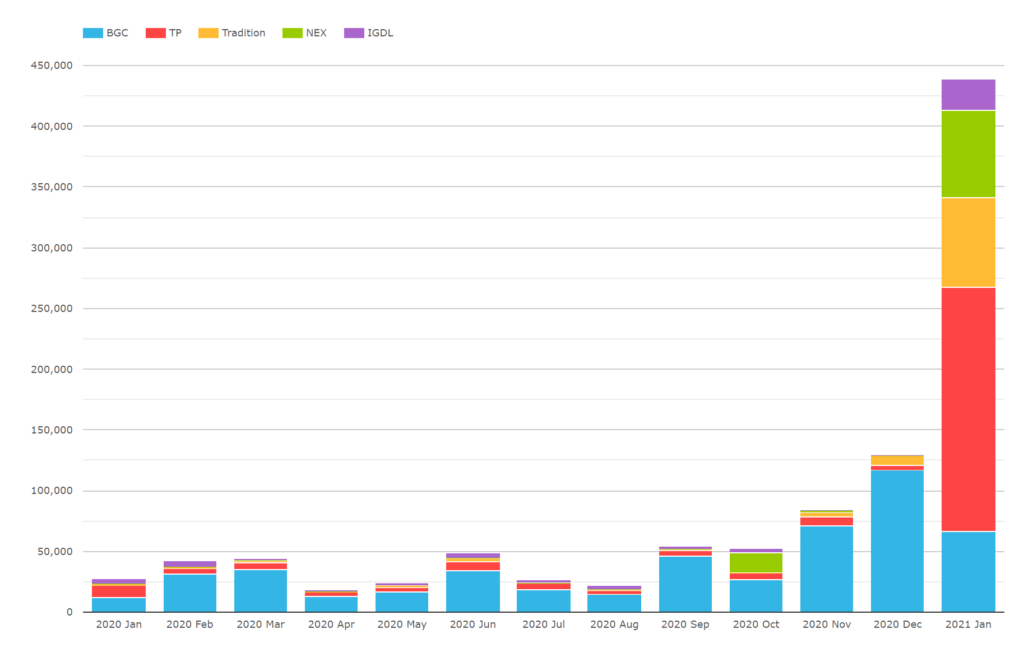

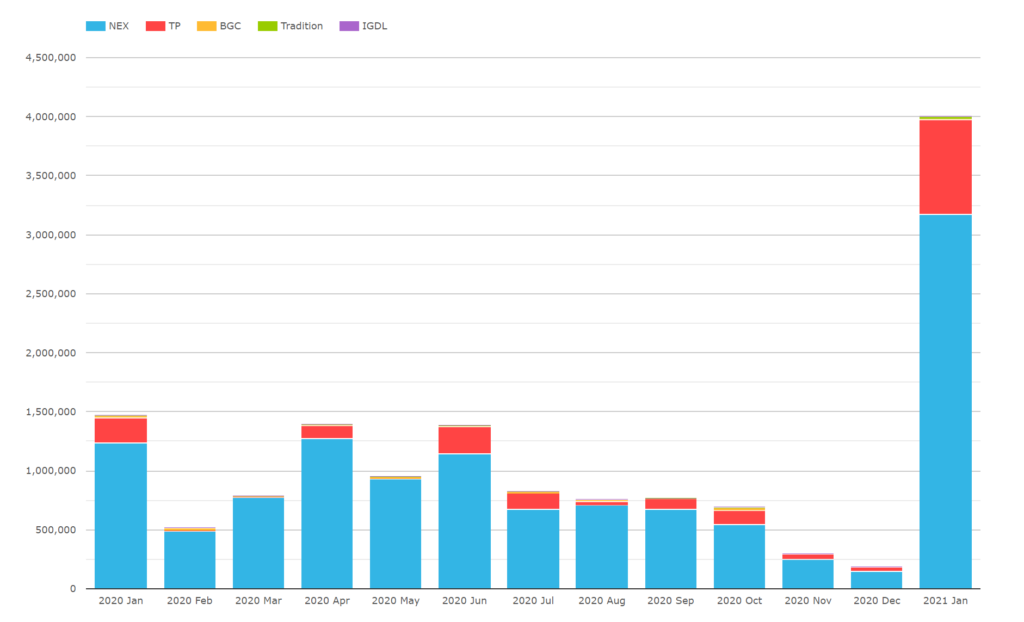

EUR and GBP IRS Trade on-SEF

Showing;

- A huge jump in the notional amounts of EUR and GBP vanilla IRS being transacted on SEFs. The SEFs benefitting are all interdealer venues.

