We cover SOFR Swaps and other RFRs on a regular basis, so I thought today it would be interesting to see if Swaptions and CapsFloors that reference SOFR are trading.

Swaptions

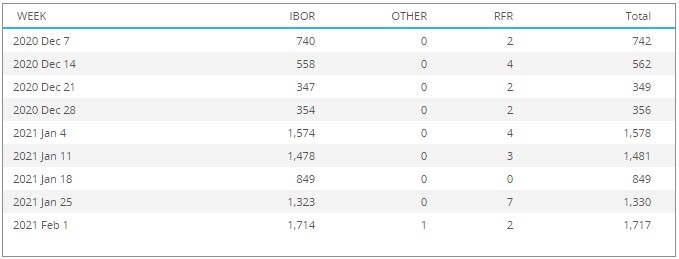

Using SDRView, we can search for Swaptions in USD and categorize by reference index.

- Libor trade counts are in the range 350 to 1,700 trades a week

- The one Other is referencing FedFunds

- While 2 to 4 trades each week reference SOFR, so small but regular

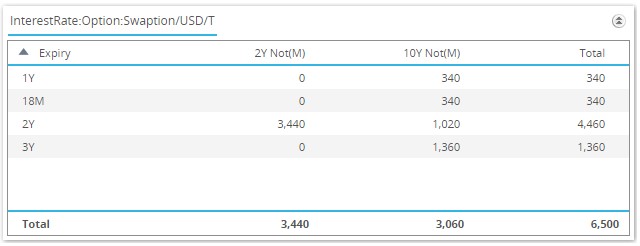

Taking a closer look at the SOFR Swaptions traded between 4 Jan to 5 Feb 2021:

- 2y2y with $3.4 billion notional from 7 trades, all straddles traded on 28-Jan

- 3y10y with $1.36 billion from 4 trades, 3 payers, 1 receivers

- 2y10Y with $1 billion from 3 trades, 2 payers, 1 receivers

- A total gross notional of $6.5 billion, though a number of trades are reported with capped notionals of $170m, $240m or $460m so actual notional will be higher

- All trades Off SEF, except for 3 trades in 2y2y on 28-Jan

- And all reference USD-SOFR-COMPOUND or USD-SOFR-H15

CapsFloors

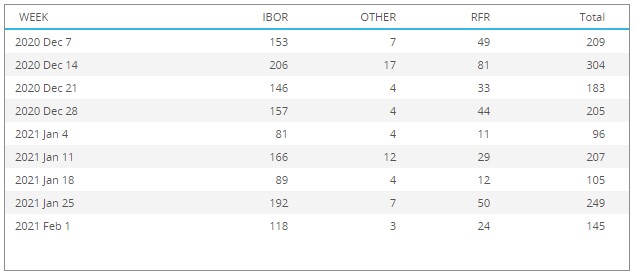

Next in SDRView, lets see if we can find any CapsFloors.

- Libor trade counts are in the range 80 to 200 trades a week

- Other is a mixed bag with CMS Spread, Muni, Prime

- But a surprisingly high number of SOFR trades, 10 to 80 a week

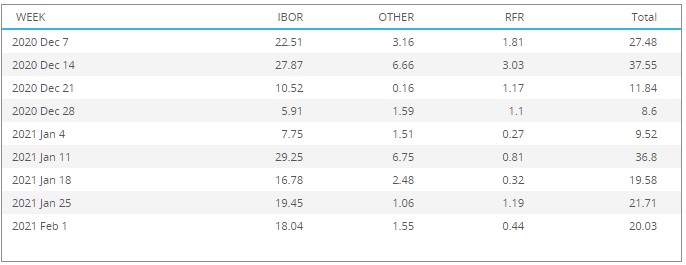

While the number of trades is not far off Libor, switching to gross notional shows that while Libor averages $20 billion a week, SOFR is around $1 billion.

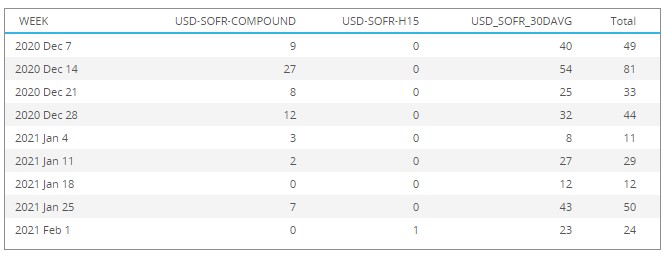

And looking in more detail at just the SOFR CapsFloors.

- The majority of these reference SOFR_30DAVG with 1M caplet periods, which is interesting and I don’t know why that is the case (if you know, please add a comment below or send us an email)

- While less common are those referencing SOFR-COMPOUND, though these are also mostly 1M caplets

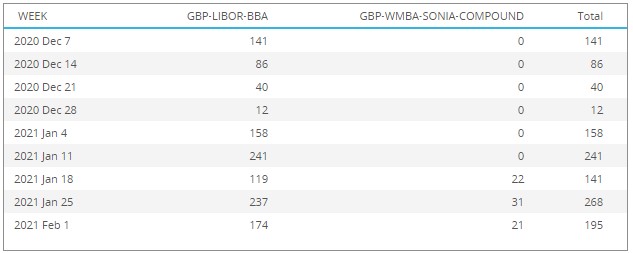

SONIA

And before I end, just out of curiosity, we do see GBP Swaptions and CapsFloors referencing SONIA being reported now to US SDRs, which is great to see and a topic for another day.

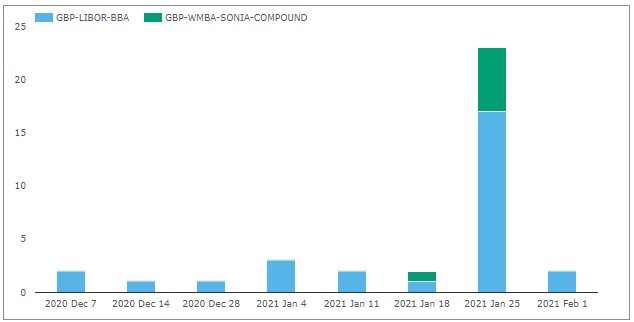

Woops, all tables and no charts, very unusual for our blogs, so might as well do a chart for the GBP CapsFloors one.

No 30-day averaging of the OIS rate in SONIA, so will be interesting to know if the US CapFloor market has picked 30-day SOFR averaging as a standard or if that is a common hedging trade and the OIS will be the standard.

That’s all for today.