Clearing Houses have published their latest CPMI-IOSCO Quantitative Disclosures:

- Initial margin for ETD at $465 billion is down 6% QoQ and down 18% YoY

- Initial margin for IRS at $340 billion is up 9% QoQ (to a record high) and up 26% YoY

- Initial margin for CDS at $69 billion is flat QoQ and up 4% YoY

- 1Q23 saw a lot of market volatility and a number of CCP disclosures with new highs

- Highlighted are B3, CFFEX, CME, DTCC, Eurex Clearing, LCH Clearnet

- Charts and details below

Background

Under the CPMI-IOSCO Public Quantitative Disclosures, CCPs publish over two hundred quantitative data fields covering margin, default resources, credit risk, collateral, liquidity risk, back-testing and more.

CCPView has over 7 years of these quarterly disclosures for 44 Clearing Houses, each with multiple Clearing Services, covering the period from 30 Sep 2015 to 31 Mar 2023. This disclosure data provides insights into trends over time at one CCP and comparisons between CCPs.

Let’s take a look at the latest disclosures.

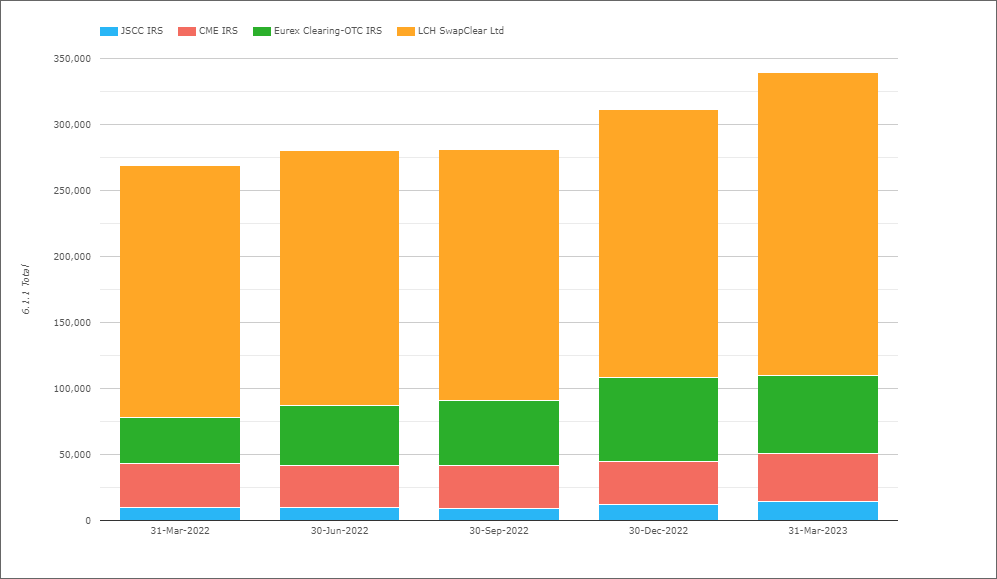

Initial Margin for IRS

- Total IM for these four CCPs was $340 billion on 31-Mar-2023

- Up $28 billion or 9% QoQ and $71 billion or 26% higher YoY

- LCH SwapClear with $229 billion or £185 billion on 31-Mar-2023

- Up 10% QoQ and 27% YoY in GBP terms (Up 13% and 20% in USD terms)

- Eurex OTC IRS with $60 billion or €55 billion

- Down €4 billion or 7% QoQ and Up €24 billion or 77% YoY (in EUR terms)

- CME IRS with $36 billion, Up 9% QoQ and 7% YoY

- JSCC IRS with $14.5 billion or Y1,940 billion, Up 24% QoQ and 62% YoY (in JPY terms).

Total IM for IRS at $340 billion, is a new record high, up from the prior high of $312 billion on 30-Dec-22.

LCH SwapClear increasing $26 billion QoQ is responsible for the majority of the $28 billion increase.