- Monthly volumes are well on their way to trading over $500bn in a single month. This is about ten times the monthly volumes we saw in 2020.

A couple of interesting notes here:

- The split between EUR and GBP currencies is roughly as expected. $180bn in GBP plays $260bn in EUR.

- This excludes the D2C SEFs (Bloomberg and Tradeweb) who have not seen a change in behaviour (so far as the data shows).

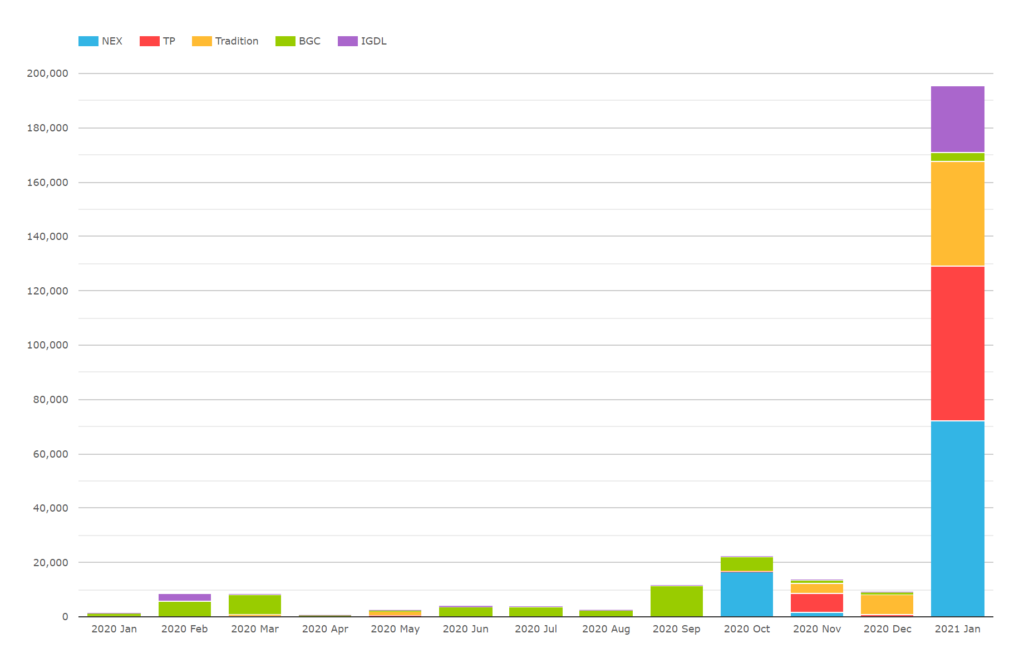

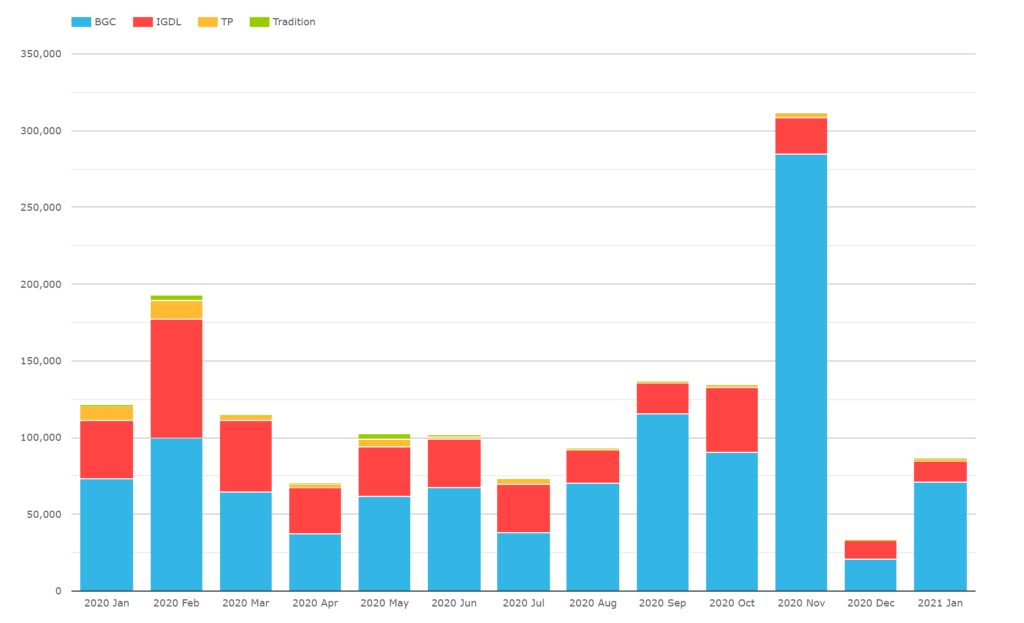

EUR and GBP SPS Are Taking-Off

Some of this increase in volume on-SEF in IRS alone can be put down to the move away from FRAs (which are “toxic” from a LIBOR fallback perspective). Instead of FRAs, there are now systematically reported Single Period Swaps (SPS) being transacted on-SEF. These can be easily shown by looking at the explosion in volumes of short-dated IRS reported on-SEF in EUR and GBP IRS:

Showing

- On-SEF transacted volumes of just 1M-1Y tenors in EUR and GBP.

- SPS have now started to trade! Please see our blog on GBP Toxic FRAs for more background on this.

This is not the whole story, however. Evidently as a result of Brexit, there are also more FRAs being reported on-SEF this year:

Showing;

- This is not just a LIBOR transition story in terms of short-dated activity.

- It is also a Brexit story. FRAs are now trading on-SEF in EUR and GBP in higher volumes than ever before.

- Over $4trn in EUR and GBP FRAs have already traded this year, up over 10 times compared to the average monthly volume in Q4 last year.

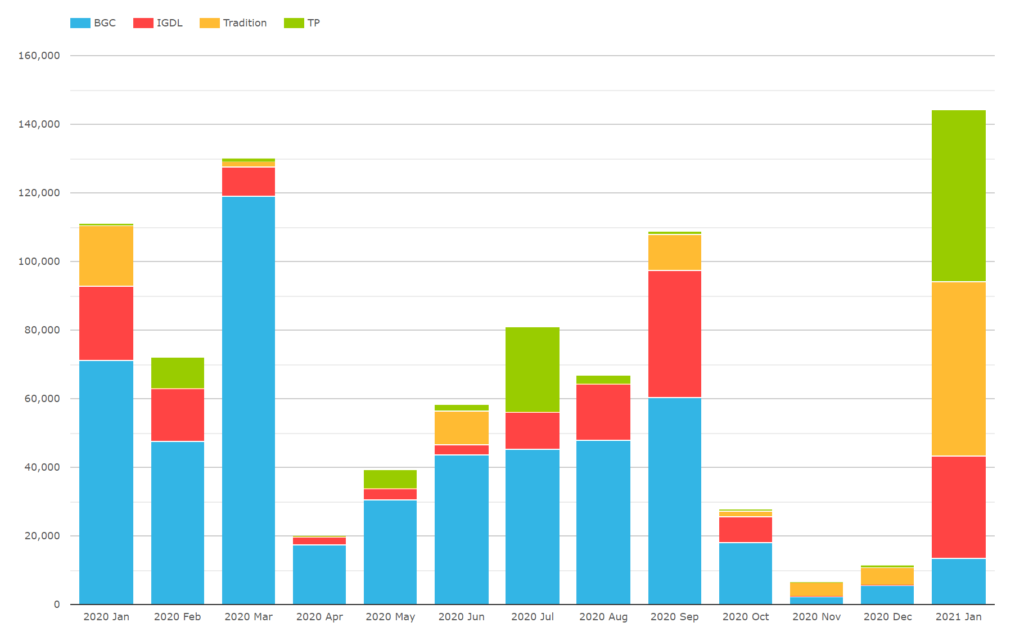

The Brexit Move is Instrument Specific

The move to on-SEF execution has not occurred across the board. For example, there has been no discernible shift in Swaption trading in EUR and GBP markets:

Showing;

- Notional volumes of EUR and GBP Swaptions executed on interdealer SEFs each month.

- There has been no change in monthly volumes in January that we can see.

- We assume the big spike in Swaption volumes on the BGC SEF in November 2020 was the result of a Capitalab optimisation/compression run in these products.

Our working assumption is therefore that instruments subject to the Derivatives Trading Obligation in Europe (and the UK) are the European products that are now being traded on interdealer US SEFs.

This is backed up by the data in EUR and GBP OIS. These are not subject to the DTO either (I think), and we have seen no increase in SEF volumes in these instruments either:

The chart above shows the notional amounts of EUR and GBP OIS swaps transacted each month. It is strange how the market share has completely shifted towards TP and Trads from BGC and IGDL previously. Is that a possible Brexit effect? Doubtful….