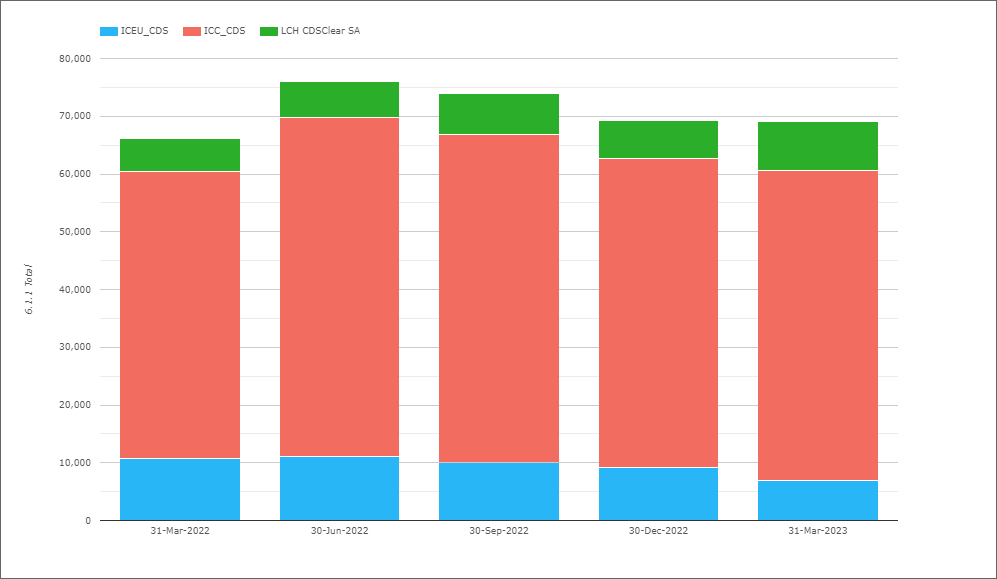

Initial Margin for CDS

- Total IM for these three CCPs was $69 billion on 31-Mar-2022

- Flat QoQ and Up $3 billion or 4% YoY

- ICE Credit Clear with $53.7 billion, flat QoQ and Up 8% YoY

- LCH CDSClear with €7.9 billion, Up 29% QoQ and 54% YoY

- ICE Europe Credit with €6.3 billion, down 27% QoQ and 34% YoY

LCH CDSClear increasing QoQ and YoY, while IM at ICE Europe Credit down but still significant, even though this service will now end in October 2023.

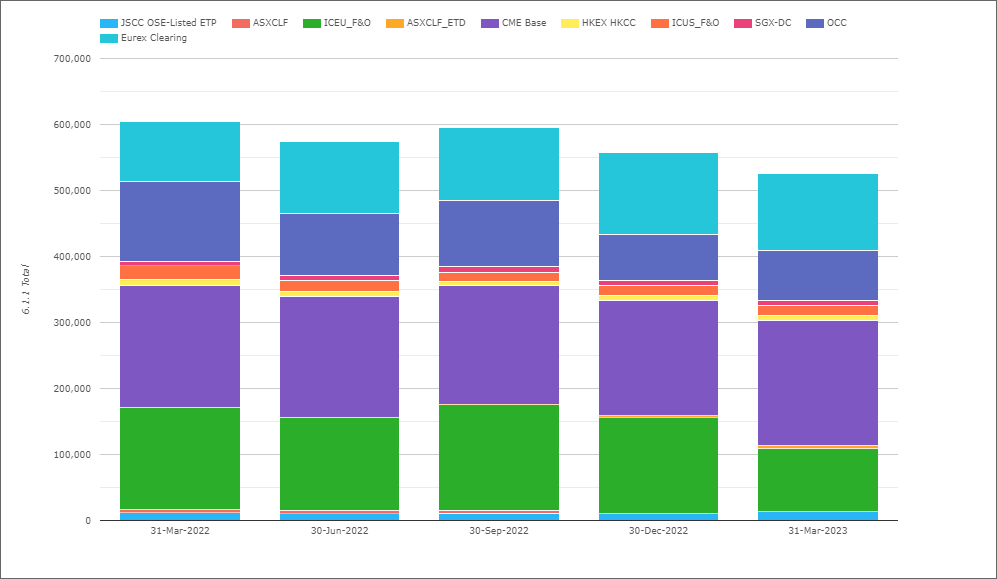

Initial Margin for ETD

- Total IM for these CCPs was $465 billion on 31-Mar-2023

- Down $29b or 6% QoQ and down $105b or 18% YoY

- (Note the chart shows higher totals as Eurex includes OTC IRS IM, which I exclude)

- CME Base with $189 billion, up 9% QoQ and up 2% YoY.

- ICE Europe F&O with $95 billion, down 34% ($50b) QoQ and down 38% ($59b) YoY

- OCC with $75 billion, up 7% QoQ and down 38% ($46b) YoY.

- Eurex with $57 billion, down 7% QoQ and flat YoY.

- ICE US F&O $15.7 billion, up 1.5% QoQ and down 28% YoY.

- JSCC OSE Listed ETP with $14.2 billion, up 36% QoQ and 18% YoY

- HKEX HKCC with $7.7 billion, up 3.5% QoQ and down 7% YoY

- SGX-DC $7.3 billion, flat QoQ and up 6% YoY

- ASX CLF $4.8 billion, up 23% QoQ and down 7% YoY

ICE Europe F&O the largest contributer to the overall IM decrease QoQ and YoY, with a drop of $50b QoQ and $59b respectively, persumably this is due to much lower volatility in European energy markets decreasing IM and possibly also less outstanding positions.

Other Disclosures of Interest

Next let’s do a quick scan of 31-Mar-23 disclosures, highlighting those with significant changes.

Before we do, a quick note to state that the majority of Clearing Houses have moved to a 2-month lag in reporting these disclosures. However a number of CCPs have not yet reported, so are either sticking to the old 3-month lag or have missed the 2-month date. These are AthexClear, BME, CC&G, ECC, EuroCCP, Keler, OMIClear and SIX. If you work at one of these, or at a clearing member, please consider/request moving as soon as possible to publishing 2-months after the quarter end.

Selected Changes:

- B3 (Brasil Bolsa Balcao) – 7.3.1 Estimated largest same-day and where relevant intra-day payment obligation that would be caused by the default of a single particpant in extreme but plausible market conditions was $4.96 billion, a new high, the previous high as $4.1 billion in the quarter ending 30-Sep-2022

- CFFEX (China Financial Futures Exchange) – 6.2.5 Total IM PreHaircut held as Non-Cash Sovereign Government Bonds – Domestic, was $7.5 billion, up from $6.5 billion and the highest on record

- CME Base – 7.3.1 Estimated largest mult-day payment obligation that would be caused by the default of a single particpant in extreme but plausible market conditions was $21.9 billion, a new high and up from $19.4 billion in the prior quarter

- CME Base – 7.3.4 Actual largest USD intraday and multiday payment obligation of a single participant, peak day amount of the previos 12 months was $3.735 billion, up from $3.38 billion in the prior quarter

- DTCC GSD – 4.1.4 Prefunded -Aggregate Participant Contributions Required was $36.7 billion, up from $28.7 billion in the prior quarter and the highest on record

- DTCC GSD – 4.1.5 Prefunded -Aggregate Participant Contributions Post-Haircut Posted was $43.7 billion, up from $3597 billion in the prior quarter and the highest on record

- DTCC GSD – 4.3.1 Cash deposited at a central bank of issue of the currency concerned post haircut was $16.75 billion a new record and up from $13.7billion in the prior quarter

- DTCC GSD – 6.1.1. Total IM required was $36.7 billion, up from $28.7 billion in the prior quarter, also a new high

- DTCC GSD – 6.6.1 Average Total VM paid to the CCP by participants was $5.7 billion, also a new high and up from $4.3 billion

- DTCC NSCC – 7.3.1 Estimated largest same-day and where relevant intra-day and multi-day payment obligation that would be caused by the default of a single particpant in extreme but plausible market conditions was $42.3 billion, a new high, the prior was $40.7 billion in 31-Mar-2021 quarter

- …… moving on from DTCC …..

- Eurex Clearing – 6.7.1 Maximum total variation margin paid to the CCP on any given business day was €15.3 billion, the highest on record and up from €13.3 billion in the prior quarter

- ICE Europe F&O – 6.1.1 Total Initial Margin required was $95 billion, down significantly from the elevated $135 billion to $145 billion range it has been in since Dec-2021 and back to the $90 billion on 30-Sep-2021; a return to normaility in energy markets?

- LCH Clearnet Ltd – 6.2.3 Total IM PreHaircut Secured Cash deposied at commercial banks (including reverse repo) jumped to $81.4 billion, up from $52.5 billion and the highest on record

- LCH Clearnet Ltd – 6.2.7 Total IM Prehaircut Non-Cash Agency Bonds also a new high of $7.8 billion from $3 billion in the prior quarter

- LCH Clearnet Ltd – 6.2.15 Total Inital Margin Held a new high of $317 billion, up from $287 billion in the prior quarter and up from $201 billion on 29-Mar-2019

- LCH Clearnet SA – 6.2.15 Total Inital Margin Held also a new high of €59 billion, up from €49 billion

- ….. we could go on and on and on …..

There are a lot more Clearing Services and Disclosures but I will stop there and leave it to those of you with your own CCPView access to analyze further changes.

As well as a Web UI, we also offer an API to programatically access this data.

IOSCO Quantitative Disclosures

CCPView has disclosures from 44 Clearing Houses, each with many Clearing Services, covering Equities, Bonds, Futures, Options and OTC Derivatives with over 200 quantitative data fields each quarter and quarterly figures from September 2015 to March 2023.

If you are interested in this data, please get in touch.