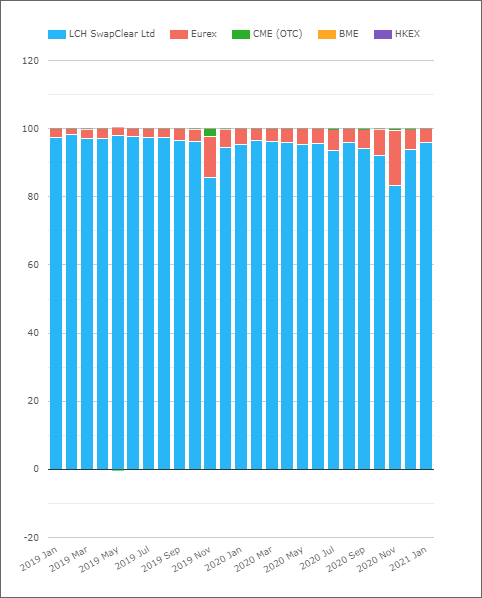

There Has Been No Change in Clearing Behaviour

We cannot talk about the Brexit impact here without mentioning the $77bn elephant in the room. Will EUR swap clearing move “onshore” to Eurex?

So far, the data shows there has been no shift toward onshore EUR clearing in 2021:

Showing;

- The market share of LCH and Eurex in vanilla EUR Interest Rate Swaps.

- This excludes FRAs (which are very short-dated and mainly traded for portfolio maintenance reasons).

- Eurex market share so far in 2021 stands at ~4% in EUR IRS. This is pretty much in line with where it was in the second half of 2020 and doesn’t show any Brexit impacts.

We expect this chart to change over the coming months if EUR participants stop trading FRAs and move to SPS. The FRAs previously reported at Eurex will then be reported as IRS and will increase their market share. We don’t think that is a Brexit effect however. That is an IBOR transition/RFR impact only.

Final Chart

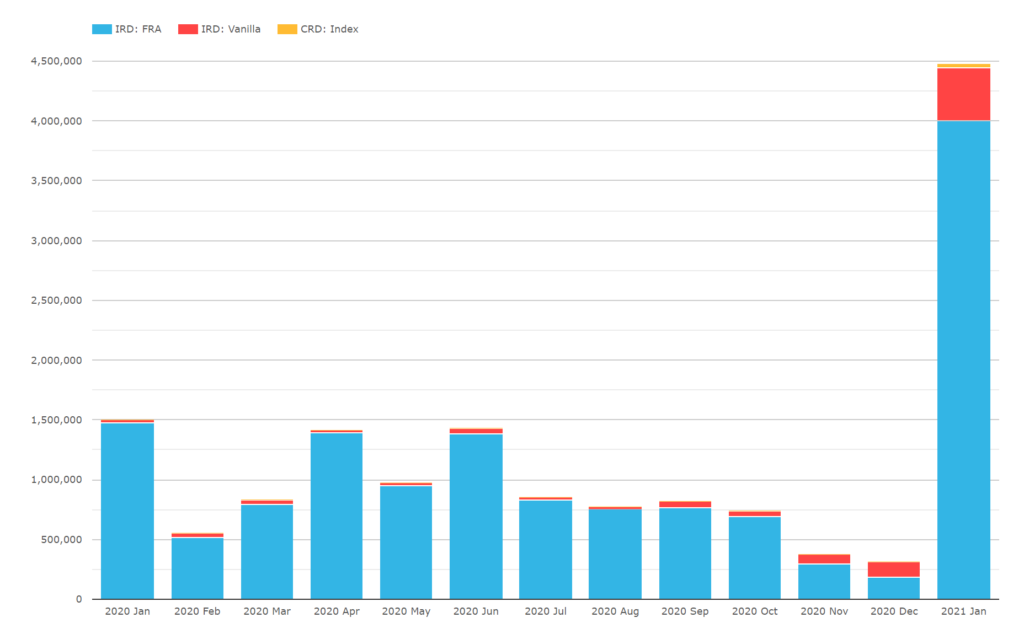

The final chart shows the volume of EUR and GBP products in vanilla IRS, FRAs and CDX Index transacted on Interdealer SEFs so far this year:

I think that says it all! Volumes across these three product classes have increased by ~10 times this year on interdealer SEFs as a result of Brexit. Or put another way:

- Brexit has moved over $4trn in derivatives out of Europe/UK execution venues and onto US SEFs.